AMD and NVIDIA Capitalize on Saudi AI Developments Amid Competition

Advanced Micro Devices, Inc. (AMD) is making strides in the data center industry, competing aggressively with NVIDIA Corporation (NVDA) by securing substantial client contracts. Recently, AMD formalized a partnership with Saudi Arabia’s Humain, prompting speculation about its ability to exceed NVIDIA in the long term and its investment attractiveness. This article delves into the details.

Saudi AI Initiatives Enhance Opportunities for AMD and NVIDIA

Initially, several semiconductor companies expressed concerns about a potential economic slowdown affecting artificial intelligence (AI) hardware investments. Geopolitical tensions further compounded these worries. However, optimism has returned since new agreements were forged between Saudi Arabia and U.S. chip manufacturers.

AMD recently announced a significant $10 billion partnership with the Saudi AI firm Humain, aimed at expanding its AI infrastructure over the next five years. This move is strategically designed to mitigate the impacts of U.S. export restrictions to China. Notably, NVIDIA is also poised to benefit from Saudi Arabia’s AI initiatives. The company has established its own partnership with Humain, planning to deliver over 18,000 AI-focused chips worth nearly $700 million.

NVIDIA is set to supply its advanced graphics processing units (GPUs) to Humain, with its GB300 Blackwell chips to be used in a 500-megawatt data center in the region. This arrangement serves to bypass restrictions imposed by the Trump administration on the sale of H20 chips to China.

The collaboration between NVIDIA and AMD with Humain illustrates a growing AI trade that benefits both companies without a definitive victor. According to Bank of America Corporation (BAC) analyst Vivek Arya, their combined agreements with Humain are estimated to yield between $15 billion and $20 billion over the next five years.

Can AMD Overcome NVIDIA in the Long Run?

NVIDIA’s commanding presence in the GPU market often translates into higher prices for its products, primarily attracting large enterprises as customers. Conversely, AMD is equipped to compete with NVIDIA on pricing, appealing to those unable to afford NVIDIA’s premium offerings.

Additionally, major corporations are seeking cost-effective avenues to develop AI infrastructure. For example, Microsoft Corporation (MSFT) is utilizing AMD’s MI300X chips, while Oracle Corporation (ORCL) has committed to the MI355X GPUs, presenting notable challenges to NVIDIA’s upcoming Blackwell chips.

Although these developments could boost AMD’s data center revenues and stock price, expectations for AMD to outperform NVIDIA remain low. Increased spending on AI data centers is likely to drive NVIDIA’s stock growth, mainly due to the popularity of its CUDA software platform among developers and the surging demand for Blackwell chips.

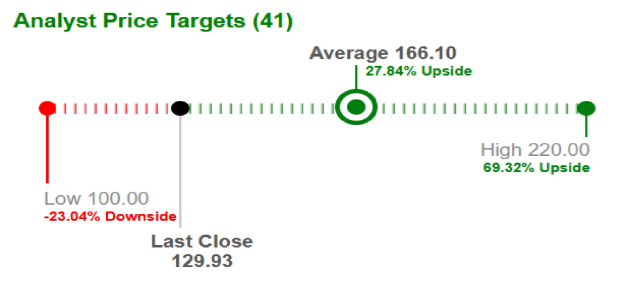

This outlook has led brokers to raise NVIDIA’s average short-term price target by 27.8%, now pegged at $166.10, up from $129.93.

Image Source: Zacks Investment Research

On a different note, AMD has had its short-term price target raised by 13.8% to $128.03, up from $112.46.

Image Source: Zacks Investment Research

Analyzing Current Opportunities in AMD and NVIDIA Stocks

Despite not overtaking NVIDIA’s market position, AMD is well-positioned to enhance its growth through the recent Saudi partnership. Furthermore, AMD has announced a $6 billion share repurchase program, demonstrating management’s confidence in the company’s future. This buyback initiative aims to reduce the number of outstanding shares, potentially increasing value for remaining shareholders.

However, AMD stock currently appears expensive. With a price-to-earnings ratio of 28.7X forward earnings, AMD’s valuation contrasts with the Computer – Integrated Systems industry’s average of 20.9X. Potential investors might consider waiting for a more favorable entry point before acquiring AMD shares. As it stands, AMD holds a Zacks Rank of #3 (Hold).

Image Source: Zacks Investment Research