Uber Technologies Gears Up for Q4 2024 Earnings Release

Uber Technologies (UBER) is set to announce its fourth-quarter 2024 results on February 5, prior to market opening. According to the Zacks Consensus Estimate, earnings are projected at 50 cents per share, with revenues anticipated to reach $11.7 billion.

Explore the latest EPS estimates and updates on Zacks Earnings Calendar.

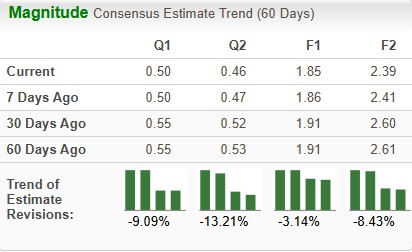

In recent months, the earnings estimate has dropped by 9.1%. This suggests a decline of 24.2% compared to the same quarter last year. Meanwhile, projected revenues indicate an 18.2% increase from the figures reported a year ago.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Looking ahead to 2025, the Zacks Consensus Estimate projects UBER’s revenues at $50.7 billion, signaling a 15.9% growth year over year. The consensus for full-year EPS stands at $2.39, suggesting a year-over-year increase of 28.8%.

Over the last four quarters, UBER has exceeded EPS estimates three times and fell short once, with an average earnings surprise of 83%.

Recent Price and EPS Developments for Uber Technologies

Q4 Earnings Predictions for UBER

Our analysis indicates that Uber may exceed earnings expectations this quarter. With a positive Earnings ESP of +1.43% and a Zacks Rank of #3 (Hold), the prospects of hitting earnings targets look promising.

For more insights, check the entire list of Zacks #1 Rank stocks.

Key Factors Influencing UBER’s Q4 Results

Uber’s performance this quarter may be affected by reduced gross bookings, largely due to lower demand in the ride-hailing sector tied to high inflation and a shift toward more affordable transportation methods.

Gross bookings for the fourth quarter are expected to fall between $42.75 billion and $44.25 billion, reflecting a constant currency growth of 16-20% from Q4 2023. Currently, our estimate is $44.15 billion.

The number of trips is projected to grow year-over-year by about 17.5%, mirroring growth from Q3 2024, factoring in a push from currency fluctuations.

Additionally, freight revenues might face significant challenges due to a struggling freight market. However, Uber is aiming for growth through investments in autonomous vehicles, with plans to update the market during the upcoming conference call.

Current Stock Performance and Valuation for UBER

Recently, Uber’s stock has lagged behind its industry peers, the broader sector, and the S&P 500 index, as well as its competitor Lyft (LYFT).

6-Month Stock Price Overview

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

In terms of valuation, Uber’s price/sales ratio indicates it is trading at a forward sales multiple of 2.74, lower than its five-year median of 3.01 and below the industry average of 6.04.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Is Now the Right Time to Invest in UBER?

Uber’s efforts to expand in international markets provide potential for growth and diversification. Furthermore, its recent collaboration with NVIDIA (NVDA) has put it in a strong position to compete with Tesla (TSLA) in the emerging robotaxi market. The company is well-positioned to capitalize on autonomous technology as it evolves.

Despite attractive valuations, the timing for investment in UBER stock appears challenging. Concerns over a slowdown in gross bookings and elevated debt levels warrant caution for potential investors.

Exciting Stocks Poised for Growth

Five stocks have been identified by Zacks experts as strong candidates for significant gains in 2024, with previous picks achieving remarkable returns of +143.0%, +175.9%, +498.3%, and even +673.0%.

Now, you can discover these promising investment opportunities by clicking to learn more.

Want the latest recommendations from Zacks Investment Research? You can download the 7 Best Stocks for the Next 30 Days for free.

Find reports on NVIDIA Corporation (NVDA), Tesla, Inc. (TSLA), Lyft, Inc. (LYFT), and Uber Technologies, Inc. (UBER) for further insights.

For the complete article, visit Zacks.com.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.