Compass Point Boosts Innovative Industrial Properties to ‘Buy’

On November 8, 2024, Compass Point upgraded their rating for Innovative Industrial Properties (LSE:0JBD) from Neutral to Buy.

Significant Growth Expected: Analyst Price Forecast

As of October 22, 2024, analysts predict that the average price for Innovative Industrial Properties will reach 138.21 GBX/share within a year, showcasing a potential growth of 29.35%. The predicted range spans from a low of 115.90 GBX to a high of 187.54 GBX. This average target indicates a rise from its recent closing price of 106.85 GBX/share.

For those interested in growth opportunities, check our leaderboard highlighting companies with notable price target increases.

Projected Revenue and Earnings Per Share

The annual revenue forecast for Innovative Industrial Properties is set at 310 million, representing a slight decline of 0.43%. Additionally, the expected annual non-GAAP EPS (earnings per share) stands at 5.81.

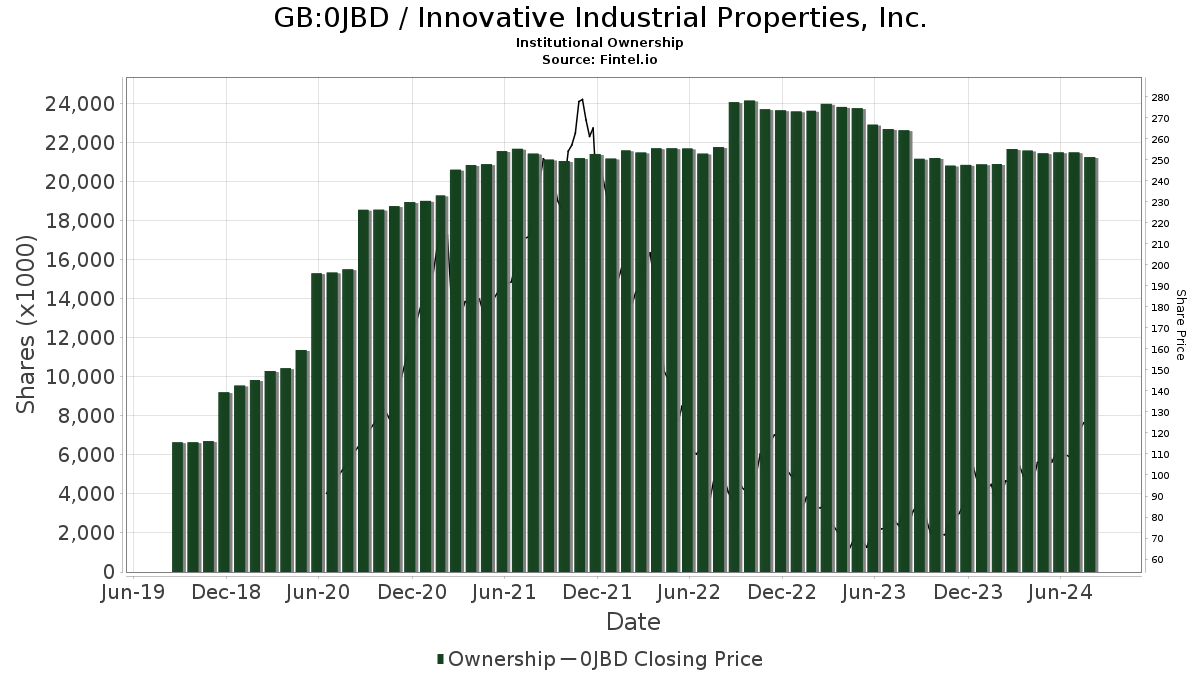

Investors’ Interest: Fund Sentiment

A total of 689 funds and institutions currently report holding stakes in Innovative Industrial Properties. This marks an increase of 6 owners, or 0.88%, from the previous quarter. The average portfolio weight of these funds in 0JBD is now 0.22%, reflecting a rise of 2.41%. Institutional ownership grew by 3.09% over the past three months, totaling 21,566,000 shares.

What Other Shareholders Are Doing

IJR – iShares Core S&P Small-Cap ETF holds 1,844,000 shares, representing 6.51% ownership in the company. This reflects a decrease of 2.82% from its earlier filing, although the ETF has increased its allocation in 0JBD by 6.55% in the last quarter.

VGSIX – Vanguard Real Estate Index Fund Investor Shares holds 1,130,000 shares, equating to 3.99% ownership. This is down from 1,145,000 shares reported previously, marking a decrease of 1.34%. However, its portfolio allocation in 0JBD increased by 4.43% last quarter.

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares owns 876,000 shares, or 3.09% of the company, down from 882,000 shares, a decrease of 0.74%. Still, the fund boosted its allocation in 0JBD by 1.82% recently.

NAESX – Vanguard Small-Cap Index Fund Investor Shares holds 713,000 shares, which is 2.52% ownership, a slight drop from 715,000 shares previously, representing a 0.34% decrease. Yet, this fund increased its allocation in 0JBD by 10.28% over the last quarter.

IWM – iShares Russell 2000 ETF holds 656,000 shares, translating to 2.32% ownership, also showing a decrease from 686,000 shares by 4.49%. Despite this, it raised its allocation in 0JBD by 10.14% over the last quarter.

Fintel prides itself on being a top resource for individual investors, traders, financial advisors, and smaller hedge funds, offering extensive data on fundamentals, analyst reports, ownership, and fund sentiments, as well as tools for superior investment decisions.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.