Photo by SOPA Images/LightRocket via Getty Images

Goldman Sachs has labeled Nvidia’s (NASDAQ:NVDA) upcoming earnings report as “arguably the most important single stock earnings print in years.”

The market anticipates an 11% implied move for NVDA, as stated by Brian Garrett, a managing director at Goldman Sachs specializing in cross asset sales.

“The amount of market capitalization at stake in terms of potential gain or loss is equivalent to the market value of the 37th largest stock in the S&P 500 (SPY) (IVV) (VOO), amounting to over $200 billion,” Garrett expressed.

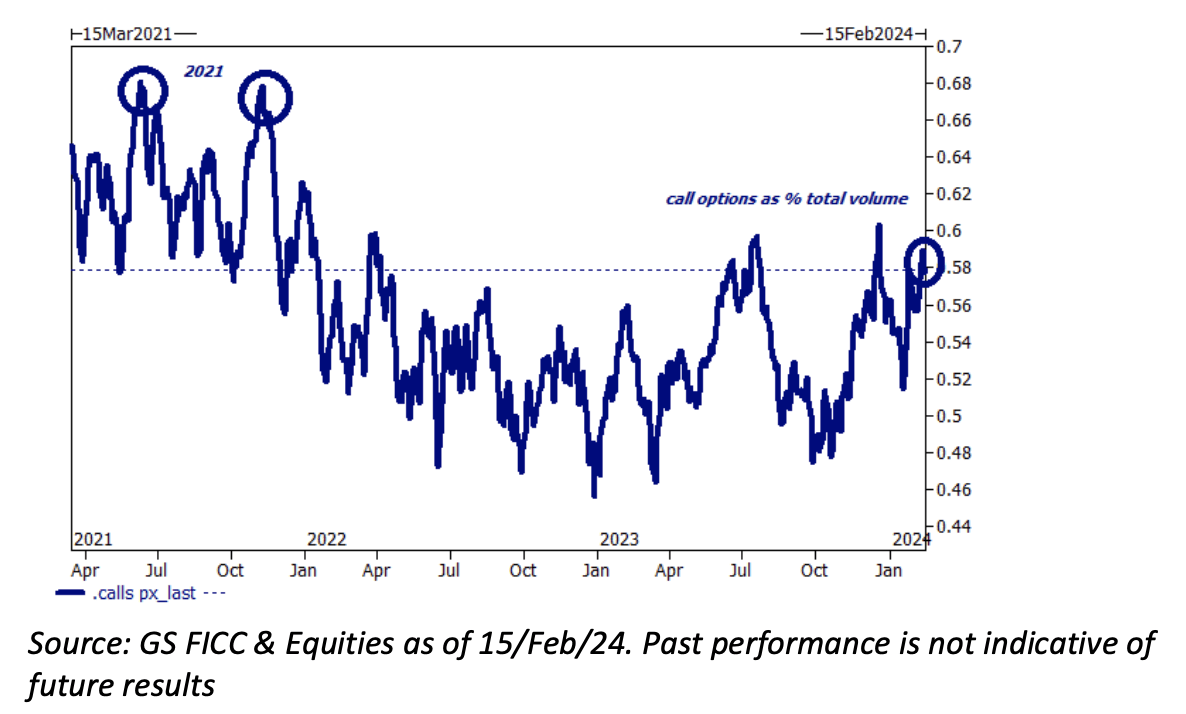

Looking back, Garrett pointed out that the last occurrence of such magnitude (in 2021) coincided with a “decent top” in the S&P, although he acknowledged that the Federal Reserve was pursuing a different strategy at the time.

Moreover, Garrett highlighted a robust retail appetite for call options, noting that nearly 60% of all options traded in the market were call options, marking one of the highest ratios seen since 2021.

Interestingly, the Google trend search for “call options” has reached a two-year high.