Strong Earnings Season Continues with Focus on Retail Sector

Note: The following is an excerpt from this week’s earnings Trends report. To access the full report, which contains detailed historical actuals and estimates for current and future periods, please Click here>>>

- Over 90% of earnings reports are in, indicating a robust reporting cycle. Companies are showing an acceleration in growth and comfortably surpassing consensus estimates.

- Total earnings for 456 S&P 500 companies reporting are up +13.6% from last year, attributed to +5.5% higher revenues. Of these, 77.6% exceeded EPS estimates, while 66.7% beat revenue forecasts.

- The focus is now shifting to the Retail sector, with brick-and-mortar retailers set to report results soon. More than half of Zacks Retail sector companies have already unveiled their Q4 performances.

- As of now, Q4 results are reported for 95.3% of the Retail sector’s market capitalization within the S&P 500 index. Total earnings rose +32.3% year-over-year, driven by +7.0% higher revenues. Notably, 72.0% surpassed EPS and revenue estimates. Excluding Amazon’s results, the sector’s earnings and revenue growth rates adjust to +4.6% and +5.4%, respectively.

Assessment of Retail Sector Earnings

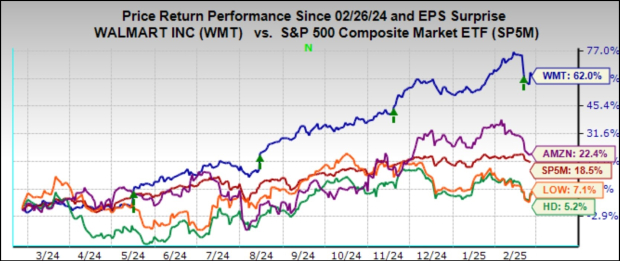

Current earnings attention is on the Retail sector, with significant players releasing quarterly results. Walmart’s shares dipped after its report, as investors were unimpressed with the company’s earnings guidance. Despite solid results and continued market share gains coupled with e-commerce growth, the guidance appears overly cautious.

This reaction seems influenced more by profit-taking after Walmart’s strong performance; over the past year, its shares have risen +62.1%, outperforming the S&P 500’s +18.3% rise and Amazon’s +23.3% growth.

In contrast, Home Depot’s shares increased after its earnings release, even though the guidance was weak. Market participants responded positively to better-than-expected comparable store sales, which turned positive for the first time after eight consecutive quarters of declines. Similar results emerged for Lowe’s, which also reported positive comps following a lengthy downturn.

The home-improvement sector faces challenges from high-interest rates impacting home sales and remodeling expenditures. However, housing bulls believe that a strong labor market, high home equity levels, and favorable demographic trends will support a recovery, even amid ongoing elevated interest rates. The turnaround in comp sales for Home Depot and Lowe’s may bolster these optimistic views, hinting at a sustainable recovery in the latter half of the year.

The chart below illustrates the one-year performance of Walmart, Amazon, Home Depot, and Lowe’s in relation to the S&P 500 index.

Image Source: Zacks Investment Research

Tech Sector Earnings Outlook: Signs of Change?

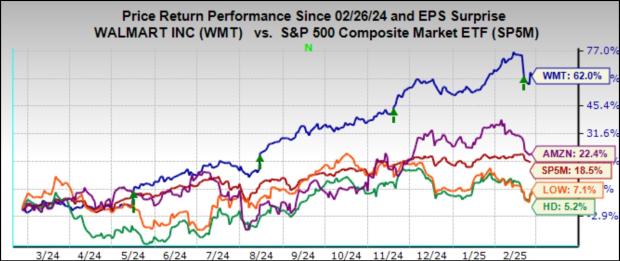

The Technology sector has fueled growth in recent quarters, with Q4 2024 forecasts indicating a +24.6% increase in earnings year-over-year on +11.4% higher revenues. This marks the sixth consecutive quarter of double-digit earnings growth.

This trend follows the sector’s +23.2% earnings growth on +11.9% increased revenues in Q3 2024. As depicted in the chart below, the sector’s growth trajectory is projected to continue in the upcoming quarters.

Image Source: Zacks Investment Research

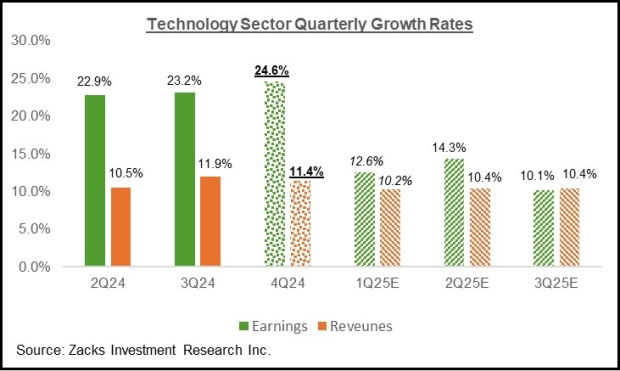

The Tech sector has benefited from a consistently improving earnings outlook, with estimates showing a steady increase. However, recent data indicate a shift in this revision trend, as outlined in the chart of aggregate 2025 earnings estimates for the sector below.

Image Source: Zacks Investment Research

The Broader Earnings Perspective

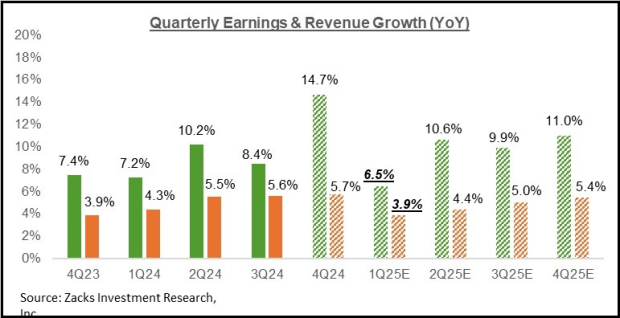

The following chart illustrates expectations for Q4 2024 based on achievements from the preceding four periods, alongside current projections for the next four quarters.

Image Source: Zacks Investment Research

As depicted above, total S&P 500 earnings for the current period (Q1 2025) are expected to rise +6.5% year-over-year, accompanied by +3.9% greater revenues.

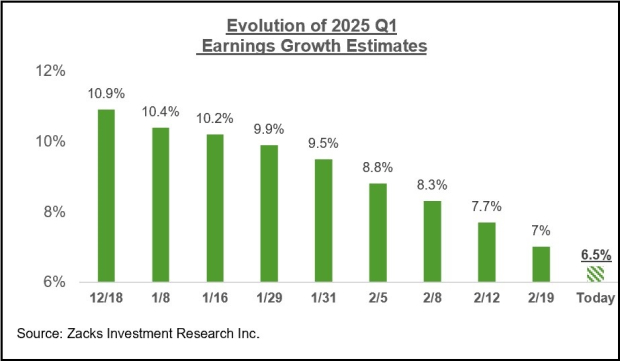

Nevertheless, estimates for this period have been trending downward since the quarter commenced, as illustrated in the following chart.

Sector Earnings Estimates Decline, but Growth Expected in 2025

Image Source: Zacks Investment Research

Since January, there has been a noticeable decline in earnings estimates across 15 of the 16 sectors. The only exception is the Medical sector, which has seen a rise in its estimates. Major sectors experiencing the steepest cuts include Conglomerates, Aerospace, Construction, and Basic Materials, among others. Interestingly, the Tech sector has also faced headwinds in its earning projections, which differs from trends observed in previous periods.

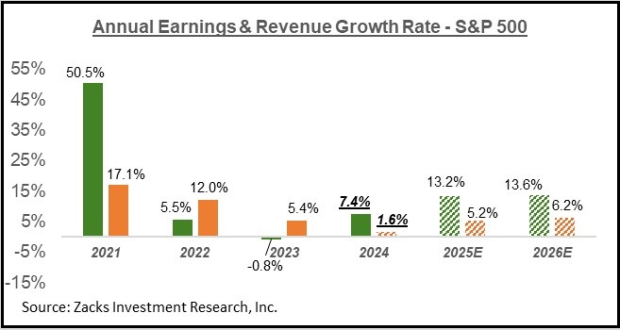

The chart below provides an overview of the annual earnings landscape.

Image Source: Zacks Investment Research

The expectation for the upcoming years is double-digit earnings growth for each of the next two years. There is also a noteworthy expansion in the number of sectors anticipating strong growth compared to recent trends. By 2025, nearly all sectors tracked by Zacks are projected to experience earnings growth, with seven of the 16 sectors forecasting double-digit increases. This marks a shift from the past two years, where most earnings growth was driven by the ‘Magnificent Seven’ companies. In 2025, the S&P 500 is expected to see double-digit earnings growth even without contributions from this mega-cap group.

Zacks Research Chief Highlights Stock with High Growth Potential

In this evolving market landscape, Zacks’ team of experts has identified five stocks with the highest probability of gaining 100% or more in the coming months. Among these, Sheraz Mian, Director of Research, spotlights one particular stock that is poised for substantial gains.

This top pick is recognized as one of the most innovative financial firms, boasting a rapidly growing customer base of over 50 million and a portfolio of cutting-edge solutions. While not every elite pick ends up being a winner, this stock has the potential to outperform past high-fliers like Nano-X Imaging, which surged by 129.6% in just over nine months.

For those interested in the latest recommendations from Zacks Investment Research, you can access the report titled “7 Best Stocks for the Next 30 Days.” Click here to obtain this free report.

Additionally, here are three notable stocks to consider:

- Amazon.com, Inc. (AMZN): Free Stock Analysis Report

- Lowe’s Companies, Inc. (LOW): Free Stock Analysis Report

- The Home Depot, Inc. (HD): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.