Microsoft Corporation (NASDAQ: MSFT) saw a stock increase of 23% over the three months ending June 10, 2025, following an earnings report where the company beat both revenue and earnings expectations while confirming its full-year guidance. Microsoft’s ongoing investment in data centers has been highlighted, even as year-over-year earnings per share (EPS) growth is anticipated to decline from 14%-17% in 2025 to 11%-14% in 2026.

As of June 10, MSFT stocks are trading at approximately 37x earnings and 36x forward earnings, reflecting a 5% premium over historical averages. This positions Microsoft favorably against competitors like Amazon.com Inc. (NASDAQ: AMZN), which trades at 39x earnings, and Apple Inc. (NASDAQ: AAPL), at 31x earnings. However, institutional buying of MSFT stock has dropped nearly 50% in the last quarter, indicating a potential slowing in momentum.

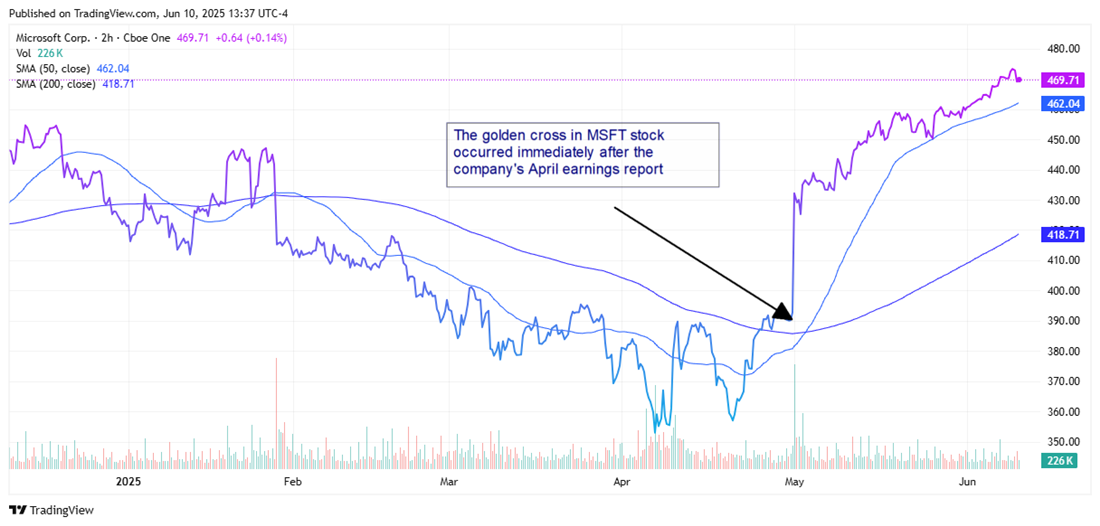

A golden cross pattern was recently formed in MSFT stock, where the 50-day simple moving average crossed above the 200-day average. This technical signal may indicate future trends, although a lack of institutional activity raises concerns about the stock’s rally sustainability. Nonetheless, Microsoft’s strong position in the enterprise AI landscape remains a bullish indicator for long-term investors.