Apple (NASDAQ: AAPL), a company known for creating millionaires, has seen a meteoric rise of 792% in its shares over the last decade. However, recent setbacks in 2024 have left investors a bit jittery, with the stock down 11% year to date.

Macroeconomic challenges tested Apple’s resilience last year, resulting in four consecutive quarters of revenue declines. But in the first quarter of 2024, the tech giant finally turned the tide, growing its revenue by 2% year over year to $120 billion, surpassing Wall Street estimates by over $1 billion.

Nevertheless, beating expectations hasn’t completely calmed investor worries about certain aspects of Apple’s business. In Q1 of 2024, while the company’s iPhone division reported a 6% increase in total sales, China saw a 13% decline in iPhone sales. The preference for local brands in China poses a threat to Apple’s foothold in its third-largest market.

Compounding Apple’s woes, on March 4, news of a $2 billion antitrust fine from the European Commission over its music streaming service caused another dip in the stock price.

Despite these recent challenges, Apple’s dominance in the tech sphere, coupled with its robust financial standing, remains unquestionable. The burning question lingers: Can Apple still pave the way to millionaire status, potentially securing your retirement dreams?

Strength in the Storm: Apple’s Resilience

Apple’s market position in tech is undeniably potent. The company holds a significant market share across various product categories including smartphones, tablets, smartwatches, and headphones. Surprisingly, Apple ranks third in U.S. e-commerce market share, after giants like Amazon and Walmart, despite offering a more limited product range.

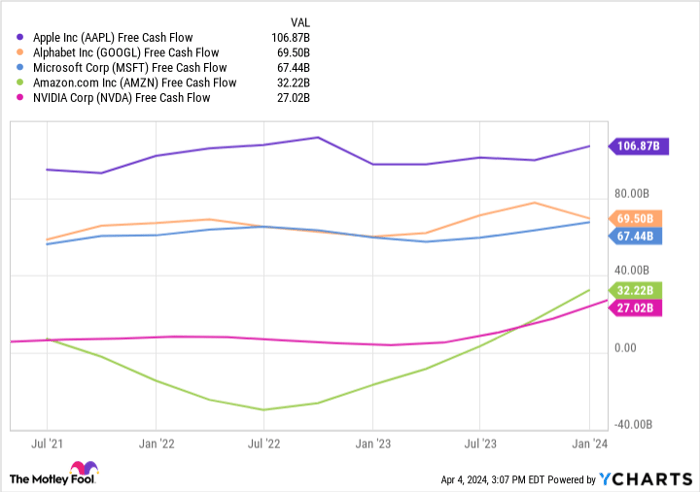

Data by YCharts.

Apple’s unwavering popularity has translated into strong financial prowess, enabling it to weather unexpected storms. As depicted in the chart, Apple’s free cash flow surpasses that of major players in the tech realm. Despite revenue hits in 2023, Apple’s free cash flow surged by 10%, providing a solid cushion for further investments.

Although the decline in Chinese sales raises concerns at present, growth in other regions could offset these losses in the long run. Simultaneously, Apple is actively diversifying its business away from the iPhone dependency. In Q1 2024, European product sales, Apple’s second-largest market, posted a 10% revenue increase year over year. Similarly, sales in Japan saw a remarkable 15% surge.

Furthermore, with the recent unveiling of Apple’s inaugural virtual/augmented reality headset, the Vision Pro, the company might have unlocked a significant growth avenue for the future. The VR market is projected to expand at a whopping 31% compound annual growth rate until at least 2030.

Apple, a bold entrant in the VR space, is renowned for swiftly claiming dominance in new sectors. Therefore, an investment in Apple today could potentially be a stake in the future leader of the $20 billion VR market.

A Path to Millionaire Status with Apple?

Apple’s trajectory indicates a promising growth story with a history of reliability. Its supremacy in tech and strategic forays into emerging fields like VR/AR and AI are poised to propel its stock value for the foreseeable future.

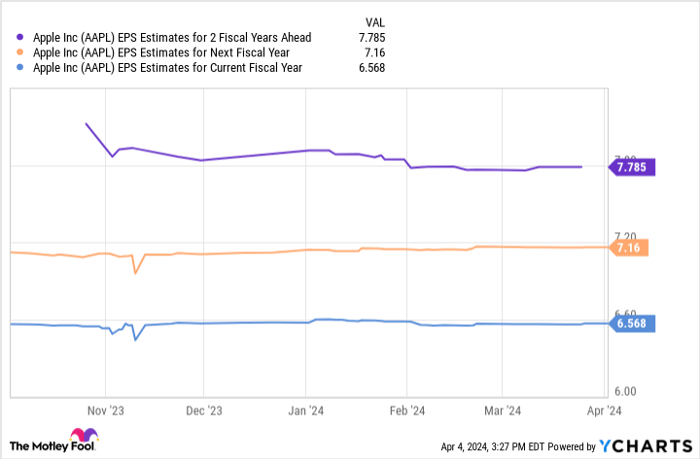

Data by YCharts.

Based on projections, Apple’s earnings could climb to nearly $8 per share by fiscal 2026. Applying a forward price-to-earnings ratio of 26 to this figure yields a potential share price of $208, indicating a 23% stock growth over the next two fiscal years. These forecasts position Apple to likely outperform the S&P 500, which saw a 13% increase over the last two years.

Therefore, Apple’s stock continues to present an enticing proposition for a diversified investment portfolio. With substantial cash reserves and a commanding brand presence, Apple emerges as a formidable long-term asset, ideal for retirement planning. Counting on Apple’s knack for delivering substantial gains over time seems like a prudent move.

For investors nearing retirement in the next five years, exploring other options might be advisable as Apple navigates through its recent challenges. Conversely, for early-stage investors with a horizon of 20 years or more, a well-timed investment could pave the way to millionaire status by retirement, with Apple’s stock potentially playing a pivotal role in achieving that financial goal.

Is Now the Time to Invest in Apple?

Before diving into Apple stocks, it’s crucial to ponder:

The Motley Fool Stock Advisor analysts have pinpointed what they consider the 10 best stocks poised for exceptional growth… and Apple didn’t make the list. These selected stocks are expected to yield substantial returns in the years to come.

Stock Advisor extends a straightforward roadmap to success for investors, offering insights on portfolio construction, regular updates from analysts, and bi-monthly stock picks. Since 2002, the Stock Advisor service has significantly outperformed the S&P 500.*

Explore the 10 stocks

*Stock Advisor returns as of April 8, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Dani Cook has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Apple, Nvidia, and Walmart. The Motley Fool has a disclosure policy.

The perspectives expressed in this article are solely those of the author and may not reflect the views of Nasdaq, Inc.