DocuSign Surges, Outpacing Industry Growth

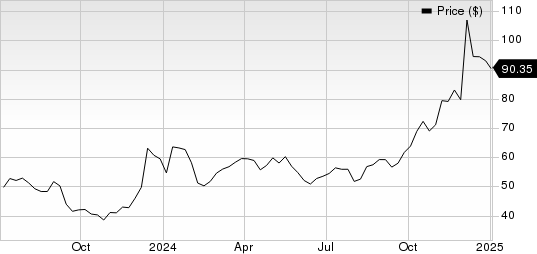

DocuSign, Inc. (DOCU) has seen a remarkable increase in stock price over the past six months, rising by 67%. This surpasses the 11% growth of the internet software sector and the S&P 500’s 6.4% increase.

The company maintains a strong Growth Score of B, which summarizes crucial metrics from its financial statements. This score provides insights into the sustainability and quality of its growth.

Earnings projections show an 18.5% increase for fiscal 2025 and a 4.3% rise for fiscal 2026, compared to the previous year. DocuSign anticipates a long-term earnings growth rate of 9.4% over the next three to five years.

Current Stock Performance

Current stock price for DocuSign | Latest quote for DocuSign

Key Drivers of DocuSign’s Growth

DocuSign’s growth in revenue is largely fueled by strong consumer demand for its eSignature solution, which operates in a vast market. The customer base has seen steady expansion, with numbers rising from 1.1 million in 2022 to 1.5 million in 2024. This trend indicates that growth is likely to continue. Although demand is rising, the eSignature market is still not fully tapped, presenting significant opportunities for DocuSign to extend its global reach and revenue potential.

Around 97% of DocuSign’s total revenue comes from subscription fees, which cover access to its products and customer support for durations ranging from one to three years. This subscription model aids software developers by providing predictable revenue flows and more visibility on cash flows. It also helps make expensive software solutions accessible to smaller businesses.

DocuSign has seen growth in both commercial and enterprise sectors due to its strategic marketing efforts. New initiatives, enhanced customer programs, and diverse use cases have driven a 10% increase in subscription revenues during fiscal 2024. This was mainly from expanding existing customer revenues and welcoming new clients.

The company has fortified its partnerships with major players, including Salesforce (CRM) and Microsoft (MSFT). For example, DocuSign is collaborating with Salesforce to automate contract creation for users of Slack. They also integrated their eSignature services with Microsoft Teams last year, becoming the primary electronic signature provider in Teams’ Approvals app. These alliances enhance DocuSign’s access to a broader customer base.

Potential Drawbacks for Investors

DocuSign has never distributed dividends and currently has no plans to do so. Investors looking for cash returns may find the company’s stock less attractive because the only potential return comes through price appreciation, which is uncertain.

As of the end of the second quarter of fiscal 2025, DocuSign’s current ratio, a critical measure of liquidity, was 0.84. This is down from 0.93 in the previous quarter and from 0.88 in the same period last year, falling below the average for the industry. A current ratio below 1 suggests that the company may struggle to meet short-term liabilities, raising concerns about its financial health. This situation highlights the importance of managing working capital to maintain liquidity, as it can impact operational stability and investor confidence.

DocuSign’s Market Standing

Currently, DocuSign holds a Zacks Rank of #3 (Hold). For a list of stocks with a #1 Rank (Strong Buy), you can refer to the provided resources.

Exciting Stock Opportunities Ahead

Out of thousands of stocks, five Zacks experts have each selected their top picks expected to rise by over 100% soon. One standout, chosen by Director of Research Sheraz Mian, targets millennial and Gen Z consumers and generated nearly $1 billion in revenue last quarter. Recent market adjustments could make this an ideal investment opportunity. While not all recommendations guarantee success, this one has the potential to outperform past Zacks stocks like Nano-X Imaging, which surged by 129.6% in under nine months.

For insights on these top stocks and four additional recommendations, click to see the report.

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Salesforce Inc. (CRM) : Free Stock Analysis Report

DocuSign Inc. (DOCU) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.