The Federal Reserve is expected to consider cutting interest rates in September, which could significantly benefit tech companies like Nvidia (NVDA), particularly those engaged in growth and innovation. Nvidia’s capital expenditures for the year are projected to exceed $3 billion, focusing on AI infrastructure, as lower rates can reduce borrowing costs and facilitate funding for its ambitious AI initiatives.

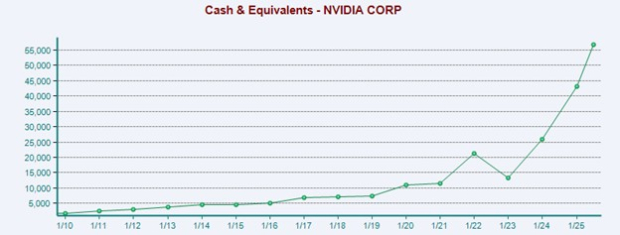

Nvidia recently reported a 55% increase in Q2 sales, totaling $46.74 billion, with its data center segment contributing 88% of revenue, amounting to $41 billion. The company is also heavily invested in AI startups, participating in significant funding rounds, including OpenAI’s $6.6 billion and xAI’s $6 billion, potentially positioning it to benefit from favorable market conditions stemming from interest rate cuts. As of Q2, Nvidia holds over $56 billion in cash and equivalents, a nearly 400% increase since 2021.

The company’s long-term debt is manageable at $8.46 billion, supporting its overall strong balance sheet, with total liabilities at $40.6 billion against assets of $140.74 billion. Nvidia’s price-to-cash flow ratio stands at 55.4X, significantly above industry averages, highlighting its current stock valuation amid investor optimism surrounding potential rate cuts.