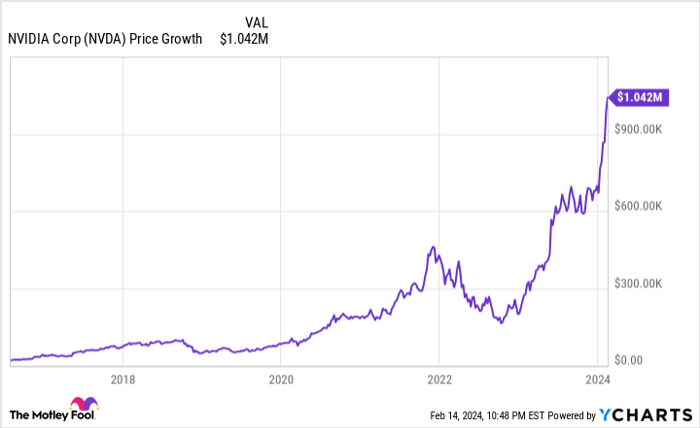

Nvidia (NASDAQ: NVDA), a stellar investment over the past decade, has surged by about 170 times in value. A $20,000 investment a decade ago would now be worth over $3.4 million. In just around five years, this investment would have scaled the millionaire summit.

If you have a spare $20,000 after clearing bills, settling high-interest debts, and building up an emergency fund, should you bet it on Nvidia? Can it potentially replicate its remarkable past and turn you into a millionaire?

The Astounding Growth of Nvidia

In 2016, Nvidia reported $5 billion in revenue. By 2024, its annual revenue is anticipated to almost hit $60 billion, marking a staggering 12-fold increase in eight years. This exceptional surge stems from Nvidia’s dominant position in the market for discrete graphics processing units (GPUs), originally used in gaming PCs and now deployed in various sectors from automotive to data centers.

The market has rewarded Nvidia handsomely, propelling it to become the world’s fourth-largest company with a market capitalization of $1.82 trillion, a massive leap from $30 billion in August 2016. The company’s prospects seem robust, supported by catalysts such as the rapidly expanding AI chip market and the digital twin sector, along with its foray into cloud gaming.

Nvidia’s projected earnings growth rate of over 100% compound annual growth for the next five years, coupled with prospective revenue opportunities worth a staggering $1 trillion, further underscore the company’s vast potential for growth.

Nvidia’s Potential for Future Growth

Despite its current market cap of around $1.8 trillion, projecting a 50-fold surge in growth would catapult its market cap to an astronomical $90 trillion, representing an outlandish three-fourths of the global economy. While this may sound implausible, considering that global GDP has surged by over 1,800% in the last 50 years, Nvidia’s $90 trillion market cap seems less far-fetched if the global GDP logs a 1,000% growth in the next 50 years.

Nvidia’s potential to maintain supremacy in its end markets and solid product development could potentially turn a $20,000 investment today into $1 million in the long run. However, this optimistic outlook hinges on Nvidia’s ability to outpace its competitors over the ensuing decades.

Why Nvidia Remains a Top Stock to Buy

With its rapid growth and anticipation of robust bottom-line performance, Nvidia’s stock is poised to offer healthy returns in the next five years. Currently trading at 35 times forward earnings, compared to its five-year average earnings multiple of 42, this could be an opportune time to consider investing in this leading AI stock before it surges higher.

Should you invest $1,000 in Nvidia right now? The Motley Fool Stock Advisor has identified the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks in the list are anticipated to yield significant returns in the coming years. With a history of tripling the return of S&P 500 since 2002, the Stock Advisor service provides investors with a blueprint for success, including regular analyst updates and two new stock picks each month.

*Stock Advisor returns as of February 12, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.