Amidst the clamor for tech titans like Nvidia and Amazon, there are lesser-known gems in the market that beckon savvy investors. These growth stocks, although not immediate gratification, promise long-term rewards that glitter like hidden treasures waiting to be unearthed.

Let’s shine a light on two undervalued jewels that Wall Street holds in high esteem.

1. Costco Wholesale

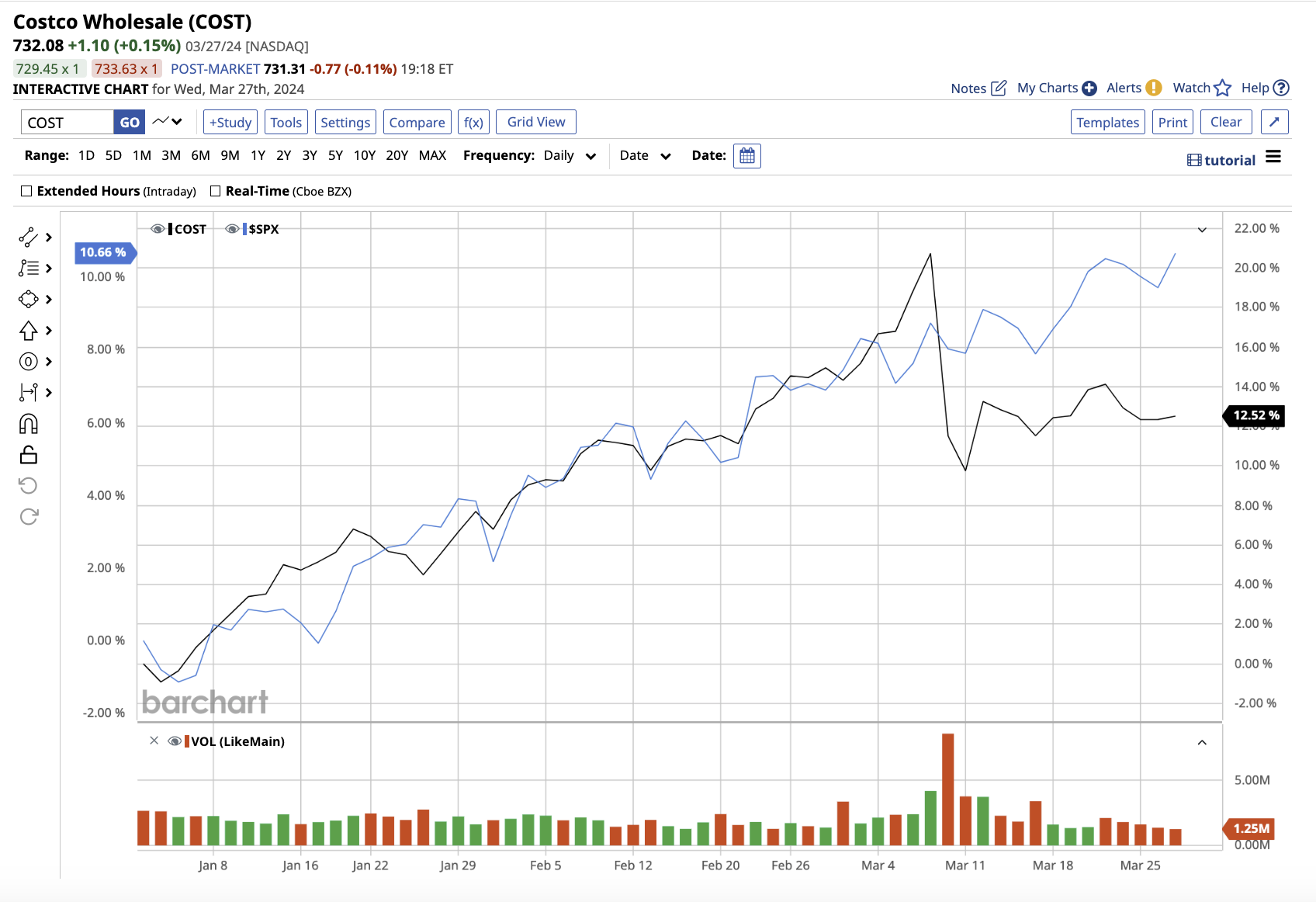

Costco Wholesale (COST), a titan among membership-only retailers, may not sparkle as brightly as the hot AI stocks flooding the market. Nevertheless, Costco’s robust performance over the last decade, with a staggering 556% stock return, outshines even the S&P 500’s modest 180.6% gain.

Year-to-date, COST stock has gained 11%, a testament to its enduring appeal.

Costco’s membership-based business model fosters a symbiotic relationship with consumers. Offering discounted bulk products and exclusive deals, the company rakes in a steady revenue stream through membership fees, amounting to $1.1 billion, up by 8.8% year-over-year in the second quarter of fiscal 2024.

In the second quarter, Costco saw a 5.7% uptick in total revenue, reaching $57.33 billion. Earnings per share surged to $3.92, compared to $3.30 in the same quarter the previous year. This relentless growth trajectory has seen Costco’s revenue and earnings balloon at rates of 9.6% and 11.4% annually over the last five years.

With a global footprint spanning 875 warehouses and e-commerce sites, Costco’s revenue stream diversification shields it from the perils of market dependence. Add its 0.56% dividend yield and forward-thinking e-commerce thrust, and Costco emerges as a beacon of resilience, guiding investors to stable wealth accumulation.

Analysts foresee Costco’s revenue scaling by 4.9% to $254 billion in fiscal 2024, with a 12.4% earnings surge. And the outlook for fiscal 2025 is equally promising, with revenue and earnings poised to leap by 7.2% and 9.3%, respectively. While Costco’s 42 times forward 2025 estimated earnings might seem steep compared to Walmart’s 23x, the former’s trajectory echoes a tale of sustained growth.

As the retail landscape evolves, Costco’s strategic shifts toward e-commerce and its expansive global network whisper promises of continued prosperity. Whether a seasoned investor seeking stability or a rookie yearning to ride the retail wave, Costco’s allure lies in its unassuming ability to weave wealth over time.

What Are Analysts Saying About COST Stock?

With a resounding chorus, Wall Street sings COST stock’s praises, doling out a “strong buy” verdict. Out of 19 analysts, 19 champion it as a “strong buy,” while three advocate a “moderate buy,” and seven counsel to “hold.”

The mean price target for COST stock stands at $774.58, signaling a potential 5.7% upswing. And for the optimistic, the high target of $905 beams with a tantalizing 23.5% rise in the coming year.

2. Marvell Technology

Marching in step with the AI revolution, the semiconductor realm witnesses Marvell Technology (MRVL) dazzling investors with its AI product lineup. From powering data centers with high-performance networking solutions to enabling cloud computing and 5G connectivity through cutting-edge storage technologies, Marvell stands tall amidst its peers.

With a market cap of $62 billion, Marvell has surged by 17.5% year-to-date, eclipsing the broader market’s stride.

Marvell’s fourth-quarter fiscal 2024 revenue surged, exceeding expectations and reaching $1.43 billion, with adjusted net income clocking $0.46 per diluted share. CEO Matt Murphy’s remark encapsulates Marvell’s success, citing a robust 54% year-over-year increase in data center end-market revenue propelled by AI.

Looking forward, Marvell anticipates buoyant growth in its data center segment while acknowledging near-term softness in consumer demand, carrier infrastructure, and enterprise networking in the first quarter of fiscal 2025. A revival is on the horizon for the latter half of fiscal 2025.

The forecast for Q1 includes revenue hitting $1.15 billion (+/- 5%) with adjusted diluted EPS at $0.23 (+/- $0.05). Though analysts predict a slight downturn in fiscal 2025, Marvell’s expected revenue and earnings upticks in fiscal 2026 by 31.9% and 72.5% pique interests. Trading at a reasonable 29 times forward earnings and eight times forward sales, Marvell stands as a compelling investment in the semiconductor niche leveraging AI capabilities.

What Are Analysts Saying About MRVL Stock?

Post Marvell’s stellar Q4 results, Wall Street’s ardor for MRVL stock has only intensified. Stifel Nicolaus analyst Tore Svanberg maintains a “buy” rating with a target price of $86, encapsulating the bullish sentiment.

The Street’s sentiment resounds in unison with a “strong buy” rating for MRVL stock. Of the 28 analysts covering MRVL, 25 extol it as a “strong buy,” two laud a “moderate buy,” and one advocates a “hold.”

The average price target sets sail at $87.78 for MRVL stock, hinting at a potential 23.8% rise from current levels. While the ambitious high target of $100 beckons with a promising 41.1% sprint in the next 12 months.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.