Constellation Energy’s Strategic Acquisition: What It Means for Investors

With strong technical indicators and a major acquisition in progress, Constellation Energy Corp.‘s CEG stock appears set for growth after its $26.6 billion bid for Calpine Corp.

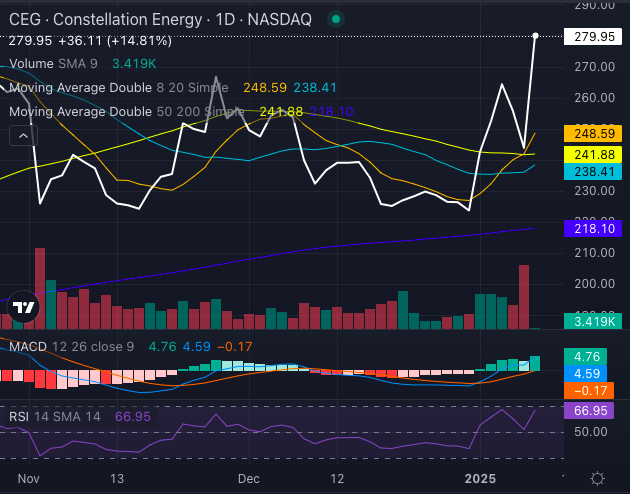

Chart created using Benzinga Pro

Explore: Constellation Energy: Will AI Power Surge Light Up Stock?

Analysts and investors are taking notice of the impending deal, which is projected to increase earnings per share (EPS) by over 20% by 2026, with an additional $2 per share expected in subsequent years.

Based in Baltimore, Constellation anticipates that acquiring Calpine will expand its customer base to 2.5 million.

This acquisition is on track to finalize within 12 months, subject to regulatory approval and standard conditions.

Positive Signs Indicate Future Growth

Constellation Energy’s stock, currently priced at $279.95, is well above its eight-day, 20-day, 50-day, and 200-day moving averages, all signaling bullish momentum. The MACD (moving average convergence/divergence) stands at 4.59, indicating ongoing buying activity, while a stable RSI (relative strength index) of 66.95 reflects moderate buying pressure.

This agreement with Calpine coincides with Constellation Energy securing contracts surpassing $1 billion from the U.S. government to provide nuclear power to over 13 federal agencies.

Additionally, the company is collaborating with Microsoft to revitalize the Three Mile Island Unit 1 nuclear power plant.

Keep Reading:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs