Analysts Project Significant Upside for QDPL and Key Holdings

In our analysis of ETFs at ETF Channel, we evaluated the trading price of each underlying holding against the average analyst 12-month forward target price, calculating the weighted average implied target for the ETF itself. For the Pacer Metaurus US Large Cap Dividend Multiplier 400 ETF (Symbol: QDPL), the implied analyst target price is set at $42.14 per unit.

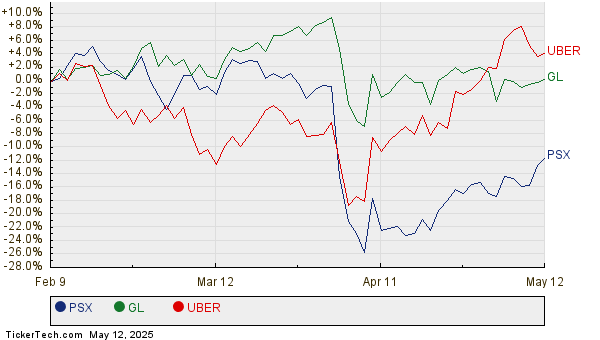

Currently trading at approximately $36.87, QDPL presents a potential upside of 14.28%, based on the average analyst targets for its underlying holdings. Three notable holdings with significant upside potential include Phillips 66 (Symbol: PSX), Globe Life Inc (Symbol: GL), and Uber Technologies Inc (Symbol: UBER). Phillips 66’s recent trading price is $110.92 per share, while the average target price sits at $131.11—an 18.20% increase. Globe Life Inc has a recent share price of $121.94, with an expected target of $141.42, translating to a potential upside of 15.97%. For Uber Technologies, analysts project a target price of $95.43 per share, reflecting a 15.24% increase from its recent price of $82.81. The chart below illustrates the twelve-month price history of PSX, GL, and UBER:

Below is a summary table highlighting the current analyst target prices for the mentioned stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Pacer Metaurus US Large Cap Dividend Multiplier 400 ETF | QDPL | $36.87 | $42.14 | 14.28% |

| Phillips 66 | PSX | $110.92 | $131.11 | 18.20% |

| Globe Life Inc | GL | $121.94 | $141.42 | 15.97% |

| Uber Technologies Inc | UBER | $82.81 | $95.43 | 15.24% |

These analyst targets prompt a discussion: Are these projections well-founded, or are they overly optimistic? Investors should consider whether analysts’ expectations hold true against recent industry and company developments. High target prices may reflect confidence in the future; however, they could also indicate potential downgrades if target assumptions become outdated. These points warrant deeper investor research.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Additional Insights:

• OPA shares outstanding history

• AMIX Split History

• Drugs and Pharmaceuticals mergers and acquisitions

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.