Compelling Upgrade: AvidXchange Holdings Gets New Buy Rating from Compass Point

Fintel reported on November 7, 2024, that Compass Point has raised its outlook for AvidXchange Holdings (NasdaqGS:AVDX) from Neutral to Buy.

Analyst Price Forecast Signals Positive Growth

As of October 22, 2024, analysts project a one-year price target for AvidXchange Holdings at $10.68 per share. The estimates range from a low of $7.07 to a high of $15.75, indicating a potential increase of 6.76% from the most recent closing price of $10.00 per share.

Check out our leaderboard of companies with the largest price target upside.

Projected Revenue Growth Looks Promising

AvidXchange Holdings is anticipated to generate annual revenue of $459 million, marking a growth of 7.33%. However, the forecasted annual non-GAAP earnings per share (EPS) stands at -0.27.

Fund Sentiment Reveals Increased Interest

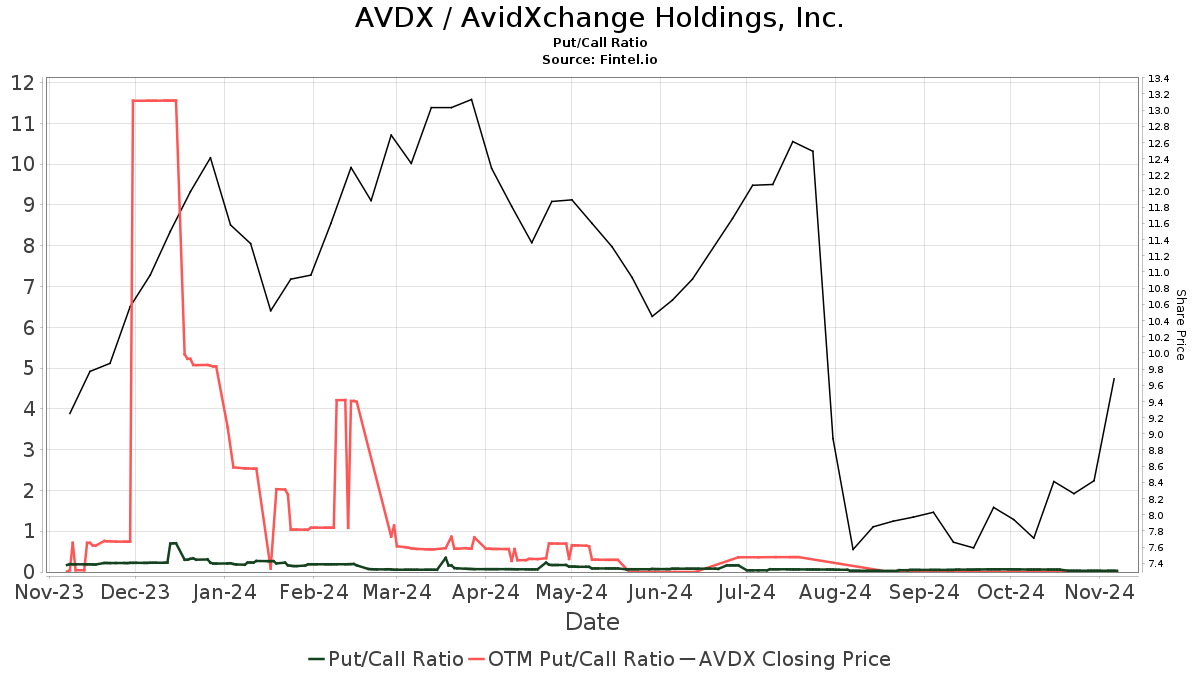

Currently, there are 430 funds or institutions holding positions in AvidXchange Holdings, reflecting an increase of 14 owners or 3.37% over the last quarter. The average portfolio weight dedicated to AVDX is now 0.42%, up by 23.47%. Shares owned by institutions rose by 4.17% in the past three months, totaling 197,867,000 shares.  The put/call ratio for AVDX is at 0.08, suggesting a bullish outlook among investors.

The put/call ratio for AVDX is at 0.08, suggesting a bullish outlook among investors.

Changes in Shareholder Positions

Senvest Management owns 10,876,000 shares, representing 5.23% of AvidXchange. Notably, this is an increase from their previous holding of 9,413,000 shares, reflecting a growth of 13.45% in their investment.

Bain Capital Venture Investors holds 9,140,000 shares, which is 4.40% of the company, showing no change in the last quarter.

Greenhouse Funds LLLP significantly raised its holdings to 6,493,000 shares, a 31.19% increase from the 4,468,000 shares reported earlier. Their investment in AVDX also saw a portfolio increase of 10.83% over the past quarter.

North Reef Capital Management owns 6,300,000 shares, representing 3.03% of the company. This is up from 5,500,000 shares, indicating a 12.70% increase, although overall, their portfolio allocation in AVDX decreased by 6.65% last quarter.

Furthermore, VTSMX – Vanguard Total Stock Market Index Fund Investor Shares holds 5,086,000 shares or 2.45% of the company, marking a slight increase from 5,021,000 shares, albeit with a decrease in their allocation by 9.67% for the last quarter.

AvidXchange Holdings: Company Overview

(This description is provided by the company.)

AvidXchange is a prominent provider of accounts payable automation software and payment solutions tailored for middle-market businesses and their suppliers. Their end-to-end software and payment platform digitizes and streamlines the accounts payable processes for over 7,000 businesses and have facilitated payments to more than 700,000 suppliers in the past five years.

Fintel stands out as a primary platform for investing research, designed to aid individual investors, traders, financial advisors, and small hedge funds.

Our comprehensive data includes fundamentals, analyst reports, ownership data, fund sentiment, options insight, insider trading, and more. Exclusive stock picks are supported by advanced, backtested quantitative models aimed at enhancing potential profits.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.