For the past three years, investors in Chinese tech stocks have endured a rough ride. However, current valuations and other favorable catalysts are making these stocks more appealing than ever. The prolonged struggle has led to a significant number of investors holding large short positions, forming a compelling contrarian case.

Certainly, concerns about the weak economy and geopolitical risk in China have made potential investors wary. Nevertheless, the exodus from these stocks has created an opportunity, much like the best fishing grounds being in uncrowded waters.

Adding to the allure, Chinese banking authorities are injecting liquidity into the economy, which is expected to provide a tailwind. Furthermore, the appealing valuations of these stocks limit the downside, as they likely trade below intrinsic value, even as analysts raise earnings estimates.

Additionally, with the China Internet ETF KWEB down 75% from its peak, technical signs point to a potential bottom. Observing the bullish wedge pattern, a breakout above $27.25 could signal the start of a new bull run.

On the flip side, failure to sustain levels above $24.50 may indicate otherwise.

Image Source: TradingView

Tencent Holdings: A Conviction Buy

Tencent Holdings Limited, a multinational conglomerate and one of the world’s largest technology companies, is a major force in social media, gaming, and entertainment. Its diverse portfolio includes widely used platforms such as WeChat and significant holdings in the global gaming industry.

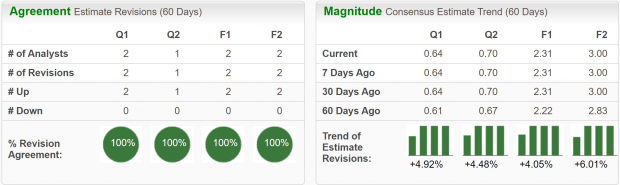

Clearly convinced of its undervalued status, Tencent has been aggressively repurchasing its shares. Analysts, too, have raised earnings estimates, awarding Tencent a Zacks Rank #1 (Strong Buy). Projected earnings show robust growth, with the stock currently trading at a decade-low earnings multiple.

Image Source: Zacks Investment Research

PDD Holdings Group: Riding the E-commerce Wave

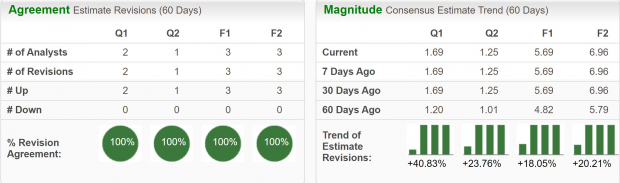

PDD Holdings Group, also known as Pinduoduo, has emerged as a formidable player in the e-commerce landscape, challenging industry giant Alibaba. With soaring sales and earnings estimates, the stock earns a Zacks Rank #1 (Strong Buy) despite relatively higher forward earnings multiple, justified by its rapid growth rates.

Image Source: Zacks Investment Research

NetEase: Diversified Growth Play

NetEase, a prominent presence in online gaming, e-commerce, and internet services, exhibits strong growth prospects, reflected in its Zacks Rank #2 (Buy). With a solid projected sales growth and upward trending earnings revisions, the stock offers an enticing value proposition.

The Contrarian Outlook: The Bull Case for Top-Ranked Chinese Tech Stocks

When it comes to the mystique of investing, the stock market is like a fickle friend. One moment, the market darling; the next, the outcast. Chinese technology stocks are no exception. Amidst the ebbs and flows of the market tides, companies like Netease, Tencent Holdings, and Alibaba have continued to carve out their niche, presenting investors with a perplexing yet enticing investment opportunity.

The Rise of Netease

The Chinese internet company Netease Inc., flaunts a compelling financial profile. With the ability to stand the test of time, and navigate the choppy waters of the market, Netease (NTES) is disarming skeptics with its price momentum. After a bumpy ride in recent years, Netease has refined its image, projecting resilience and growth. This is underscored by a forward P/E ratio of 12.5x, confirming its undervaluation based on growth and positioning it as a tantalizing prospect for forward-looking investors. Projections point to Netease’s EPS experiencing an annual growth spurt of 16% over the next 3-5 years.

The Enigma of Tencent

Competition in the technology sphere is akin to a battleground, and Tencent Holdings is no stranger to this battlefield. Gaining ground on the economic and social frontlines, Tencent’s strategic maneuvers are catching the eye of investors. Amidst its ongoing arsenal of products and services, Tencent prioritizes rewarding its shareholders, having repurchased a whopping $2 billion of its own shares and delivering an impressive 32% return on equity (ROE). As if that wasn’t enough, Tencent’s 10% YoY sales growth and its forward P/E ratio of 17.17 reinforce its standing as an undervalued asset.

The Alibaba Paradox

Alibaba Group Holding Ltd’s execution on a business level brings a sense of bewilderment to those following the stock market. Its stock price has taken a downward plunge, plummeting by 78% from its all-time high, in stark contrast to the company’s meteoric rise in annual sales over the same period. Sporting a Zacks Rank #3 (Hold), Alibaba is somewhat of a Jekyll and Hyde in the market, teetering on the edge of conflicting sentiments. Nevertheless, the stock’s one-year forward earnings multiple of 8.8x presents a glimmer of hope, indicating a fraction of its 10-year median multiple of 36.1x. A dividend yield of 1.4% adds an extra punch to Alibaba’s value proposition, making it an intriguing choice for the discerning investor.

The Bigger Picture

Although Chinese equities carry an additional layer of risk, the allure of these tech stocks is undeniable. Naysayers would do well to take note of the compelling propositions that Netease, Tencent Holdings, and Alibaba are painting on the canvas of the stock market. For investors testing the waters of Chinese technology stocks, these are not mere offerings; they are a vivid testament to the unrelenting nature of the market.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.0% per year. So be sure to give these hand-picked 7 your immediate attention.

NetEase, Inc. (NTES) : Free Stock Analysis Report

Tencent Holding Ltd. (TCEHY) : Free Stock Analysis Report

Alibaba Group Holding Limited (BABA) : Free Stock Analysis Report

KraneShares CSI China Internet ETF (KWEB): ETF Research Reports

PDD Holdings Inc. (PDD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.