“`html

Netflix proposed an $82.7 billion acquisition of Warner Bros. Discovery (WBD) on December 5, 2025, faces challenges after Paramount Skydance announced a $108.4 billion all-cash counter-offer on December 8, 2025. Paramount’s offer of $30 per share, compared to Netflix’s $27.75 per share in mixed consideration, has raised concerns about Netflix’s ability to finalize the deal.

As of Q3 2025, Netflix had a debt of $14.46 billion and revenues of $11.51 billion. The proposed acquisition’s complexity includes WBD’s planned separation of Discovery Global by Q3 2026 and a potential 12 to 18-month regulatory timeline. Paramount’s all-cash bid addresses WBD shareholder concerns and raises regulatory questions regarding market dominance, with a combined subscription video-on-demand market share of 43% post-merger.

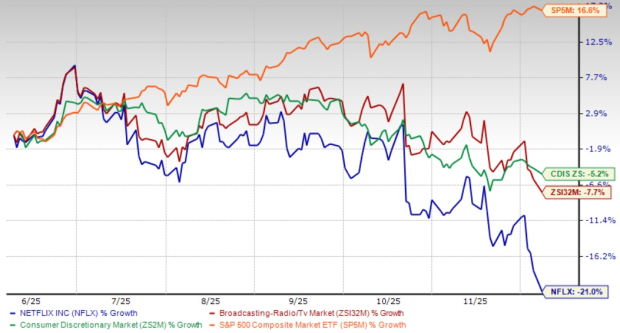

Paramount Skydance, carrying $13.6 billion in gross debt, generated a net loss of $257 million but is targeting $3 billion in efficiency savings. In comparison, Disney operates with $42 billion in debt but focuses on streaming profitability over large acquisitions. Netflix’s stock has dropped 21% in the last six months, contrasting with the 7.7% decline in the Zacks Broadcast Radio and Television industry.

“`