This article was coproduced with Leo Nelissen.

It’s no secret that buying a new home in today’s market is akin to steering a craft through a treacherous maelstrom. Prospective buyers grapple with a toxic blend of challenges – elevated rates, soaring home prices, and the pervasive financial squeeze exerted by stubborn inflation (core inflation languishes stubbornly at 4%).

For instance, Redfin’s data shows that the median home sales price in the United States concluded the year a hefty 4.4% higher than the preceding year, resting at roughly $363 thousand.

At a staggering 6.6% rate, homebuyers need approximately $3,400 per month to meet mortgage payments on a median home – a stark contrast to the consistently sub-$1,500 figures witnessed in 2020. This, in part, explains the scarcity in housing supply, with homeowners entrenched in favorable mortgage deals unwilling to take on more costly debt, causing them to stay put.

But what’s even worse? The disconcerting fact that Wall Street is now locked in a fierce competition for single-family homes.

Witness The Wall Street Journal’s headline, “Wall Street Moves Into The Neighborhood,” which illuminates the extent of this encroachment.

The increasingly cutthroat U.S. housing market has lured major investors to pivot to a novel modus operandi – the construction of entire suburban neighborhoods tailored for renting.

With towering interest rates, escalating housing prices, and constraints on conventional channels, institutional investors are grappling with the challenge of meeting return goals. And it’s this very predicament fueling their burgeoning interest in single-family homes – a shift attributed to stronger rent growth and longer tenant tenure compared to the conventional domain of U.S. apartments, a trend that’s been a recurrent theme in our Investment Circle discussions.

Yet, the traditional method of acquiring individual houses has grown increasingly inefficient. Furthermore, bulk-purchasing of newly constructed houses becomes an exercise in futility amidst the dearth of housing inventory, which leads to immediate purchases by regular buyers.

Enter the rise of “build-to-rent” communities – a phenomenon gaining significant traction as a means of overcoming these challenges. Approximately 10% of new housing constructions are dedicated to build-to-rent, with 900 such neighborhoods spread across the nation. This approach not only consolidates rental properties but also renders maintenance more cost-effective.

While some firms like American Homes 4 Rent are independently constructing thousands of new family homes, others like Invitation Homes (NYSE:INVH), opt for partnerships with housebuilders, albeit at a higher cost.

And this brings me to Invitation Homes, my preferred vehicle for harnessing the wisdom of Wall Street.

What Sets Invitation Homes Apart?

Let’s start from the top for those getting acquainted with the INVH ticker.

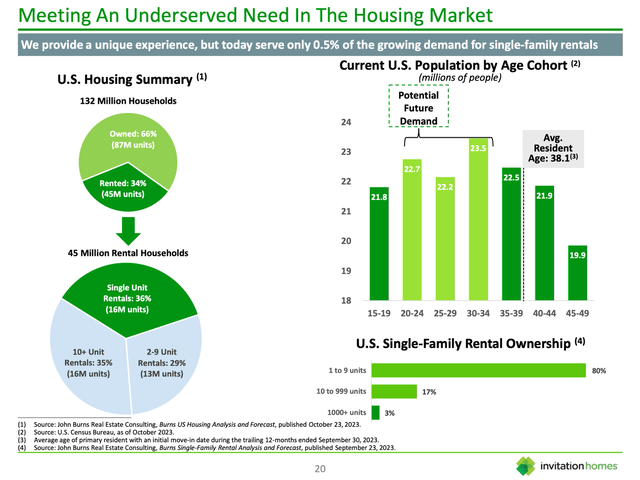

Invitation Homes stands as a major proprietor and operator of single-family homes for lease, boasting a portfolio of over 80,000 homes across 16 markets in the United States entering 2023.

Nestled in coveted neighborhoods, the company makes a compelling case for addressing the burgeoning demand for leased lifestyles, proffering quality residences in close proximity to workplaces and reputable schools.

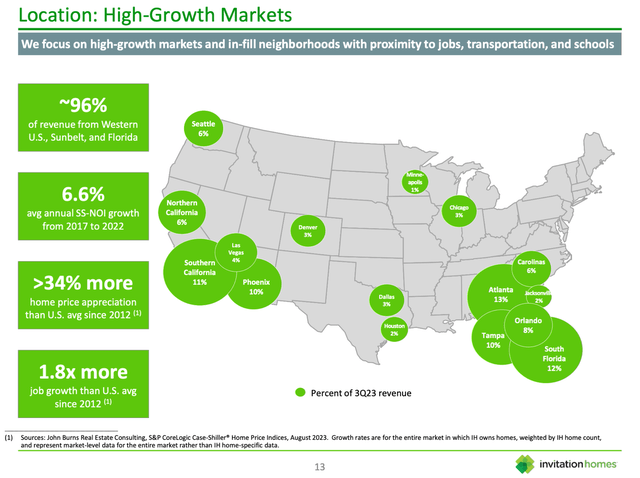

Operating in markets with robust demand, formidable entry barriers, and a potential for rental growth, particularly in the Western United States, Florida, and the Southeast, Invitation Homes has its gaze fixed on strategic mergers and acquisitions to enable efficient market and asset selection.

Essentially, the company’s portfolio reaps the rewards of local density and economies of scale, affording it a vertically integrated platform.

In essence, the company engages with residents through digital platforms, allowing for effective and efficient management of its expansive portfolio. This digital marketing approach, coupled with initiatives like Resident Appreciation Month, sets them apart in fostering a sense of community and connectivity among residents – a win-win scenario.

For instance, approximately 12,800 homes in Atlanta are under the company’s ownership and are managed by a lean operational team, consisting of a VP of Operations, 2 Directors of Operations, alongside supportive staff like Portfolio Directors, leasing personnel, and maintenance personnel. Impressive yet less than 100 maintenance employees oversee this substantial housing inventory.

To boot, the firm’s highly standardized approach, aiming to minimize employment and maintenance outlays while streamlining operations and enhancing renter comfort, epitomizes operational efficiency.

INVH Positions Itself for Growth in Robust Housing Market

Moreover, the company holds the majority of its assets in highly sought-after regions, including the Western U.S., Sunbelt, and Florida, which collectively contribute to almost all of its revenue.

Since 2017, INVH has experienced a 6.6% annual growth in its same-store net operating income (“NOI”), capitalizing on over 34% home price appreciation, well above the U.S. average since 2012.

Its primary markets have also witnessed job growth 1.8 times higher than the national average since 2012.

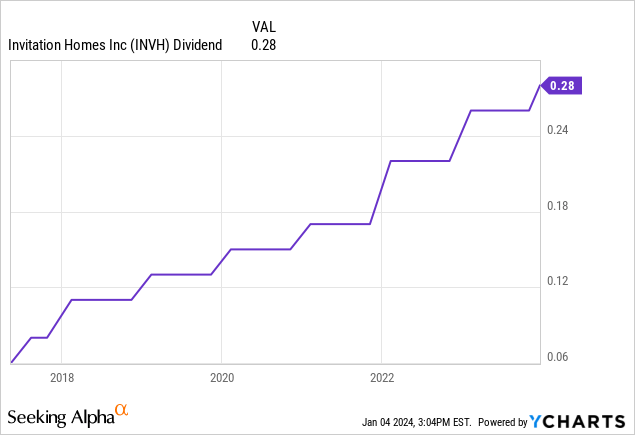

Furthermore, INVH boasts an appealing dividend, currently at $0.28 per share per quarter, yielding 3.3%.

Over the last five years, the company has achieved an impressive 25% dividend compounded annual growth rate, which was driven by robust dividend growth post-IPO.

Beginning with a $0.06 per share quarterly dividend in 2017, INVH subsequently hiked it by 33.3% on August 4, 2017.

Analysts project INVH to generate $1.49 in 2023 adjusted funds from operations (“AFFO”), equating to a 75% payout ratio, indicating a well-protected dividend with potential for sustained long-term growth.

The company maintains a BBB credit rating, marking it as investment-grade.

As of the end of the third quarter, INVH boasted $1.8 billion in available liquidity and a net debt-to-EBITDA ratio of 5.5x, within the targeted 5.5x to 6x range.

Moreover, the majority of its debt carries a fixed interest rate or has been swapped to a fixed rate, with a weighted average interest rate of 3.8%.

Now, let’s delve into INVH’s performance and position in the market in the third quarter.

INVH Thrives In This Market

Similar to Wall Street professionals, INVH is banking on the U.S. housing market.

During the third quarter of 2023, Invitation Homes took advantage of unique external growth opportunities, including a notable acquisition of 1,870 wholly-owned homes for $650 million, with a mid-5% year-one yield expected to grow into the 6% range within the next year.

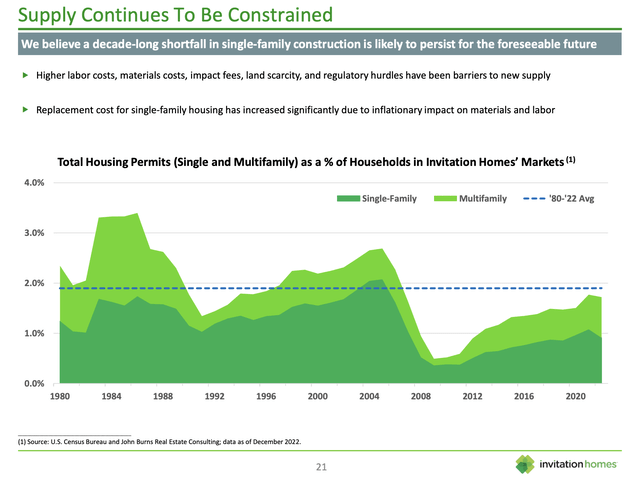

The aggressive purchasing is in response to ongoing shortages, a topic previously touched upon, as INVH operates in the context of a substantial housing scarcity in the United States, estimated to be several million units.

This demand-supply imbalance remains a significant driver of the company’s strong performance, with robust demand for single-family homes for lease fueled by various factors.

One such factor is the changing landscape of homeownership costs, with leasing through Invitation Homes now averagely over $1,100 a month cheaper than owning in the company’s markets.

This cost advantage, combined with the flexibility and convenience of leasing, places INVH favorably in the market.

Furthermore, INVH has strategically positioned itself to meet the growing demand for single-family homes for lease, driven by favorable demographics, a desire for flexibility and convenience, and rising mortgage rates making leasing a more appealing and affordable option compared to home ownership.

These developments have translated to strong earnings, with the company’s same-store NOI growing by 4% year-over-year in the third quarter, in line with expectations.

This growth was underpinned by a 6% year-over-year increase in same-store core revenues, driven by a 6.2% growth in average monthly rental rates and a 20-basis point improvement in bad debt, indicating improved tenant health.

Overall, Invitation Homes continues to attract high-quality residents, with new residents boasting a combined household income of over $142,000 per year.

Moreover, the company’s partnership with Esusu, announced in July, has enrolled over 160,000 residents in a free credit reporting program, resulting in approximately half of them witnessing an average credit score increase of over 20 points.

- The occupancy rate for the third quarter stood at an impressive 96.9%, surpassing pre-pandemic norms by 120 basis points.

- Blended rent growth for the same period was 6.2%, comprising renewal rent growth of 6.6%

INVH: An Intriguing Investment Opportunity in Real Estate

INVH revealed promising figures in its recent financial results, with impressive revenue growth and updated full-year guidance. Let’s delve into the details that make INVH an interesting investment prospect in the real estate market.

Company Performance and Guidance

In a striking exhibit of strength, INVH reported an 8.3% year-over-year growth in total revenues for the first quarter of 2023 and new lease rent growth of 5.2%. This growth demonstrates the company’s competitive edge and resilient positioning in the real estate sector.

The company also updated its full-year guidance, narrowing the same-store NOI growth range for 2023 to 4.5% to 5%. This adjustment reflects a fine-tuning of same-store core revenue and expense growth, with explanations provided for the changes during the earnings call.

Notably, INVH addressed the increase in same-store core expense growth, primarily attributed to higher property tax expenses in certain regions, with a revised growth expectation of approximately 10% to 10.5% for the full year.

Moreover, the updated guidance included tighter ranges for expected core FFO per share and AFFO per share for the full year 2023, showcasing the company’s commitment to precision and transparency in its forecasted financial performance.

Valuation Analysis

The valuation of INVH presents an intriguing narrative. Currently trading at a blended P/AFFO ratio of 22.9x – placing it below its five-year normalized valuation multiple of 26.1x – the stock showcases potential value for discerning investors.

Coupled with the expected AFFO growth rates and the company’s historical performance, the clarity in valuation opens the door for a return of 8.3% per year through 2025, inclusive of its 3.4% dividend. A compelling figure set against its strong history of delivering returns since going public.

Considerations and Market Analysis

Despite the optimism, certain reservations merit attention. The market’s anticipation of rate cuts and the potential impact of inflation on real estate stocks calls for a cautious assessment of INVH’s near-term prospects.

Furthermore, while the company’s growth rates remain robust, they currently fall below the five-year average, setting the stage for patient monitoring and strategic entry into the stock.

It’s noteworthy that INVH’s recent price trajectory, despite an upward trend, suggests a measured contemplation for investment, especially with the potential for a better entry point.

Investment Perspective and Concluding Remarks

In conclusion, INVH presents an opportunity for investors seeking exposure to a real estate heavyweight with abundant potential for future growth and stability. The company’s strategic positioning, operational efficiency, and dividend yield of 3.3% accentuate its appeal as a top-tier landlord in the sector.

While valuation considerations demand vigilance, INVH remains a compelling long-term investment choice, aligning with the evolving investment landscape and allowing investors to echo the sentiments of Wall Street professionals.

Note: Brad Thomas is a Wall Street writer; his predictions or recommendations are not infallible. This article serves as a free platform for research and second-level thinking, aiming to assist investors with informed decision-making.