AGNC Investment (NASDAQ: AGNC) presents itself as an income-generating stock, but it doesn’t quite fit the mold that many dividend-driven investors seek.

Falling interest rates may offer some relief to the company, yet this won’t be enough to transform AGNC, a stock with a 14% ultra-high yield, into an attractive option for dividend investors. Below is everything you need to understand before being lured by a high yield into a potential investment misstep.

Understanding AGNC Investment

AGNC Investment operates as a mortgage real estate investment trust (REIT), aiming to provide small investors access to large-scale real estate opportunities and the cash flows generated by these assets.

To maintain its REIT status, a company must distribute at least 90% of its taxable income as dividends. This approach allows REITs to avoid corporate taxes, although it’s important to remember that these dividends are taxed at the individual’s regular income tax rate.

Image source: Getty Images.

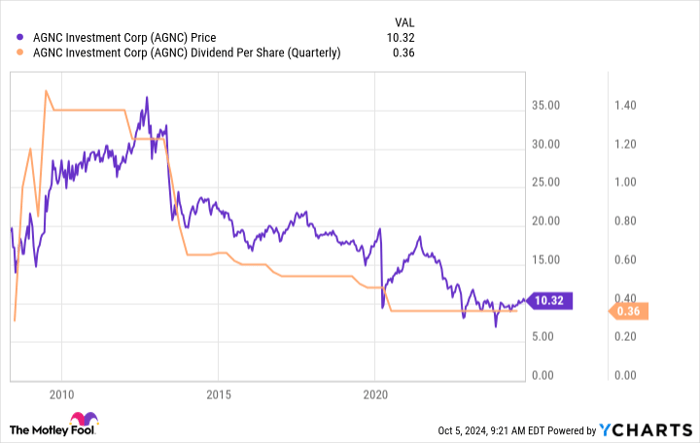

While AGNC seems appealing as an income stock, a closer look at its dividend history and stock price reveals a worrying trend. Initially, the stock price surged, but it has since declined steadily, just as the quarterly dividends have done.

AGNC data by YCharts.

Consider this: Would a dividend investor want a stock that offers a high yield while its price and dividends are consistently declining? Such an outcome would lead to diminished income and reduced capital, which is counterproductive to investment goals.

Benefits of Lower Interest Rates for AGNC Investment

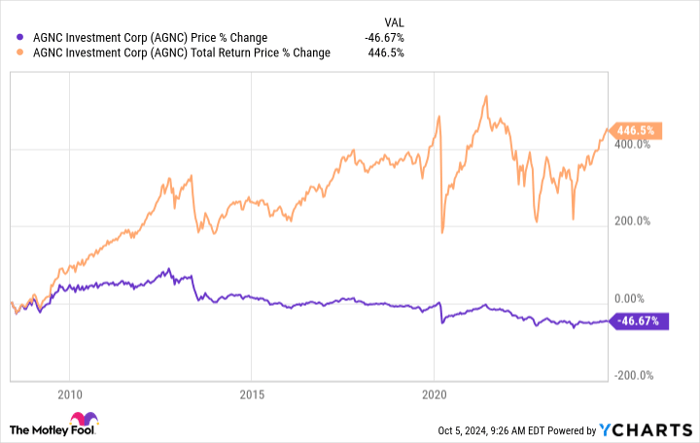

Interestingly, AGNC is viewed as a total-return investment, meaning it assumes reinvesting dividends. This changes the narrative significantly.

The graph below illustrates this well, with the orange line representing total return, which remains favorable compared to the declining purple line denoting stock price. The robust dividend allows for additional shares of AGNC to be purchased, compensating for stock price drops.

AGNC data by YCharts.

However, this strategy isn’t typically employed by income-focused investors. Instead, it’s often favored by institutional investors like pension funds that utilize asset allocation models. If you align with that approach, AGNC Investment could merit consideration for reinvested dividends.

But for traditional dividend investors, AGNC likely won’t fulfill your needs, and maintaining this perspective is essential.

As a mortgage REIT, AGNC Investment acquires mortgages bundled into bond-like securities. These assets are traded frequently and influenced by various factors, with interest rates being particularly significant. Rising interest rates generally lower bond prices, while falling rates can help stabilize them. Thus, as rates decrease, AGNC’s operations may improve, potentially lifting its stock price as well.

Increased competition in the mortgage market may also enhance AGNC’s array of mortgage bonds, particularly if banks resume lending post-recession. The outlook for mortgage REITs like AGNC looks increasingly positive, but this improvement is contingent upon Federal Reserve actions and general mortgage conditions.

From a total-return standpoint, AGNC appears poised for potentially strong growth. There’s a chance it could even increase its dividend, but the fundamental nature of the REIT remains focused on total return objectives.

Beware When Investing for Dividends

A substantial dividend yield alone does not guarantee that a stock will enrich a dividend-focused portfolio. For those relying on dividends for day-to-day expenses, it is crucial to invest in reliable dividend payers.

History highlights that mortgage REITs like AGNC Investment often struggle with reliable dividend payouts. Even a large yield alongside a favorable market outlook does not rectify this pattern.

A Fresh Opportunity Awaits

Have you ever felt like you missed your chance to invest in top-performing stocks? Opportunity may be knocking once more.

Occasionally, our expert analysts announce a “Double Down” stock—these are stocks poised for exceptional growth. If you’re concerned you’ve missed your chance, now could be the time to invest before the next wave. Look at the numbers:

- Amazon: Investing $1,000 when we last recommended it in 2010 would yield $21,266!*

- Apple: A $1,000 investment when we double-downed in 2008 could grow to $43,047!*

- Netflix: Built from a $1,000 investment in 2004, it would result in $389,794!*

Currently, we are issuing “Double Down” alerts for three outstanding companies, and opportunities like this might not occur again soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 7, 2024

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not reflect those of Nasdaq, Inc.