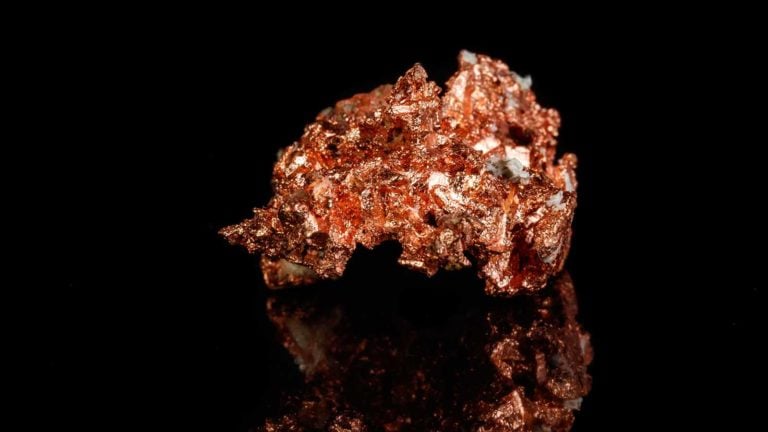

Source: Coldmoon Photoproject/Shutterstock.com

While everyone is talking about AMC (NYSE:AMC) and GameStop (NYSE:GME), the real story is copper. And if you haven’t noticed, copper prices are currently shooting for the moon.

One of the biggest investment themes I have been following is the potential for China’s economy to start showing signs of life. It’s happening. Those markets have been on a tear, and the Chinese government is finally starting to take action.

After a prolonged bear market in the country’s property sector, China is now taking some decisive steps to stabilize prices. Whether or not it will be successful is unclear, but it’s a step in the right direction.

I think the move in copper is partially based on that. As the largest importer of copper, China’s economic policies and initiatives, such as the issuance of 1 trillion yuan in ultra-long bonds for infrastructure, have a substantial impact on copper prices and demand. Projections indicate that annual global copper demand will rise to 36.6 million metric tons by 2031, up from 25.3 million in 2021, with China playing a pivotal role in this increase due to its strategic investments and consumption patterns. A resurgent China means resurgent copper.

But it’s more than China. It’s also AI.

AI and China Are Taking Copper Prices Higher

The rapid proliferation of artificial intelligence has significantly increased the demand for copper, primarily due to its extensive use in data centers. These data centers, essential for cloud computing, big data processing, and AI algorithms, require substantial amounts of copper for electrical wiring and infrastructure. Bank of America notes that the growing need for AI capabilities has shifted focus toward copper usage in data center buildouts, which has contributed to the recent rise in copper prices. This surge in demand for copper in AI data centers is a key factor driving the overall increase in global copper consumption. And that won’t go away any time soon.

What about new supply? Good luck. Mining new copper and bringing it to market is a complex and challenging process due to several factors.

Firstly, the depletion of high-grade copper ores has necessitated mining lower-grade deposits, which are more costly and less efficient to extract. Additionally, environmental regulations and community opposition often delay or halt new mining projects. The capital-intensive nature of developing new mines, which can take over a decade from discovery to production, further complicates the process. Lastly, geopolitical risks and fluctuating market prices add layers of uncertainty, making the availability of new copper to the market a formidable challenge.

The rally in copper prices looks real, as does the demand. The supply constraints are also real, however. And it could get really interesting really soon.

On the date of publication, Michael Gayed did not hold (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.