“`html

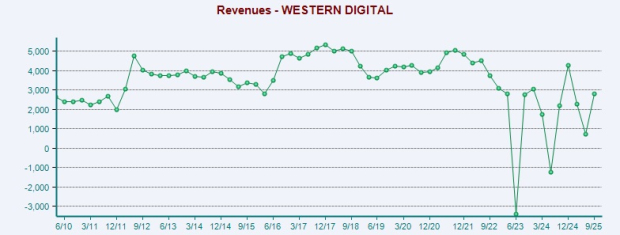

Western Digital Corporation (WDC) and Pure Storage, Inc. (PSTG) are both key players in the data storage industry, with the global market projected to reach $1,304.7 billion by 2033, growing at a 16.44% CAGR from 2025 due to increased cloud computing and remote work. In Q1, WDC shipped 204 exabytes, a 23% year-over-year increase, and is expected to see continued fiscal growth while expanding its dividend by 25% to 12.5 cents.

As of the last fiscal quarter, Pure Storage’s subscription ARR hit nearly $1.8 billion, an 18% increase year-over-year, with a total of over 13,500 customers, including 62% of the Fortune 500. However, Pure Storage confronts challenges with rising competition and an accumulated operating loss of $1.35 billion, while WDC’s shares trade at a lower valuation of 19.45X forward earnings compared to PSTG’s 82.84X.

WDC has seen a 120.6% stock price increase over the past year, outpacing PSTG and the industry average. Analysts favor WDC, currently ranked #1 (Strong Buy) by Zacks, compared to PSTG’s #3 (Hold) rating, suggesting a more favorable investment outlook for WDC at this time.

“`