National Grid (NGG) is poised for growth due to a strategic investment of nearly $69 billion (£60 billion) in infrastructure in the UK and the US over the next five years. This investment is aimed at accommodating rising customer demand, with 2.5 gigawatts (GW) of new customer projects connected to their transmission network this year, including 1.6 GW of renewables.

The company’s fiscal 2026 earnings per share (EPS) estimate has risen by 6.3% to $5.25 over the last 60 days, and it boasts a long-term earnings growth rate of 8.4%. Additionally, NGG maintains a strong times interest earned (TIE) ratio of 3 as of fiscal 2025, indicating solid solvency. The current dividend yield stands at 5.77%, significantly above the S&P 500 Composite’s 1.15%.

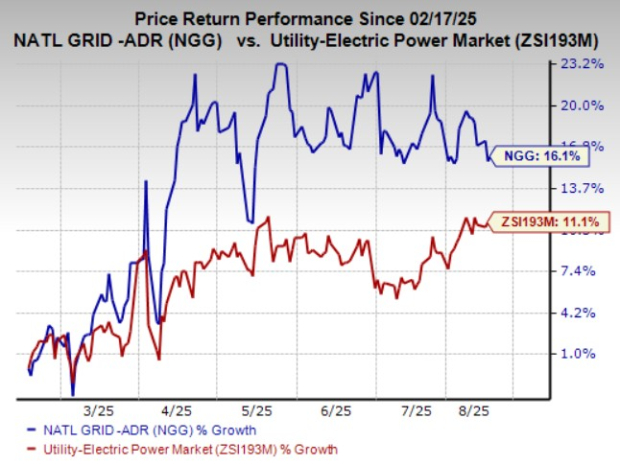

Over the past six months, NGG shares have increased by 16.1%, outperforming the industry’s growth rate of 11.1%. The company is also committed to achieving net-zero emissions by 2050 through significant investments in large-scale renewable energy projects.