Juniors are extremely important to major mining companies because they are the firms finding the deposits that will become the next mines. In this way, juniors help the majors to replace the ore that they are constantly depleting in their operating mines.

Where to look? BC and the Yukon

The mining industry is on the hunt for large copper deposits that have favorable grades and are in locations amenable to mine developments.

Over 80% of the world’s copper production comes from large-scale open-pit porphyry copper mines.

In Canada, British Columbia enjoys the lion’s share of porphyry copper/ gold mineralization. These deposits contain the largest resources of copper, significant molybdenum and 50% of the gold in the province.

Lured by copper, major miners drawn to Quesnel Trough and Golden Triangle – Richard Mills

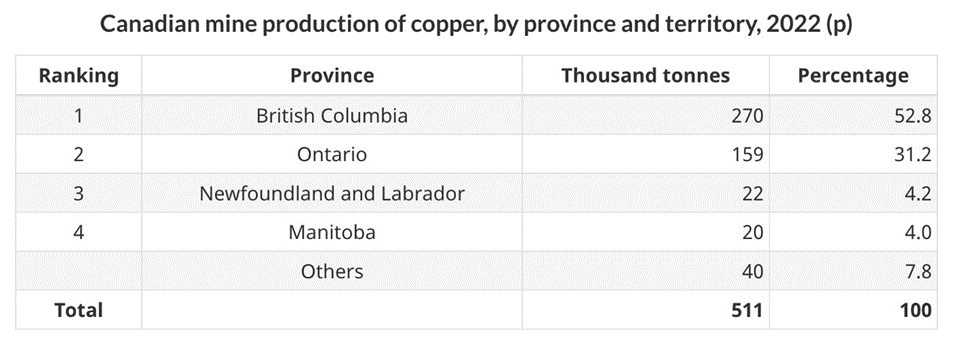

In the table below by GlobalData, via Mining Technology, we note that of 10 major operating copper mines in Canada, six are in BC.

The province accounted for just over half (53%) of Canada’s copper production in 2022.

Eight mines currently produce copper in BC: Newmont and Imperial Metals’ Red Chris, Imperial’s Mount Polley, Taseko Mines’ Gibraltar, New Gold’s New Afton, Teck Resources’ Highland Valley, Hudbay Minerals’ Copper Mountain, Centerra Gold’s Mount Milligan, and Myra Falls on Vancouver Island.

BC focused companies in 2022 nearly doubled the amount of money spent on copper exploration. According to a study by accounting firm EY, the BC government and the Association for Mineral Exploration British Columbia (AMEBC), spending that year jumped to $235 million, an 85% increase over 2021.

Upswing in exploration in British Columbia

With so much geological potential throughout BC and the Yukon, it’s not surprising to see so many exploration companies setting up camps, hoping to make the next big discovery.

We see a coming huge upswing in new copper (and gold and silver), focused exploration in British Columbia, encompassing the Quesnel Trough/ Golden Triangle, a considerable increase in interest in the carbonate replacement deposits (CRDs) near the BC-Yukon border, and extending into the Yukon, home to the legendary Keno Hill silver district.

When new discoveries are made in a mining camp, the odds significantly improve on neighboring properties where similar mineral deposition has occurred. Companies that are holding ground on trend of the discovery, or even just located in the same mining camp, suddenly have access to funding for their exploration programs.

We think interest in exploration and/or development focused juniors operating within BC and the Yukon will get a lot hotter due to the region’s prevalence of red metal. The way the copper market is going, with structural deficits appearing that we’ve been warning about for years, and prices at +$4.40/lb, we believe we’re in for a resurgence of British Columbia and Yukon exploration, development, M&A’s and mining. That is why in our last article we looked at the majors buying copper mines and developing projects in BC, and why in this article, we are focusing on the juniors.

Below is a list of 13 juniors, while obviously not exhaustive, it does present many styles of mineralization spanning much of BC and the Yukon.

NorthWest Copper Corp (TSXV:NWST, OTC Pink:NWCCF)

Northwest Copper has three projects in BC, bookended by the Mount Milligan mine and the Kemess project, both owned by Centerra Gold.

The combined Kwanika-Stardust deposits potentially combine multiple mining centers from each deposit to feed a central processing facility. NorthWest plans to drill-test the “high-conviction” Kwanika Transfer and Kwanika Andesite Breccia targets.

Lorraine is a high-grade alkalic porphyry mineralized system. The Lorraine/Top Cat area is dominated by the Hogem intrusive complex, which hosts numerous alkaline and calc-alkaline porphyry Cu-Au occurrences. Other successful alkalic systems include Galore Creek, New Afton, and Mount Milligan. NorthWest plans to drill-test the Boundary target and a suite of other targets with historical data.

In 2021, NorthWest drilled the East Niv property for the first time, resulting in discovery of a new copper-gold porphyry system. The plan is to complete geological mapping, induced polarization geophysical surveys, and geochemical sampling programs over the 4 x 5-km Southwest target to define initial copper-gold porphyry drill targets.

Ascot Resources (TSX:AOT, OTCQX:AOTVF)

Ascot Resources has two projects in the Golden Triangle, Premier Gold and Red Mountain. The company plans to restart the past-producing Premier mine, which has three main deposits: Premier, Silver Coin and Big Missouri. A 2019 resource update shows 4.669 million ounces of silver and 1.099Moz of gold in the indicated category. A 2020 feasibility study outlines a restart plan to feed the Premier mill at 2,500 tonnes per day to produce approximately 1.1Moz of gold and 3Moz of silver over eight years. Ascot poured first gold at Premier in April 2024.

The nearby Red Mountain project was advanced by IDM Mining between 2014 and 2019. A substantial deposit of high-grade gold has been delineated, primarily in the measured and indicated categories, and is accessed by 2,000 meters of underground workings. With an average thickness of 15 meters and up to 40 meters in areas, the deposit is amenable to low-cost longhole stoping.

Scottie Resources Corp (TSXV:SCOT, OTCQB:SCTSF)

Scottie Resources has exploration rights to over 59,000 hectares in the southern part of the Golden Triangle. The Scottie Gold Mine project is located 20 km north of the Premier gold mine, 27 km south of the Brucejack mine, and 15 km east of the past-producing Granduc mine. It includes the Scottie gold mine that operated from 1981 to 1985, producing 95,426 oz gold at an average grade of 16.2 g/t, as well as other key targets, including Blueberry, Domino and the Bend Vein.

The Cambria project situated just outside of Stewart is bordered to the north by Newmont’s Brucejack mine, to the west by Ascot’s Premier gold project, and to the east by Ascot’s Red Mountain project.

The Georgia high-grade gold project is anchored by the Georgia River mine, which last operated in 1939 with a head grade of 22.6 g/t gold. According to Scottie, only a small part of this hydrothermal system was explored by the past-producing underground mine or drill tested.

Tudor Gold (TSX:TUD, USOTC:TDRRF)

Tudor Gold is focused on the Treaty Creek copper-gold project, which

borders the KSM property to the southwest and the Brucejack mine to the south. The past-producing Eskay Creek mine is 12 km to the west. The project hosts the Goldstorm deposit, which according to Tudor, is one of the largest gold discoveries of the past three decades.

A recent (April 2024) resource estimate for the Goldstorm deposit shows an indicated mineral resource containing 21.66Moz of gold at 0.92 g/t, 128.73Moz of silver at 5.45 g/t, and 2.87 billion pounds of copper at 0.18%.

Tudor says the deposit’s initial resource represents a large, structurally controlled gold-silver-copper porphyry mineralizing system that is open to further expansion with drilling. The Treaty Creek property also includes additional zones and showings of hydrothermal alteration and gold with or without base metals that have formed in porphyry and epithermal settings. The Eureka, Calm Before the Storm (CBS) and Perfectstorm zones are considered to be early- to advanced-stage exploration targets.

Enduro Metals (TSXV:ENDR, OTC:ENDMF)

Enduro Metals holds one of the largest land positions in the Golden Triangle, including the 688 square-km Newmont Lake property, which contains at least four mineralized systems with district-scale potential all starting from surface: Burgundy, McLymont, North Toe and Chachi.

A 2021 discovery hole at Burgundy Ridge intersected 331 meters of 0.71% copper-equivalent from surface. 2022 exploration focused on expanding the mineralized footprint at Burgundy, aiming to demonstrate an alkalic porphyry system with size and grade rivaling Galore Creek to the northwest. Field crews last summer were dispatched to conduct geophysical, geochemical, and geological mapping surveys at the flagship, Newmont Lake.

North Toe is a copper-gold porphyry target previously covered by a retreating glacier. North Toe is around 8 km northeast of Burgundy Ridge, and is believed to be part of a 20-km structural corridor controlling copper-gold mineralization known as the Copperline.

Kodiak Copper Corp (TSXV:KDK, OTCQB:KDKCF)

Kodiak Copper’s MPD copper-gold porphyry project consolidated four properties: Man, Prime, Dillard and Axe. MPD is located near Merritt, southcentral BC, in the Quesnel Trough. It is also midway between the operating Copper Mountain and Highland Valley mines.

Claudia Tornquist, President & CEO of Kodiak said, “Kodiak’s 2023 exploration program was a resounding success. We set out to demonstrate the potential of MPD beyond our initial discovery at the Gate Zone, and our drilling has now proven multiple kilometre-scale mineralized porphyry centres across the property. Importantly, 2023 results include high-grade intercepts and mineralization right from surface. The discovery of an entirely new porphyry centre at 1516 is a particularly positive development which we will certainly follow up on.”

Dolly Varden Silver (TSXV:DV, OTCQX:DOLLF)

Dolly Varden’s Kitsault Valley project is located at the southern end of the Golden Triangle. It represents the amalgamation of its original namesake silver property and its Homestake Ridge gold-silver property.

This 163-square-kilometer land package hosts one of the largest undeveloped high-grade precious metals projects in Western Canada.

Results from Dolly’s 2023 51,500m drill program contained some spectacular, “jewelry-box” silver grades. The highlight of a grouping of holes from the Wolf Vein was hole DV23-368, which intersected 1,898 g/t over 1.00m within 381 g/t Ag over 29.34m core length.

In February, Dolly announced that 2023 step-out drilling encountered a new gold-rich zone to the northwest of the Homestake Silver deposit.

In December, Dolly said it was acquiring the southern portion of the Big Bulk project from Libero Copper & Gold.

When combined with Dolly’s northern portion, it doubles the size of the Big Bulk project to approximately 6,000 hectares. The option gives Dolly a consolidated copper-gold porphyry project in the Golden Triangle.

Goliath Resources (TSXV:GOT, OTCQB:GOTRF)

Goliath’s Golddigger property covers 61,685 hectares of the Eskay Rift within the Golden Triangle; it is within 3 km of the Red Line. Over 65,000 meters of drilling at the newly discovered Surebet Zone has confirmed 1.8-square kilometers of multiple highly mineralized stacked zones containing bonanza gold grades that remain open.

In January, Goliath reported discovery of the new high-grade gold- copper Treasure Island target. The target contains channel samples that assayed up to 28.08 grams per tonne gold-equivalent, and grab samples up to 11.08 g/t AuEq. Treasure Island is located 36 km north of the Surebet discovery, 6 km to the east of, and on trend with, the Porter Idaho mine, and 9 km east of Stewart. The target has recently been exposed because of glacial retreat and will be drill-tested for the first time during the 2024 field season.

Goliath’s updated model at Surebet confirms six new gold veins for a total of 10, increasing the tonnage potential to 78-97 million tonnes.

Silver North Resources (TSXV:SNAG, OTCQB:TARSF)

Silver North’s underexplored Haldane project demonstrates high-grade, high-width potential akin to the veins being mined at the Yukon Territory’s Keno Hill, one of the most prolific silver districts in Canada.

In 2021, Silver North announced a new discovery at the West Fault Zone, where drilling intersected 311 g/t silver over 8.7 meters (true width), This was followed by 3.14m of 1,315 g/t silver.

According to Silver North, this new zone has been traced over a 100- by 90-meter area with room to expand along strike and at depth.

South of Haldane, Silver North is working with partner Coeur Mining to develop the Tim carbonate replacement deposit (CRD) property, located on the Yukon side of the Yukon-British Columbia border.

Silver North has an option agreement with Coeur Mining, which can earn 80% ownership in the project by spending $3.5 million on exploration over five years, making $575,000 cash payments and completing a feasibility study within eight years.

Coeur is funding a minimum $700,000 drill program of about 2,000 meters, expected to start in June.

Core Assets (CSE:CC, OTCQB:CCOOF)

Core Asset’s Blue property is in the last unexplored area of British Columbia’s Stikine Terrane. It consists of three projects with a combined 11 exploration targets. These targets span several mineral deposit types including Mo-Cu-bearing porphyries with associated with copper or copper-zinc-silver rich skarn deposits, silver-lead-zinc-copper rich massive sulfide carbonate replacement deposits (CRDs), and distal base metal-gold-silver vein assemblages.

At the center of the Blue property, the Silver Lime project contains one of the largest and highest-grade surface expressions of any early-stage CRD project. Silver Lime contains copper, molybdenum, silver, zinc, lead, and gold-bearing ore styles that span the full porphyry-skarn-carbonate replacement spectrum.

In 2023, Core Assets completed 4,245m of shallow, exploratory diamond drilling over 21 drill holes; 14.4 line-kilometers of a high-resolution 3D-DCIP geophysical survey over the high-grade Pete’s-Sulphide City-Gally Trend; and collected 89 surficial rock samples across the Silver Lime CRD-porphyry project footprint.

Skeena Resources (TSX:SKE)

Skeena is revitalizing the Eskay Creek and Snip projects, two past-producing mines located in the Golden Triangle.

Discovered in 1988, the former Eskay Creek mine produced about 3.3 million ounces of gold and 160 million ounces of silver at average grades of 45 g/t Au and 2,224 g/t Ag. It was once the world’s highest-grade gold mine and fifth-largest silver mine by volume.

The company completed a definitive feasibility study for Eskay Creek in November 2023 which highlighted high-grade, pit-constrained reserves of 4.6Moz AuEq at an average grade of 3.6 g/t AuEq. Skeena is aggressively advancing Eskay Creek toward production, with construction activities continuing in 2024.

Skeena acquired the past-producing Snip mine from Barrick Gold in July 2017. The property consists of one mining lease and eight mineral claims totaling approximately 4,546 hectares in the Liard Mining Division. The Snip mine produced approximately 1 million ounces of gold from 1991-99 at an average grade of 27.5 g/t.

Eskay Mining (TSXV:ESK, OTCQX:ESKYF)

Eskay Mining’s ESKAY-Corey property hosts several volcanogenic massive sulfide (VMS) targets and has the potential to host nickel-copper massive sulfide and several occurrences of vein-style mineralization. Main VMS target areas on the property include the SIB-Lulu, TV-Jeff, C10, GFJ and Spearhead zones.

A new model of the Eskay Mining District suggests the flanks of each of three anticlines are prospective for Eskay Creek-style VMS mineralization where favorable strata (rock layers) are exposed.

Precious metal-rich volcanogenic massive sulfide deposits are the focus of Eskay’s exploration.

Eskay says it received encouraging assay results from its 2023 diamond drill and exploration campaign. Drill intercepts of 6.28 g/t AuEq over 15m, 2.96 g/t AuEq over 22.52m, 2 g/t AuEq over 61.23m and 1.39 g/t AuEq over 45.67m were encountered at the Cumberland showing.

Rock chip samples of 37.23, 23.34, 20.34 and 20.23 g/t AuEq were taken from Scarlet Knob.

Decade Resources (TSXV:DEC)

Decade Resources has a 65% interest in the Red Cliff property, a former copper-gold producer from the early 1900s in the Golden Triangle.

Decade has identified four gold-bearing zones called Red Cliff, Upper Montrose, Lower Montrose and Waterpump within eight Crown-granted claims along Lydden Creek.

Six mineralization types have been identified: extremely fine grained pyrite in host rocks that have been pervasively altered to a mixture of sericite and quartz; a stockwork of quartz veinlets carrying coarse-grained pyrite and chalcopyrite plus or minus visible gold; a stockwork of fine pale yellow-brown sphalerite-galena with plus or minus chalcopyrite and plus or minus visible gold; massive pyrite veins with variable amounts of chalcopyrite and quartz with generally low to significant gold values; massive hematite veinlets with coarse cube pyrite along wide stockwork zones; and intensely silicified rocks, possibly intrusive with strong epidote and chlorite associated with quartz veins up to 5 meters wide, containing up to 25% coarse pyrite and local minor chalcopyrite.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of any companies mentioned in this report. None of the companies mentioned are paid advertisers on his site aheadoftheherd.com except Silver North (TSX.V:SNAG).