Corcept Therapeutics Sees Impressive Growth in 2024

Corcept Therapeutics Incorporated (CORT) has enjoyed a remarkable year in 2024, with shares rising by 60.5% as of November 5, 2024.

Innovative Drug Development for Serious Health Conditions

Based in the United States, Corcept focuses on discovering and developing drugs aimed at treating severe disorders affecting the endocrine, oncologic, metabolic, and neurologic systems. For over 25 years, the company has concentrated on cortisol modulation, identifying more than 1,000 unique selective modulators and currently conducting advanced clinical trials.

Korlym Drives Demand Amid New Developments

Korlym, Corcept’s primary drug for treating Cushing’s syndrome, has experienced significant demand and has been a key driver of the company’s growth. Moreover, a new drug application for relacorilant, aimed at the same condition, is expected to be submitted in the fourth quarter of 2024.

Strong Earnings and Revenue Performance

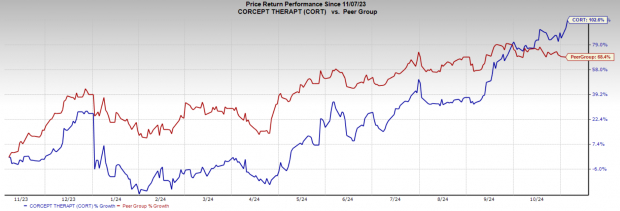

Corcept holds a Zacks Rank #2 (Buy) and operates within the Zacks Medical – Drugs industry, alongside competitors Ionis Pharmaceuticals, Inc. (IONS) and Collegium Pharmaceutical, Inc. (COLL). Ionis is currently rated #3 (Hold), while Collegium shares a similar rank of #2. Over the past year, Corcept’s stock has surged by 102.6%, significantly outpacing the 68.4% increase of its peer group.

In its latest quarterly report, Corcept announced earnings of 41 cents per share, surpassing the Zacks consensus estimate of 27 cents—a surprise of 51.9%. This performance is an improvement from earnings of 28 cents per share a year prior. The company has beaten earnings expectations in each of the past four quarters. Additionally, Corcept reported revenues of $182.6 million, which exceeded estimates by 6.1% and compares favorably to last year’s revenues of $123.6 million, successfully topping revenue estimates three times in the last four quarters.

Investment Potential and Market Context

Corcept’s stock is currently seen as undervalued, trading around $52. Analysts project earnings of $1.25 per share and revenues of $683.8 million for the fiscal year, representing a remarkable 33% increase in EPS and a 41.8% growth in revenues. Importantly, the Medical – Drugs industry ranks in the top 29% of all industries in the Zacks universe, adding to the case for investment.

Explore Further Opportunities

See This Stock Now for Free >>

Latest Recommendations from Zacks

Explore Corcept’s Peers

Corcept Therapeutics Incorporated (CORT) : Free Stock Analysis Report

Collegium Pharmaceutical, Inc. (COLL) : Free Stock Analysis Report

Ionis Pharmaceuticals, Inc. (IONS) : Free Stock Analysis Report

To read this article on Zacks.com, click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.