Sandisk’s Impressive Surge

Sandisk (NASDAQ: SNDK), recently spun off from Western Digital, has seen its stock price surge over 1,200% in just six months, turning an $8,000 investment into approximately $105,000. The company reported adjusted earnings per share of $6.20 for Q1 2026, well above analyst expectations of $3.62, and revenue of $3.03 billion, surpassing estimates of $2.69 billion.

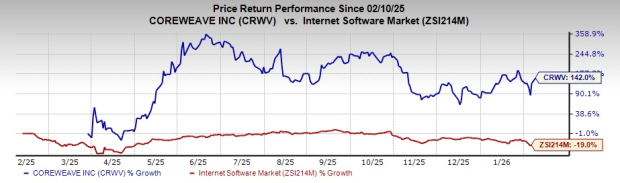

As of early 2026, Sandisk’s stock is up around 145%. The company’s growth is fueled by increased demand for memory storage related to artificial intelligence, leading to stronger pricing power. Sandisk’s current market valuation stands at approximately $86 billion, trading at about 15 times its future profits based on analyst projections.

Investors should exercise caution, as such rapid price increases could lead to significant volatility if market sentiment shifts negatively. Analysts from Motley Fool have identified 10 alternative stocks believed to offer better investment potential than Sandisk.