Pampa Energia’s Growth Strong Amid Evolving Energy Sector

Pampa Energia S.A. (PAM) is strengthening its market position through a focus on asset quality and an expanding electricity generation portfolio. The company’s efforts to enhance operations across generation, transmission, and distribution sectors in Argentina present promising growth opportunities, making PAM a noteworthy investment in the utility sector.

Here are the key factors that contribute to PAM’s appeal as a solid investment option at this time.

Growth Projections and Surprise History

The Zacks Consensus Estimate for PAM’s 2025 earnings per share (EPS) has increased by 67.2% to $11.20 over the past 90 days.

Furthermore, the Zacks Consensus Estimate for 2025 sales stands at $2.15 billion, representing a 14.7% growth from the previous year.

PAM has achieved an impressive average earnings surprise of 168.1% over the last four quarters.

Liquidity Position

As of the end of the first quarter of 2025, PAM’s current ratio was recorded at 1.82, significantly above the industry average of 0.77. A current ratio above one indicates that PAM has sufficient short-term assets to cover all short-term liabilities if necessary.

Debt Position

PAM’s total debt to capital stands at 38.69%, which is significantly lower than the industry average of 62.5%.

Additionally, the time-to-interest earned ratio at the end of the first quarter of 2025 was 4.1, suggesting that the company can comfortably meet its future interest obligations.

Return on Equity (ROE)

Return on equity reflects how effectively a company uses its funds to generate returns. Currently, PAM’s ROE is 15.29%, outpacing the industry average of 10.05%. This highlights PAM’s efficient use of shareholder funds compared to its peers in the electric power utility sector.

Investment in Clean Power Generation

Pampa Energía is actively developing multiple wind energy projects throughout Argentina, particularly in the Province of Buenos Aires. Since 2018, it has invested over $1 billion in establishing 687 megawatts (MW) of wind energy capacity. The company aims to position itself as a leading efficient energy supplier, with renewable energy playing a crucial role in its long-term vision.

In the first quarter of 2025, PAM’s net power generation reached 5,951 gigawatt-hours, sourced from hydro, wind, and thermal resources.

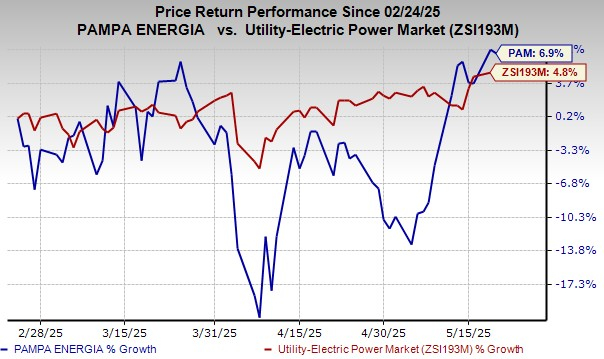

Stock Price Performance

In the last three months, Pampa Energia’s stock has increased by 6.9%, outperforming the industry, which grew by 4.8% during the same period.

Other Notable Stocks

Other notable stocks in the utility sector include DTE Energy (DTE), WEC Energy Group (WEC), and Evergy (EVRG), all currently rated #2 (Buy) by Zacks. DTE’s long-term (three to five years) earnings growth rate is 7.64%, while its 2025 EPS estimate suggests a 5.9% year-over-year improvement.

WEC boasts a long-term earnings growth rate of 6.95%, with an average earnings surprise of 6.2% in the past four quarters. Meanwhile, EVRG has a long-term earnings growth rate of 5.7% and a 2025 EPS estimate indicating a 5.9% year-over-year increase.

The views and opinions expressed herein are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.