Can IonQ Become the Next AI Success Story Like NVIDIA?

The rise of artificial intelligence (AI) has transformed NVIDIA Corporation (NVDA) into a Wall Street favorite since its IPO in 1999. As quantum computing emerges as a key technology, the question arises: will IonQ, Inc. (IONQ) replicate NVIDIA’s trajectory and prove to be a promising investment? Let’s explore.

Positive Indicators for IONQ’s Future

The quantum computing market holds significant potential, as McKinsey estimates it could reach $2 trillion by 2035. This growth complements IonQ’s offerings; its quantum computing systems are assisting major players like Microsoft Corporation (MSFT) and Amazon.com, Inc. (AMZN) by providing AI researchers with access to advanced quantum models.

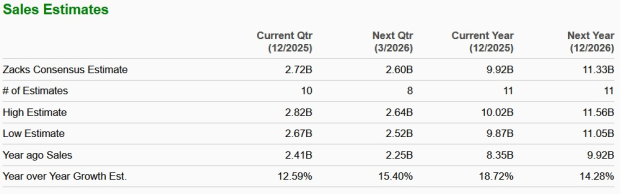

IonQ distinguishes itself in the quantum computing arena. Its linear ion chains can exceed 100 qubits, yielding fewer errors than competitors, which led to a revenue of $43.1 million last year—an impressive 95% year-over-year increase. This revenue exceeded IonQ’s initial projections.

At NVIDIA’s recent “Quantum Day,” CEO Jensen Huang highlighted the substantial growth opportunities within quantum computing, revising his earlier prediction from the CES conference that practical quantum computing was still 15 years away.

Recent advancements indicate that IonQ’s quantum computing capabilities are already 12% faster than classical computing, demonstrating its near-term commercial viability. This progress is attributed to a collaboration with Ansys, a leader in engineering simulations.

IonQ also boasts a strong financial foundation, necessary for continued research, development, and strategic acquisitions. The company raised approximately $360 million in net proceeds from a recent equity offering, bolstering its pro forma cash balance to over $700 million.

Assessing IONQ as an Investment: Is it the Next NVIDIA?

IonQ stands out among quantum stocks, thanks to its stability and innovation in the quantum computing sector, making it an appealing investment choice (for further reading, see “Why Buy QBTS & IONQ Stocks After NVIDIA Quantum Day?”).

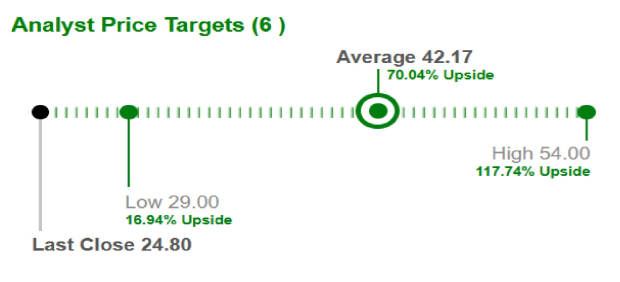

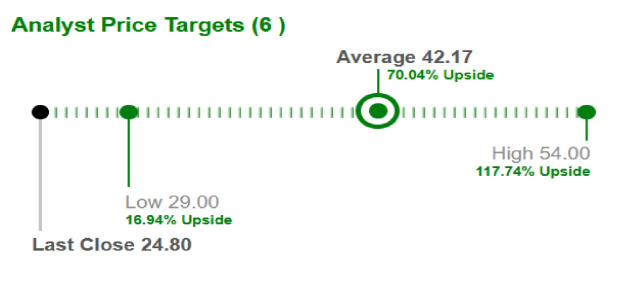

Market analysts are optimistic, raising IonQ’s average short-term price target by 70%, from $24.80 to $42.17. The highest target stands at $54, suggesting a potential increase of 117.7%.

Image Source: Zacks Investment Research

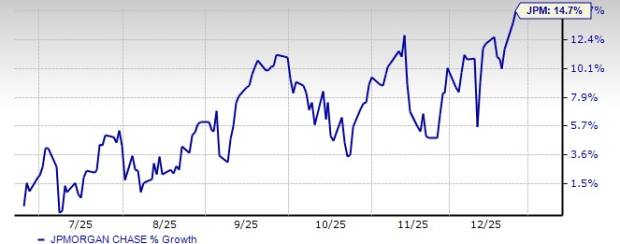

However, it may be too early to deem IONQ the next NVIDIA. NVIDIA enjoys robust financials, immense chip demand, and GPU market dominance, which are likely to keep pushing its stock price higher (read more: “Which AI Stock, NVIDIA or Palantir, Has More Upside and Is a Buy?”).

In contrast, IonQ has a high price-to-sales ratio of 119.7, suggesting overvaluation. Furthermore, for 2024, the company is expected to report a net loss of $331.6 million, which could hinder its long-term growth prospects.

Currently, IonQ holds a Zacks Rank of #2 (Buy). For a complete list of today’s Zacks #1 Rank (Strong Buy) stocks, visit our website.

Zacks Predicts a Stock Poised for Growth

Our research team has identified five stocks with high potential for gains of 100% or more in the coming months. Among those, Director of Research Sheraz Mian emphasizes one stock likely to see the highest increase.

This standout is among the most innovative firms, catering to a rapidly growing client base of over 50 million and offering a wide range of advanced solutions, giving it significant growth potential. While not all of Zacks’ elite picks succeed, this one may outperform earlier selections like Nano-X Imaging, which rose by +129.6% in just over nine months.

Free: See Our Top Stock and 4 Runners Up.

Interested in the latest recommendations from Zacks Investment Research? Download today to explore the “7 Best Stocks for the Next 30 Days.” Click here.

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.