Wall Street Faces Bearish Sentiment: Key Indicators Analyzed

“It is easy in the world to live after the world’s opinion; it is easy in solitude after our own; but the great man is he who, in the midst of the crowd, keeps with perfect sweetness the independence of solitude.” ~ Ralph Waldo Emerson

Emerson’s quote resonates deeply in financial markets. Investors often fear when they should be greedy and vice versa. As market sentiment shifts, key indicators can signal turning points. Today, I will review three significant sentiment indicators: the CNN Fear & Greed Index, NAAIM Exposure Index, and the AAII Sentiment Survey.

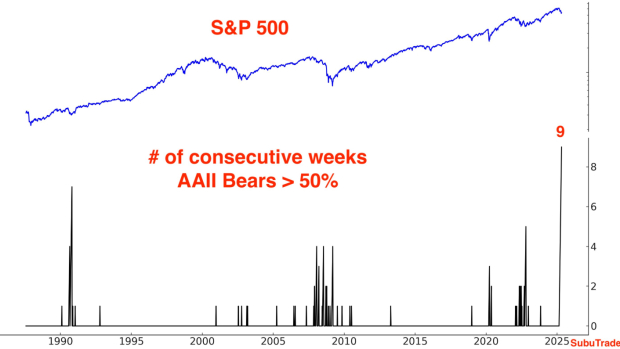

AAII Sentiment Survey Insights

The American Association of Individual Investors (AAII) conducts a weekly poll assessing retail investors’ outlook for the market over the next six months. Participants indicate whether they feel bullish, bearish, or neutral. Notably, the AAII has reported its ninth consecutive week where bearish sentiment exceeded 50%. This marks the longest streak in the survey’s 30-plus years of history.

Image Source: AAII, @subutrade

CNN Fear & Greed Index Overview

The CNN Fear & Greed Index measures overall market sentiment by combining seven market indicators, providing a score ranging from “extreme fear” (0) to “extreme greed” (100). Recently, the index hit a concerning extreme fear level of 3, one of its lowest readings.

Image Source: CNN

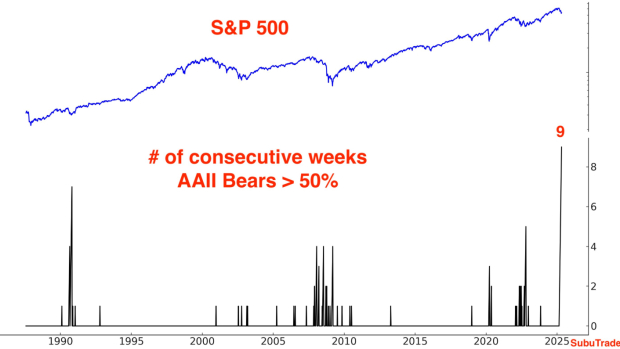

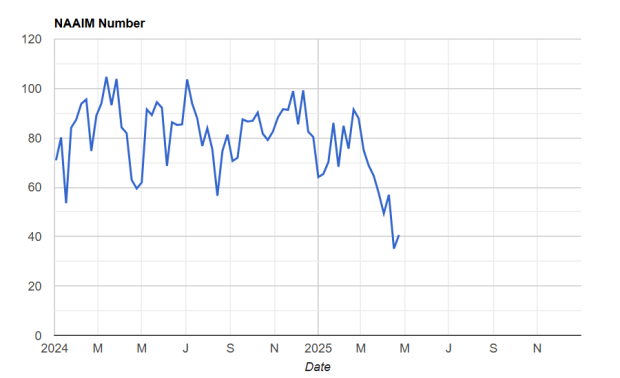

NAAIM Exposure Index Declines

The National Association of Active Investment Managers (NAAIM) tracks the average percentage of portfolio exposure to U.S. equities among its members. In a concerning trend, the NAAIM exposure index has dropped from over 100% late last year to under 40% this month.

Image Source: NAAIM

IPO Market Shows Signs of Life

The IPO market serves as a vital indicator of investor risk appetite. Despite rising volatility, 2025 has seen 98 IPOs, a 69% increase compared to the same time last year. CoreWeave (CRWV) successfully went public last month and is trading above its initial listing price. Additionally, Cantor Equity Partners (CEP) has surged by 155% just this week.

Image Source: TradingView

Recovery in Big Tech as Trade Tensions Ease

Recent developments indicate a reduction in trade tensions between the U.S. and China, benefiting major tech companies reliant on Chinese markets for production and consumers. Stocks like Tesla (TSLA), Nvidia (NVDA), and Apple (AAPL) are showing signs of recovery amidst this cooling trade rhetoric.

Conclusion: Navigating Market Sentiment

With current bearish sentiment, a thawing in trade relations, and a revitalizing IPO market, Wall Street bulls may be prepared to regain control of the market.

The views expressed herein are solely those of the author and do not necessarily reflect the views of Nasdaq, Inc.