Who Will Be the Next $1 Trillion Company? Broadcom in the Spotlight

There are currently nine companies worldwide with market capitalizations of $1 trillion or more. Taiwan Semiconductor Manufacturing (NYSE: TSM) frequently fluctuates around this threshold, making the actual count closer to ten. Investors are eager to discover which company may soon join the exclusive $1 trillion club.

One strong contender is chip maker Broadcom (NASDAQ: AVGO), valued at approximately $750 billion. While it still has room to grow, Broadcom faces competition from companies such as drug manufacturer Eli Lilly (NYSE: LLY), banker JPMorgan Chase (NYSE: JPM), and retailer Walmart (NYSE: WMT), all of which have valuations ranging from $680 billion to $710 billion.

Broadcom: A Diverse Player in Technology

Broadcom operates in numerous areas within the technology sector, offering both software and hardware products that help to diversify its business.

In the software realm, the company provides cybersecurity, mainframe, and enterprise software. Its most significant addition came from acquiring VMware for $69 billion last year. VMware enables clients to create virtual desktops, optimizing resource use securely for businesses.

On the hardware side, Broadcom produces various connectivity switches that manage data center traffic. Its top-selling products, the Tomahawk 5 and Jericho3AI switches, have experienced a 300% revenue growth year over year in the third quarter of fiscal 2024, driven largely by increasing AI demand.

Broadcom also designs custom AI accelerators, which outperform traditional graphics processing units (GPUs) when workloads are tailored for the specific chip design. Revenue from this segment grew an impressive 250% year over year in the third quarter.

The company is riding strong trends in the AI market, but its overall business growth may be weighed down by slower-performing sectors.

Positive Insights for Broadcom in 2025

Broadcom experienced a 47% increase in revenue year over year in the third quarter, which is noteworthy. However, if we exclude VMware’s revenue—since it was not part of Broadcom during the same quarter last year—this growth diminishes to only 4%. This is less impressive, especially given the strong performance in some specific areas of the business.

Looking ahead to 2025, Wall Street is optimistic. Analysts predict a 17% revenue increase and a 29% jump in earnings per share (EPS) for Broadcom. This aligns with trends seen in other major tech companies, suggesting it should not be viewed too differently despite some mixed results across its business segments.

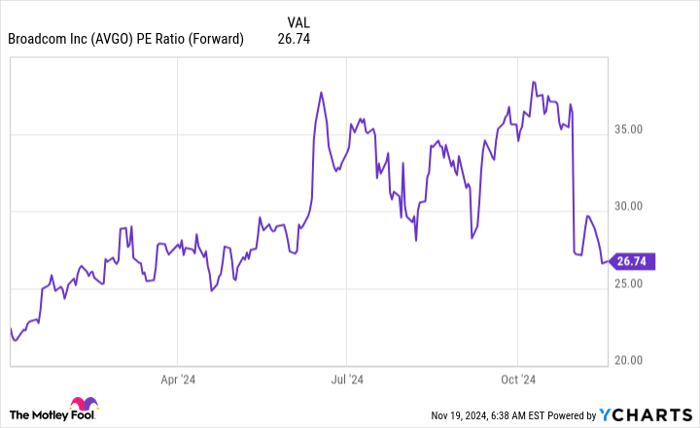

The stock currently trades at about 26.7 times its projected future earnings, similar to other major players in the tech industry. Notably, a drop in stock price observed in October was due to analysts adjusting their future earnings expectations.

AVGO PE Ratio (Forward), data by YCharts.

Broadcom’s growth is tracking closely with that of its peers in the $1 trillion club. However, it lacks the explosive growth or discounted valuation that could propel it past the $1 trillion mark in the immediate future.

As EPS growth is typically linked to stock price growth, analysts expect the stock price to rise in parallel to an anticipated 30% increase in earnings for 2025. Thus, reaching a $1 trillion valuation may be on the horizon if the stock climbs by about 30% late in 2025.

Will Broadcom outpace Eli Lilly, JPMorgan, or Walmart to earn this milestone? It remains uncertain. However, the company’s strong positioning in AI holds promise as a decisive factor.

Seize the Opportunity for Potential Growth

If you’ve ever felt you missed out on investing in top-performing stocks, here’s your chance to consider some potential winners.

Our expert analysts occasionally recommend a “Double Down” stock—companies they believe are on the verge of significant growth. If you’re concerned about missing this wave, now may be the ideal time to invest. Consider the remarkable returns:

- Nvidia: Investing $1,000 when we doubled down in 2009 would now yield $380,291!*

- Apple: A $1,000 investment when we doubled down in 2008 would be worth $43,278!*

- Netflix: If you invested $1,000 in 2004 based on our recommendation, you’d have $484,003!*

Currently, we’re issuing “Double Down” alerts for three exceptional companies, and another opportunity like this may not arise soon.

Explore 3 “Double Down” stocks »

*Stock Advisor returns as of November 18, 2024

JPMorgan Chase is an advertising partner of Motley Fool Money. Keithen Drury holds positions in Taiwan Semiconductor Manufacturing. The Motley Fool has positions in and recommends JPMorgan Chase, Taiwan Semiconductor Manufacturing, and Walmart. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

The views expressed are those of the author and do not reflect those of Nasdaq, Inc.