Analysts Anticipate Growth for iShares U.S. Real Estate ETF

In a review of ETFs within our coverage, ETF Channel has analyzed the trading prices of underlying holdings compared to the average analyst 12-month forward target prices. For the iShares U.S. Real Estate ETF (Symbol: IYR), the implied analyst target price is $106.78 per unit.

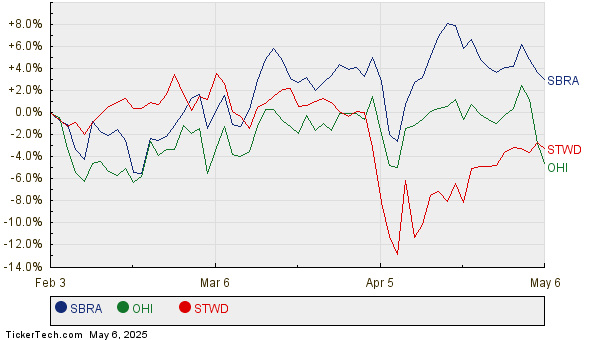

Currently, IYR is trading at approximately $94.86 per unit. This indicates a potential upside of 12.56%, based on the average target prices of its underlying holdings. Noteworthy among these holdings are Sabra Health Care REIT Inc. (Symbol: SBRA), Omega Healthcare Investors, Inc. (Symbol: OHI), and Starwood Property Trust Inc. (Symbol: STWD). Specifically, SBRA’s recent price of $17.28/share has an analyst target 13.57% higher at $19.62/share. Similarly, OHI shows a 12.95% upside from its current price of $36.18 with a target of $40.87/share. Analysts expect STWD to reach a target of $21.57/share, reflecting a 12.64% increase from its current price of $19.15. Below is a chart showing the twelve-month price history for SBRA, OHI, and STWD:

Here’s a summary table of the current analyst target prices:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares U.S. Real Estate ETF | IYR | $94.86 | $106.78 | 12.56% |

| Sabra Health Care REIT Inc | SBRA | $17.28 | $19.62 | 13.57% |

| Omega Healthcare Investors, Inc. | OHI | $36.18 | $40.87 | 12.95% |

| Starwood Property Trust Inc. | STWD | $19.15 | $21.57 | 12.64% |

These analyst targets bring to light questions about their validity. Are analysts justified in their optimistic outlook, or are they too aggressive in their predictions? A high price target relative to a stock’s current position may signify future potential but might also lead to downward adjustments if market conditions shift. This presents an opportunity for investors to conduct further research.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Institutional Holders of PQ

• ESAB Average Annual Return

• PAI Insider Buying

The views and opinions expressed herein are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.