Analysts Predict 17.76% Upside for JPMorgan Active Value ETF

At ETF Channel, we analyzed the holdings of various ETFs in our coverage. For the JPMorgan Active Value ETF (Symbol: JAVA), the implied analyst target price stands at $71.70 per unit based on its underlying assets.

Currently, JAVA is trading around $60.89 per unit. This figure suggests that analysts see a potential upside of 17.76% when considering the average target prices of the ETF’s holdings. Notably, three underlying assets show significant upside potential based on their analyst target prices: Copa Holdings S.A. (Symbol: CPA), Rayonier Inc. (Symbol: RYN), and Equity Lifestyle Properties Inc. (Symbol: ELS).

Copa Holdings (CPA), priced recently at $90.50 per share, has an average analyst target of $150.45, which indicates a potential increase of 66.25%. Rayonier (RYN) has a current share price of $24.45, with a target price of $29.80, offering a possible upside of 21.88%. Equity Lifestyle Properties (ELS) is trading at $63.06, with analysts predicting a price of $74.46, reflecting an 18.08% upside.

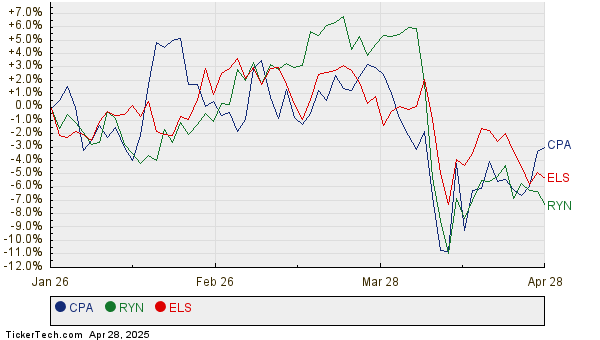

Refer to the chart below for the twelve-month price histories of CPA, RYN, and ELS:

Here’s a summary of the current analyst target prices for the discussed stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| JPMorgan Active Value ETF | JAVA | $60.89 | $71.70 | 17.76% |

| Copa Holdings S.A. | CPA | $90.50 | $150.45 | 66.25% |

| Rayonier Inc. | RYN | $24.45 | $29.80 | 21.88% |

| Equity Lifestyle Properties Inc | ELS | $63.06 | $74.46 | 18.08% |

It’s important to consider whether analysts’ forecasts are justified or overly optimistic. Are they accurately reflecting current company and industry dynamics? High price targets compared to stock prices can indicate optimism but may also precede potential downgrades. Investors should continue their research to make well-informed decisions.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Additional Resources:

• TIG Historical Stock Prices

• Waste Management RSI

• Top Ten Hedge Funds Holding BBTD

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.