Markel Group Inc. MKL has found its stride, driven by a cocktail of factors including burgeoning business volume, robust retention rates, an improving rate climate, enhanced interest income on cash equivalents, strategic acquisitions, and bullish growth projections.

Riding the Wave of Growth Projections

Diving into the figures, the Zacks Consensus Estimate for Markel Group’s 2025 earnings per share showcases a promising 21.1% surge from the forecast for 2024. Revenue estimates stand at a healthy $15.92 billion, illustrating a 5.4% uptick year-over-year.

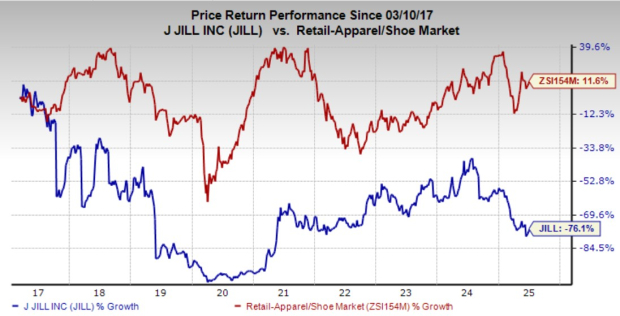

Navigating Zacks Rank & Price Performance

Markel Group presently boasts a Zacks Rank #3 (Hold). Over the past year, the stock has outpaced the overall industry growth, securing a commendable 17.4% climb.

Image Source: Zacks Investment Research

Evaluating Style Score

MKL wears its VGM Score of B with pride. This score acts as a beacon for identifying stocks that pack a potent punch with value, growth, and momentum intertwined.

Delving into Return on Equity (ROE)

Over the trailing 12 months, Markel Group’s ROE has surged to 11.2%, marking a substantial 340-basis-point climb year over year. This metric is a testament to the company’s adept utilization of shareholder funds.

Propelling Business Forward

On the business front, MKL is firing on all cylinders. Elevated premiums, a surge in new business volume, steadfast retention levels, and a series of rate hikes and product expansions are propelling the insurer forward with unwavering momentum.

Moreover, the investment domain is set to reap the rewards of the improving rate scenario, augmented interest income on cash equivalents, secured maturity securities, and short-term investments flaunting higher yields.

The strategic acquisitions executed by Markel Group serve as a potent growth catalyst, turbocharging its surety capabilities, boosting revenues for Markel Ventures, and broadening its reinsurance product portfolio. The company’s acquisition strategy is a masterstroke aimed at fostering profitable growth in insurance operations and creating added value across the spectrum of Markel Ventures’ operations.

The revenue surge in construction services and transportation-linked businesses is a result of amplified demand, soaring prices, enhanced production levels at equipment manufacturing facilities, and a complete year’s contribution from Metromont.

Capitalizing on a sturdy financial stance, Markel Group has been actively engaging in share repurchases. The firm’s share buyback plan, sanctioned by the board, entails repurchasing up to $750 million worth of shares. As of December 31, 2023, $713 million was earmarked for share repurchases, with $445 million worth of shares already repurchased in 2023.

Exploring Promising Alternatives

In the Diversified Operations segment, other noteworthy stocks include Carlisle Companies Incorporated CSL, Vector Group Ltd. VGR, and Griffon Corporation GFF. While Carlisle Companies and Vector Group flaunt a Zacks Rank #1 (Strong Buy), Griffon harbors a Zacks Rank #2 (Buy) presently.

Carlisle has trumped earnings projections in three out of the past four quarters, with an average surprise of 7.55%. Over the past year, CSL has surged by a formidable 73.5%.

Vector Group has trumped earnings forecasts in half of the last four quarters, with an average of 10.22%. Despite a dip of 10.4% in the past year, VGR is showing promising signs of growth with estimated earnings growth in 2024 and 2025.

Griffon has delivered an impressive average earnings surprise of 42.03% over four quarters, witnessing a remarkable surge of 129% over the past year.

Looking for a fresh perspective on stock picks? Zacks Investment Research has an irresistible offer for investors to explore a diverse range of options at a nominal cost.

Curious about opportunities in the stock market? Click below to learn more:

For more insightful analyses and top-notch recommendations, delve into the offerings by Zacks Investment Research and elevate your investment game.