Corpay, Inc. Sees Revenue Growth Amid Strong Stock Performance

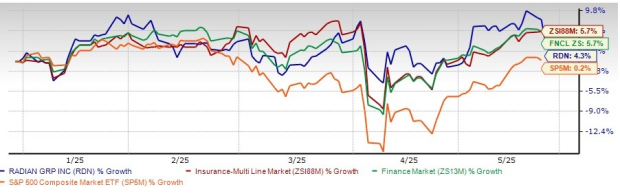

Corpay, Inc. (CPAY) has demonstrated significant stock performance over the past year, with its shares increasing by 25%. In comparison, the industry and the Zacks S&P 500 composite saw growths of 25.6% and 13.6%, respectively.

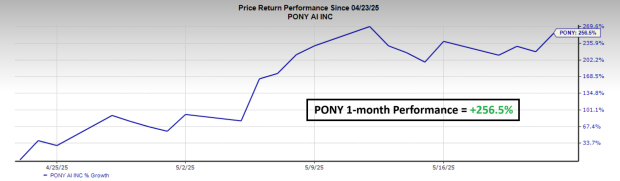

Corpay, Inc. Price

Corpay, Inc. price | Corpay, Inc. Quote

CPAY’s revenue is projected to grow by 11.3% year-over-year in 2025, followed by an increase of 10.6% in 2026. Additionally, its earnings are estimated to rise by 10.4% in 2025 and 16% in 2026.

Updated 2025 Revenue Forecast

Corpay has raised its revenue guidance for 2025 to $4.38-$4.46 billion, an improvement from the previous estimate of $4.35-$4.45 billion. This forecast is notably higher than the third quarter of 2024, which anticipated revenues between $3.98 and $4.01 billion, increasing investor confidence.

Organic Revenue Growth Trends

From 2022 to 2024, CPAY’s organic revenues have demonstrated substantial growth, hitting 13%, 10%, and 20%, respectively. Despite a slight dip in 2023, a significant uptick in 2024—driven by higher transaction volumes—shows the effectiveness of the company’s strategies in sustaining demand. This trend enhances appeal among both existing and prospective investors.

Multi-Channel Strategy Enhances Market Reach

Corpay employs a multi-channel strategy to market its solutions, which encompasses a robust digital platform, direct sales forces, and strategic partnerships. This strategic approach simplifies customer interactions, allowing for seamless online account management. The efficiency of CPAY’s sales team has improved thanks to digitally sourced leads through this omnichannel model.

Consistent Acquisition Strategy

To broaden its customer base and capabilities, CPAY actively acquires firms both domestically and internationally. Recent acquisitions include GPS Capital Markets in December 2024, which strengthened its corporate payments division, and PayByPhone in September 2023, enhancing vehicle payment solutions for B2B fleet customers. Other notable acquisitions, such as Global Reach Group, Mina Digital Limited, and Business Gateway AG, have also diversified its product offerings and geographic reach.

Current Ranking and Investment Opportunities

At present, Corpay holds a Zacks Rank of #3 (Hold). Investors interested in the business services sector may consider stocks like Amadeus IT Group (AMADY) and AppLovin (APP), both of which are rated Zacks Rank #1 (Strong Buy). Amadeus has a long-term earnings growth expectation of 7.7% and has delivered a trailing four-quarter earnings surprise of 7.4%. Meanwhile, AppLovin features an impressive long-term growth expectation of 20%, with a trailing four-quarter earnings surprise of 22.9%.