AI Stocks Diverge: Broadcom Surges While Marvell Stumbles

Artificial intelligence stocks faced a downturn over the past month. Following a strong AI-driven rally in 2024, investors are now becoming concerned about inflated valuations amid potential tariffs, trade restrictions with China, and a possible slowdown in AI spending.

Broadcom (NASDAQ: AVGO) and Marvell (NASDAQ: MRVL) were two notable winners early in the year. Their product portfolios are quite similar, earning Marvell the nickname “baby Broadcom.”

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

However, after each company reported last week, Marvell’s stock plummeted while Broadcom’s soared. This stark contrast may reflect evolving dynamics in the AI sector.

Marvell Struggles to Assure Investors

Although both companies focus heavily on infrastructure chips for networking and communications as well as custom ASIC IP for AI accelerators, Marvell’s recent reporting failed to instill confidence among investors.

Marvell’s CEO Matt Murphy previously projected $200 million in ASIC revenue for 2023 and $400 million for 2024. However, the company now expects to exceed $1.5 billion in 2024, with forecasts of over $2.5 billion in 2025.

Despite these ambitious figures, Marvell’s reliance on a single customer—Amazon (NASDAQ: AMZN)—for a significant portion of its ASIC revenue presents risks. While Marvell collaborates with Alphabet on its new Arm-based CPU, that relationship does not extend to AI accelerators.

Murphy reassured investors about expected revenue growth from custom XPUs, underscoring the setup for opportunity with Amazon. However, he addressed speculation regarding potential competition without providing a definitive denial, which unsettled investors.

Investors may have been spooked by the vague response regarding Amazon potentially exploring options outside of Marvell’s IP, raising concerns about the sustainability of Marvell’s growth trajectory in ASICs.

Image source: Getty Images.

Broadcom Reports Stronger Customer Engagement

In contrast, Broadcom experienced a surge in its stock following impressive AI revenue numbers and the announcement of engaging with two additional potential ASIC customers.

Broadcom currently serves three major ASIC clients, its largest being Alphabet for tensor processing units (TPUs), alongside what are believed to be Meta Platforms and Bytedance, the owner of TikTok. In its previous earnings call in December, Broadcom had already mentioned two more potential clients.

Now, it appears Broadcom may have engaged with two additional customers, suggesting a possible collaboration with Amazon, though this remains speculative.

Some industry insiders speculate that the earlier mentioned potential customers are Apple and OpenAI, while the latest may include Oracle and Elon Musk’s xAI. However, these associations have not been confirmed by Broadcom.

The possibility of Broadcom expanding its client base contrasted sharply with Marvell’s uncertainty regarding its major customer, affecting investor sentiment in both companies.

Valuation Factors Come into Play

In addition to differing customer dynamics, company valuations likely influenced Broadcom’s and Marvell’s recent stock market performances. Broadcom’s diversified business, bolstered by a high-margin software segment, trades at a comparatively lower valuation than Marvell.

Both companies appear overvalued based on GAAP metrics due to significant amortization of intangible assets stemming from their acquisition histories. Unlike routine capital expenditures represented by depreciation, intangible asset amortization shouldn’t be a recurring cost. Thus, evaluating both companies on a non-GAAP basis is reasonable.

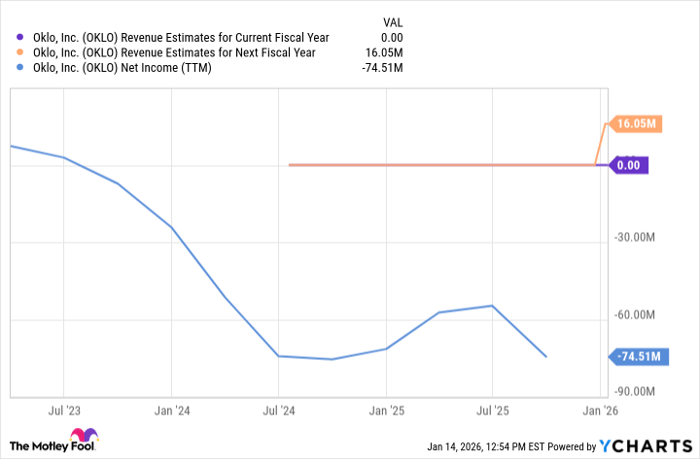

For the fiscal year ending in January, Marvell reported adjusted earnings of $1.57 per share, resulting in a non-GAAP P/E ratio around 46.8 times earnings. Before its recent report, Marvell was trading at a P/E ratio of 57.3 times and peaked at 81.2 times earlier this year.

In contrast, Broadcom’s adjusted earnings ratio sits around 36.3 times trailing twelve-month earnings, up from 33.5 times before its earnings call.

While some investors consider Marvell’s smaller size a sign of greater growth potential, Broadcom has demonstrated impressive growth despite being a larger company. Notably, Broadcom achieved a robust 25% growth last quarter, underscoring its competitiveness in the evolving AI landscape.

Marvell’s Growth Highlights Key Investment Considerations

Marvell Technology reported an impressive growth rate of 27%, even as Broadcom operates at nearly nine times its size.

Key Comparisons Between Marvell and Broadcom

When evaluating companies, two crucial factors often emerge: customer concentration and valuation. While both Marvell and Broadcom showcased relatively similar performance, Broadcom benefits from a lower valuation alongside a more diversified customer base. This contrasts with Marvell’s elevated valuation and significant reliance on a single major client, which raises some caution for investors.

The recent success seen among the Magnificent Seven stocks demonstrates that large companies can still capitalize on growth opportunities. Only sizable firms can actively engage in capital-intensive sectors, including cloud computing and artificial intelligence. Thus, in today’s transformative tech landscape, size does contribute to strength.

Is Marvell Technology a Smart $1,000 Investment Today?

Before deciding to invest in Marvell Technology, it’s essential to consider insights from financial analysts.

The Motley Fool Stock Advisor analyst team has highlighted what they believe are the ten best stocks for investors to consider right now, excluding Marvell Technology. The selected stocks have substantial potential for impressive returns in the years ahead.

For context, when Nvidia was recommended on April 15, 2005, an investment of $1,000 would have grown to an astounding $690,624!*

Stock Advisor provides a straightforward framework for investors, offering portfolio-building advice, consistent updates from analysts, and two new Stock picks each month. Since 2002, the Stock Advisor service has achieved returns that are more than quadruple that of the S&P 500.* Stay updated with the latest top 10 list by joining Stock Advisor.

*Stock Advisor returns as of March 10, 2025.

Randi Zuckerberg, a former director of market development at Facebook and sister of Meta Platforms CEO Mark Zuckerberg, serves on The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, is also a board member. Additionally, Suzanne Frey, an executive at Alphabet, holds a position on the board. Billy Duberstein and/or his clients are invested in alphabet, Amazon, Apple, Broadcom, and Meta Platforms. The Motley Fool recommends both Alphabet, Amazon, Apple, Meta Platforms, and Oracle, as well as Broadcom and Marvell Technology, adhering to a disclosure policy.

The views and opinions expressed herein are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.