“`html

Retail Sector Update

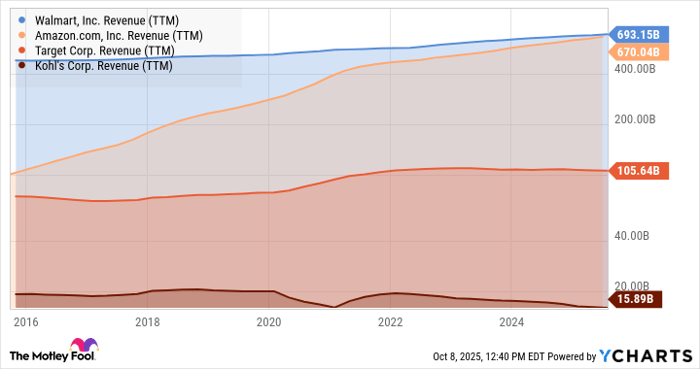

As of now, Target’s stock (NYSE: TGT) has decreased by 33% this year, presenting a potential buying opportunity. Meanwhile, Walmart (NYSE: WMT) reported a 26% increase in e-commerce revenue while its stock value has doubled over the last two years. In contrast, Kohl’s (NYSE: KSS) continues to struggle with declining sales, trading at just 0.11 times sales and 8.6 times trailing earnings.

Walmart operates approximately 4,600 stores in the U.S. and 5,600 internationally, with 94% of American households able to benefit from same-day delivery services. Additionally, Amazon (NASDAQ: AMZN) has deployed its millionth warehouse robot and has experienced an 11% year-over-year sales increase in North America for Q2 2023.

Target’s modest growth concerns have led to its stock being regarded as undervalued, despite the company’s significant annual sales generated by over 45 store brands. The incoming CEO, Michael Fiddelke, is focused on enhancing the shopping experience, aiming for improvements amid the current market challenges.

“`