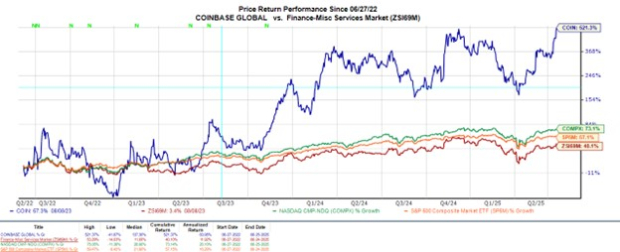

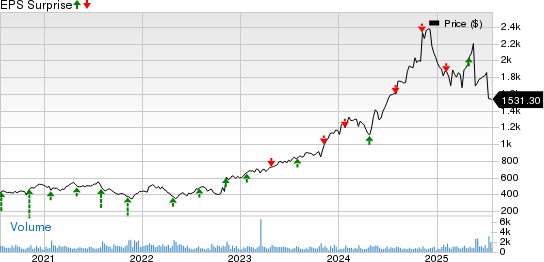

Coinbase’s stock COIN reached a new 52-week high of $369 per share on Wednesday, marking over +40% growth for the year and a staggering +500% increase over the last three years. The rise is attributed to various catalysts, including the acceptance of stablecoins and a rebound in Bitcoin prices, which have surged +15% year-to-date and +70% over the past year, now priced just above $107,000.

Key developments include Coinbase’s recent launch of stablecoin-powered payment systems and a crypto rewards credit card in partnership with American Express AXP. Additionally, the company became the first U.S. crypto exchange to receive a Market in Crypto Assets (MiCA) license, enhancing its international presence. Analysts have raised their price targets, with Bernstein setting a street-high target of $510, noting momentum from stablecoin revenue and institutional adoption.

Currently holding a Zacks Rank of #3 (Hold), Coinbase’s earnings estimates are expected to rise, potentially leading to further upgrades in the future.