FedEx (FDX) is implementing significant cost-cutting measures due to declining package volumes and macroeconomic challenges. In fiscal 2025, FDX saved $2.2 billion through its DRIVE initiative, aiming for $1 billion in savings for fiscal 2026. Despite geopolitical uncertainties, the company has increased its quarterly dividend by 5.1% to $1.45 per share and repurchased $3 billion in shares. Furthermore, FDX’s current ratio stands at 1.19, indicating a solid liquidity position.

UPS, the other industry giant, is facing similar operational challenges, including a decrease in parcel volume and high labor costs. The company plans to offer buyouts to approximately 20,000 delivery drivers and shut 73 facilities to cut costs. UPS’s long-term debt is $19.5 billion, resulting in a debt-to-capitalization of 55.4%. The company announced a 0.6% increase in its quarterly dividend to $1.64 per share but has high current payout concerns due to its elevated payout ratio of 84%.

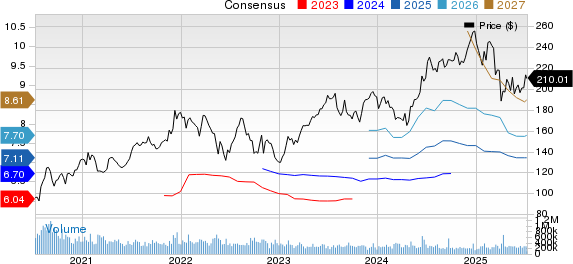

Year-to-date, UPS shares have dropped 18.8%, while FDX shares declined by 15.2%. UPS trades at a forward earnings multiple of 13.66, higher than FDX’s 12.76, making FDX a more attractive investment from a valuation perspective as it holds a Zacks Rank of 3 (Hold) compared to UPS’s Rank of 4 (Sell).