Nvidia Faces Significant Revenue Risks Amid U.S.-China Trade Tensions

It’s been a challenging year for Nvidia (NASDAQ: NVDA). Since the start of 2025, Nvidia’s stock has declined by over 30%, resulting in a loss of more than $1 trillion in market capitalization. Despite this downturn, the demand in Nvidia’s end markets is still robust, particularly in data center revenue linked to the artificial intelligence (AI) sector.

Investors anticipating a rebound should proceed cautiously. The ongoing trade conflict between the U.S. and China poses risks to as much as 30% of Nvidia’s revenues this year. Those betting on Nvidia must clearly understand these potential dangers.

Chinese Market’s Impact on Nvidia’s Revenues

This month, Nvidia announced it might incur a $5.5 billion charge associated with H20 chips earmarked for the Chinese market. New regulations could mean the company must secure licenses to export its AI chips to China. The BBC reported that these requirements are designed to mitigate the risk of the chips being repurposed for supercomputers in China. Additionally, Nvidia’s management noted that these regulations will remain effective indefinitely.

Looking at recent filings, approximately 14% of Nvidia’s sales last quarter originated from China. Losing this revenue could significantly impact the company’s financial standing, especially given Nvidia’s premium valuation. However, this figure may actually underestimate China’s overall contribution to Nvidia’s revenue.

Surprisingly, Singapore accounts for 18% of Nvidia’s current sales base, exceeding China’s share. Yet, less than 2% of those sales are ultimately directed to Singapore. The company’s management clarified that customers often use Singapore for invoicing while the products are shipped elsewhere. Findings from last month revealed that many of these shipments go to China, suggesting that China’s true contribution to Nvidia’s sales could be around 30%.

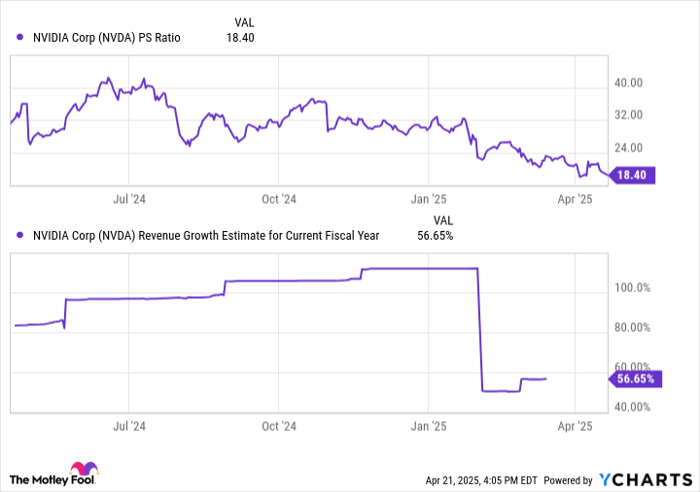

NVDA PS Ratio data by YCharts.

Implications of Export License Requirements

With the new licensing requirements for exporting its H20 chips, Nvidia may face an immediate multibillion-dollar charge once the quarter concludes. Recent reports indicate that Chinese firms have placed over $16 billion in orders for H20 chips within the first 90 days of 2025, all of which are now in jeopardy. Additionally, domestic competitors like Huawei are ramping up efforts to capture Nvidia’s market share, presenting further challenges even if the new rules are eventually relaxed.

Although Nvidia’s revenue might not drop by 30% instantly, these hurdles represent a significant headwind for the company. At the beginning of 2025, shares traded at 30 times sales, reflecting a multitrillion-dollar valuation. However, following a market correction that decimated approximately one-third of its value, Nvidia’s shares are now priced at 18.4 times trailing sales and 11.7 times forward sales. This adjustment could imply that some concerns about its Chinese sales have already been factored into the stock price. Nevertheless, losing China as a significant customer would pose substantial long-term risks to Nvidia’s growth trajectory, making this an essential aspect for investors to monitor.

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.