Amazon’s Stock Faces Mixed Sentiment Amid Economic Challenges

Analysts remain cautious but optimistic about Amazon.com AMZN stock.

A recent analysis by Benzinga Insights indicates that most Wall Street analysts hold a bullish outlook on AMZN stock, even though some have shifted to a neutral position. This shift may reflect growing skepticism surrounding the stock’s future performance.

Despite fluctuations, AMZN stock has shown considerable strength. Over the past year, its value has increased by nearly 22%, showing an overall gain of approximately 126% over the last five years. Amazon continues to thrive in e-commerce and maintains a strong presence in cloud computing, significantly contributing to its stability.

However, broader economic issues could impact AMZN stock negatively. Gallup’s Economic Confidence Index (ECI) recently held at -19, unchanged since January. Concerns about tariffs imposed by President Donald Trump on imports from Mexico and Canada are affecting consumer confidence. Furthermore, there are fears that such tariffs could worsen inflation.

Compounding these worries, the Conference Board Consumer Confidence Index dropped sharply in February, falling 7 points to 98.3. This is the largest decline since August 2021 and marks the third month in a row of falling confidence, positioning the index at the lower end of its range over the past two years. In this context, AMZN stock decreased by almost 10% in the previous month.

Exploring Direxion ETFs: In light of the mixed sentiment, investors may look towards Direxion’s Amazon-focused exchange-traded funds (ETFs) for potential trading opportunities.

Bullish investors can consider Direxion Daily AMZN Bull 2X Shares AMZU, which aims for daily returns that reflect 200% of Amazon’s performance. Conversely, bearish investors might opt for Direxion Daily AMZN Bear 1X Shares AMZD, which seeks to provide 100% of the inverse performance of AMZN stock.

Both AMZU and AMZD ETFs offer a straightforward way to trade without the complexities of options. Retail investors can acquire shares in these funds just like any other public security.

That said, investing in these ETFs carries significant risk. Direxion advises that leveraged and inverse ETFs are designed for short-term trading, ideally within one day. Holding them for longer may lead to performance results deviating from expectations due to daily compounding effects.

Performance of the AMZU ETF: Recently, the AMZU ETF has benefitted from the steady performance of AMZN stock, gaining nearly 17% over the past year.

- Investors should remain cautious, as the AMZU fund has experienced volatility, losing over 19% in the last month.

- AMZU recently rebounded from its 200-day moving average, a positive sign, but needs to reclaim its 50-day moving average to prevent further technical setbacks.

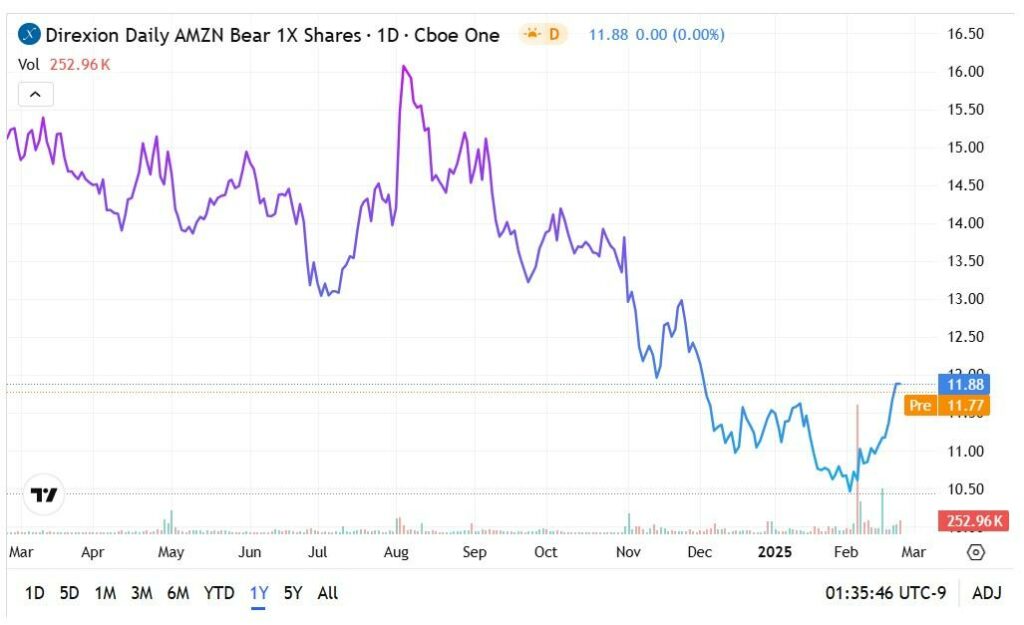

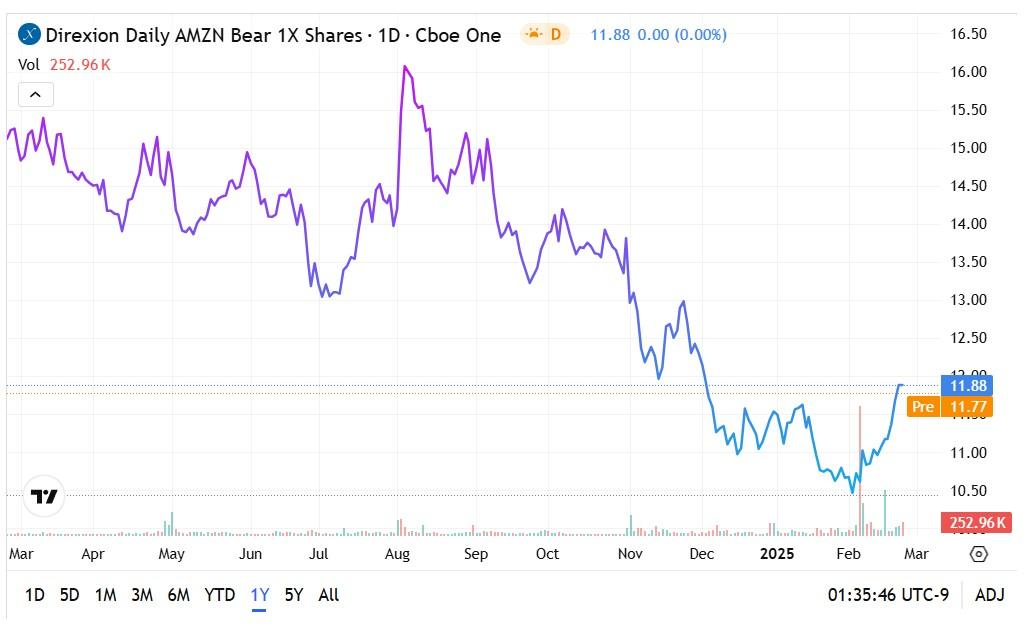

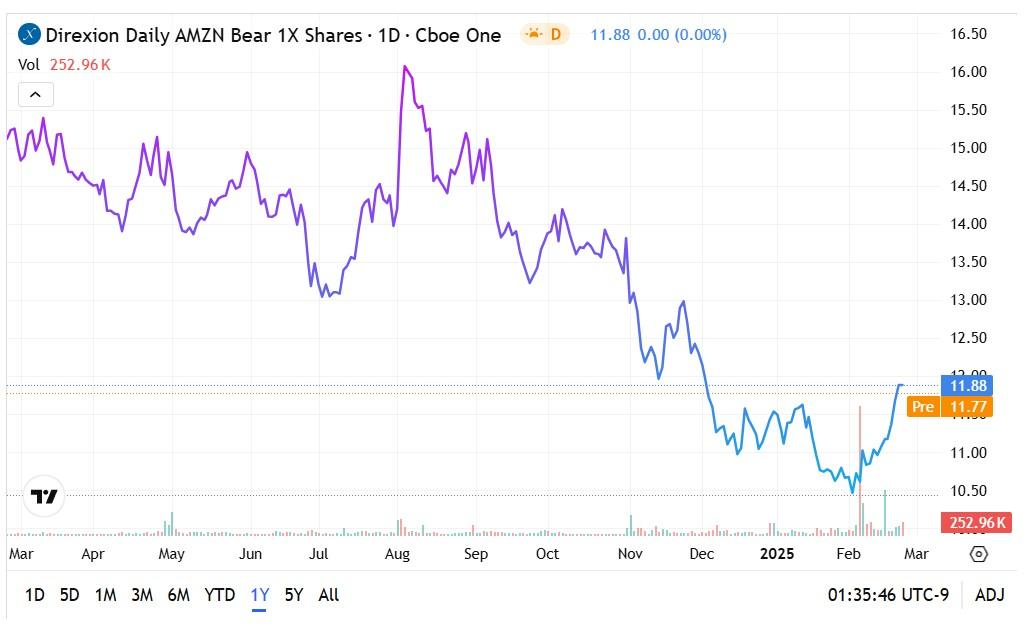

Performance of the AMZD ETF: In contrast, the AMZD bear fund has seen the odds stacked against it, losing over 21% in the last year.

- Despite its challenges, the AMZD ETF broke through its 50-day moving average in mid-February and is gaining momentum.

- Increasing trading volume suggests rising bearish sentiment, with the next key target being the 200-day moving average around the $13 mark.

Featured photo by Alexa on Pixabay.

Market News and Data brought to you by Benzinga APIs