Palantir Technologies: Q1 Earnings Reveal Growth Amid Challenges

The rise in military contracts and an expanding commercial client base have driven software company Palantir Technologies Inc.’s PLTR shares higher this year. The company also raised its outlook, citing ongoing demand for artificial intelligence (AI), leading to speculation about its potential to become a Wall Street favorite akin to NVIDIA Corporation (NVDA).

Palantir’s Q1 Earnings Report: Performance Summary

In its first quarter, Palantir reported revenues of $884 million, reflecting a 7% increase from the previous quarter and a significant 39% year-over-year growth. This figure exceeded Wall Street’s estimate of $862 million. The U.S. commercial segment saw a 19% sequential revenue increase and a 71% rise compared to the prior year, bolstered by significant contributions from U.S. Government contracts.

During this quarter, Palantir expanded its customer base by 39% year-over-year, largely due to a 65% increase in U.S. commercial customers. The company also closed 139 deals valued at over $1 million each. Its remaining performance obligation (RPO) stood at $1.9 billion, up 46% year-over-year, providing a strong foundation for future growth.

The surge in demand for Palantir’s Artificial Intelligence Platform (AIP), designed to automate complex tasks, has been instrumental in driving revenue. The company now anticipates 2025 revenues of $3.9 billion, an increase from its earlier forecast of $3.75 billion.

Before the earnings release, Palantir’s shares had risen by 65% for the year. However, following the announcement, the shares fell 9% in after-hours trading. The company reported adjusted earnings per share of 13 cents, surpassing last year’s 8 cents, but this only met Wall Street’s expectations.

Challenges Facing Palantir: Valuation Concerns and Market Pressures

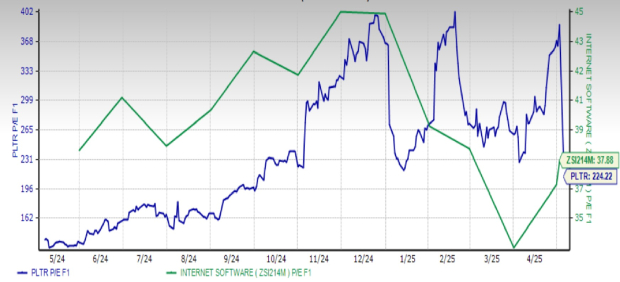

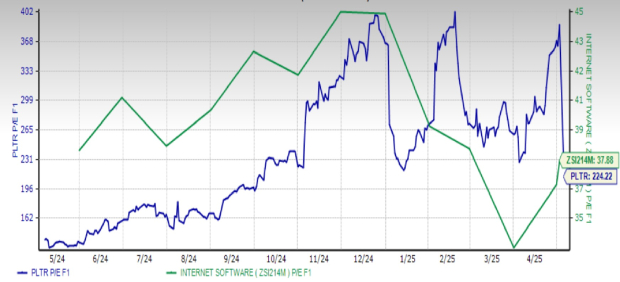

Palantir’s first-quarter results highlighted the potential for stock volatility stemming from high valuations. With a forward price-to-earnings (P/E) ratio of 224.2, significantly higher than the Internet Software industry average of 37.9, the company’s stock must maintain a very high growth rate to justify its price.

Image Source: Zacks Investment Research

Palantir currently faces two significant challenges that may hinder its growth. Over half of its revenue comes from public sector engagements, including military contracts. The Pentagon plans to reduce its yearly budget by 8% over the next five years, which could impact Palantir’s growth. Additionally, President Trump’s tariffs may lead to reduced software spending from potential clients, further affecting the company’s financial stability.

Investment Considerations: Is PLTR Stock Worth It?

Investors should be cautious when considering an investment in Palantir (PLTR) stock, even with its growing customer base and acceptance of AIP. Given the high valuation, any long-term disappointments could trigger a decline in share prices. Potential cuts to software budgets and military spending raise concerns for future growth. Investors may want to consider a dollar-cost-averaging strategy if they are willing to accept higher risks.

Drawing a comparison between Palantir and NVIDIA at this stage could be premature. NVIDIA has a strong advantage due to its consistent demand for next-generation AI chips and a dominant position in the GPU market. Brokers have increased NVIDIA’s average short-term price target by 45.1% to $166.10 from the previous $114.50 due to favorable market conditions.

Image Source: Zacks Investment Research

In contrast, brokers have lowered Palantir’s short-term price target by 32.4% to $84 from the previous $124.28.

Image Source: Zacks Investment Research

Currently, Palantir holds a Zacks Rank of #4 (Sell), while NVIDIA has a Zacks Rank of #3 (Hold).

Expert Insights: High-Potential Stocks to Consider

Zacks’ Research Chief has identified stocks with the highest probability of more than 100% growth in the coming months. Among these, one standout stock is highlighted for its innovative solutions and rapidly expanding customer base, currently exceeding 50 million.

While not all selections guarantee gains, this particular stock is positioned for significant growth. Historical context suggests that some prior Zacks’ selections, such as Nano-X Imaging, have seen substantial increases.

For those interested in staying informed, Zacks Investment Research offers insights into some of the best stocks to consider over the next 30 days.

Palantir Technologies Inc. (PLTR) : Free Stock Analysis report

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.