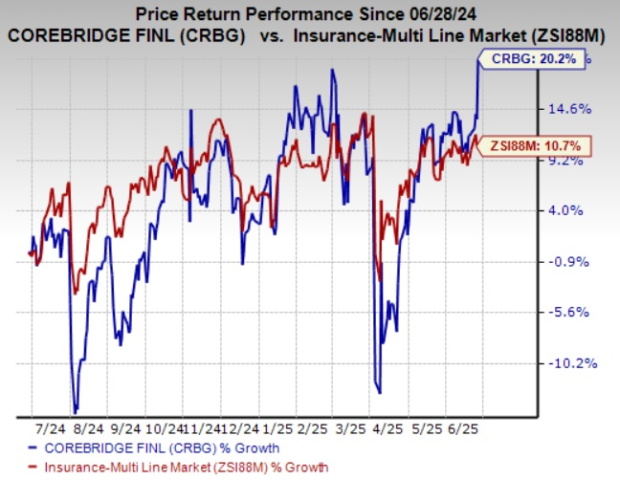

Corebridge Financial, Inc. (CRBG) has entered into a $2.8 billion reinsurance agreement with CS Life Re, a subsidiary of Venerable Holdings, Inc., to reinsure its entire block of variable annuities in the Individual Retirement segment. This transaction is anticipated to yield approximately $2.1 billion in net distributable proceeds after taxes for Corebridge. The agreement encompasses a portfolio with $51 billion in account value as of March 31, 2025.

Following customary regulatory approvals, the AGL segment of the transaction is projected for completion in Q3 2025, while the USL transaction and divestiture of the investment adviser SAAMCo are expected by Q4 2025. The reinsurance deal is set to improve Corebridge’s Life Fleet Risk-Based Capital ratio by over 50 points and may reduce adjusted after-tax operating income by $300 million in 2026.

The majority of the proceeds will be allocated towards share repurchases, with a $2 billion increase to its existing buyback authorization recently approved. Corebridge aims to reshape its portfolio and enhance shareholder value through this strategic move.