Key Facts

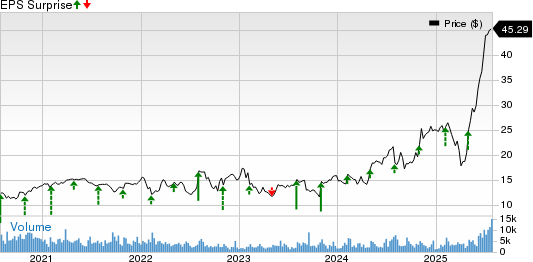

Advanced Micro Devices (AMD) (NASDAQ: AMD) is set to release its quarterly earnings on August 5, with projected revenue of $7.4 billion, indicating a 35% growth compared to the previous year. This growth rate is significantly lower than that of its competitor, Nvidia (NASDAQ: NVDA), which is expected to grow by 50% during the same period.

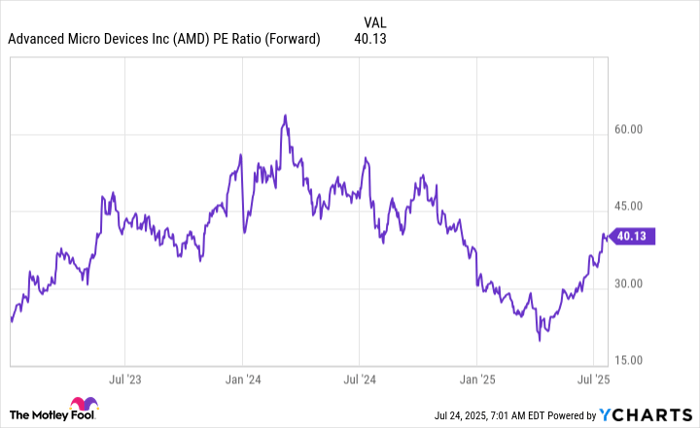

Currently, AMD’s stock trades at a forward P/E ratio of 40, which is comparable to Nvidia’s, raising concerns about its valuation despite its earnings growth potential. AMD’s broader product range, which includes CPUs and embedded processors alongside GPUs, may restrict its ability to capitalize on the booming demand for AI products, making it appear less attractive to investors than Nvidia.