“`html

Coinbase Global (COIN), the largest cryptocurrency platform in the U.S., supports over 200 digital assets and handles the most trading volume among U.S.-based exchanges. In Q1, stablecoin revenue from USDC reached approximately $300 million, representing about 15% of the company’s total revenue. This growth comes amid rising public adoption of crypto.

The GENIUS Act, which aims to regulate the stablecoin market, recently passed the U.S. Senate in a bipartisan manner. If it passes the House, it is expected to enhance market credibility and drive institutional and consumer adoption of stablecoins.

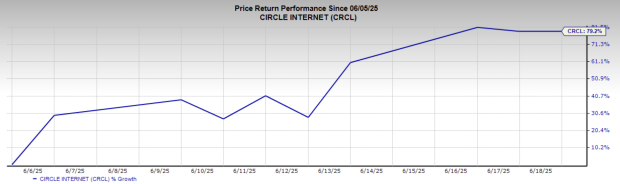

Coinbase’s partnership with Circle Internet Group (CRCL) enables it to receive half of the revenue from USDC. Despite USDC revenue accounting for only 14% of Coinbase’s business, Circle’s market cap stands at approximately $50 billion, compared to Coinbase’s $87 billion, indicating a potential undervaluation of Coinbase’s core exchange operations.

“`