Visa Inc. Achieves New Heights Amid Strong Digital Payment Demand

Visa Inc. (V), with a market capitalization of $651.4 billion, stands as a premier player in digital payments, enabling secure and efficient transactions across over 200 countries and territories. Based in San Francisco, California, Visa derives its revenue mainly from transaction processing fees, capitalizing on the ongoing transition to digital and cashless payment systems.

Visa’s Mega-Cap Status and Resilient Business Model

As a “mega-cap stock” valued at $200 billion or more, Visa exemplifies substantial size, influence, and leadership within the credit services sector. The company’s robust business model is anchored in transaction fees, which mitigates exposure to credit risk and ensures stability through various economic conditions. Visa’s advantages include its ability to capitalize on rising e-commerce, increasing contactless transactions, and strategic partnerships with financial technology firms.

Record Performance Amid Market Fluctuations

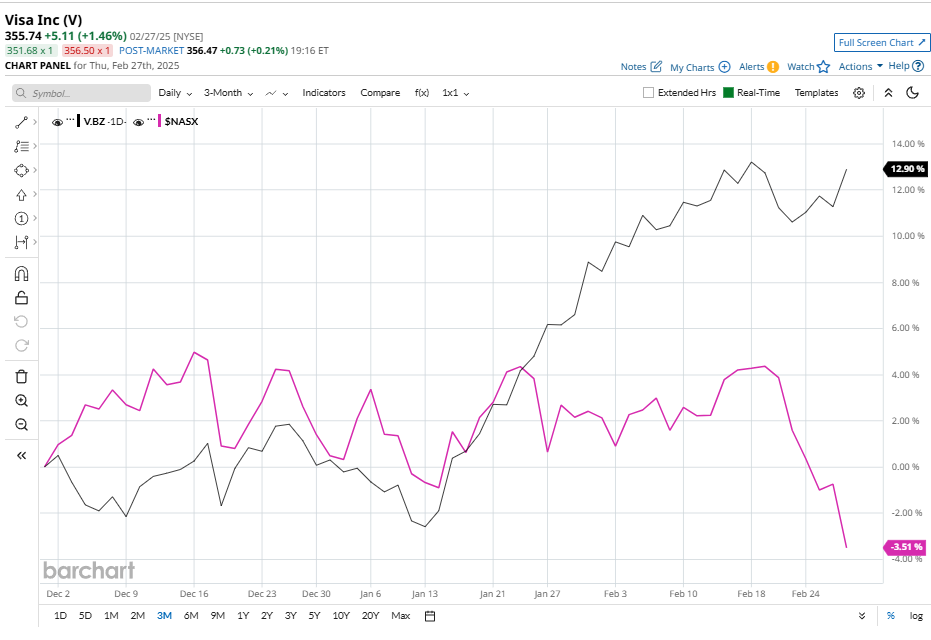

Recent trading has highlighted Visa’s strength, as the company achieved a 52-week high of $360.32. This performance comes during a period when the Nasdaq Composite ($NASX) has experienced declines, falling 2.7% over the same timeframe. In stark contrast, Visa’s stock has surged by 13% in the past three months alone.

Source: www.barchart.com

Looking at longer-term trends, Visa’s stock has risen by an impressive 31.4% over the last six months and 25.6% over the past year, outpacing the Nasdaq Composite’s modest gains of 4.5% over six months and 15.7% over the past year.

To further affirm the bullish trend, Visa has consistently traded above its 200-day moving average since late September and has remained above its 50-day moving average since mid-January.

Source: www.barchart.com

Strong Financial Results Propel Shares Higher

Visa’s performance has also outshone industry peers over the past year, driven by its resilient model, burgeoning digital transaction volumes, and robust financial outputs. The company’s strong network effect, resulting from widespread global acceptance, has led to significant transaction growth. Additionally, the resurgence of cross-border payments has enhanced high-margin revenue streams.

On January 30, Visa shares rose 2.1% following impressive results for its fiscal first quarter. Net revenue jumped 12% year-over-year to $9.6 billion, exceeding the consensus estimate of $9.3 billion. Moreover, non-GAAP net income reached $2.75 per share, surpassing market expectations. This strong performance was driven by a 9% increase in payment volume along with a 16% rise in cross-border transactions, reflecting solid consumer spending during the holiday season. In a show of confidence, Visa’s board approved a 13% increase in its quarterly dividend to $0.59 per share.

Competitive Landscape and Analyst Outlook

In the competitive landscape of credit services, Mastercard Incorporated (MA) has lagged behind, recording gains of 18.9% over six months and 19% over the past year.

Wall Street’s sentiment regarding Visa remains positive, with a consensus “Strong Buy” rating from 36 analysts covering the stock. The mean price target of $382.32 implies a potential upside of 7.5% from current levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For further information, please view the Barchart Disclosure Policy here.

More news from Barchart

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.