XRP Surges Amid Political Shifts: Can It Overtake AMD?

XRP (CRYPTO: XRP), recognized as the third-largest cryptocurrency globally, has skyrocketed since Donald Trump’s presidential election victory. The price has surged more than 530% since election night. Trump has shown support for cryptocurrency, promising a more favorable regulatory environment and aspirations to establish the U.S. as “the crypto capital of the world.”

The market capitalization of XRP now exceeds that of many well-established tech companies. This raises the question: could XRP, developed by Ripple, ultimately surpass the sizable tech player Advanced Micro Devices (NASDAQ: AMD)? We’ll explore this further.

Rising Opportunities for Both Assets

As of January 24, XRP’s market cap stood at roughly $181 billion, while AMD’s reached approximately $199 billion. AMD specializes in a variety of semiconductor devices crucial for artificial intelligence (AI), such as central processing units (CPUs), graphics processing units (GPUs), and field-programmable gate arrays (FPGAs). Major tech companies rely on AMD’s technology for applications ranging from gaming to cloud services and AI computations.

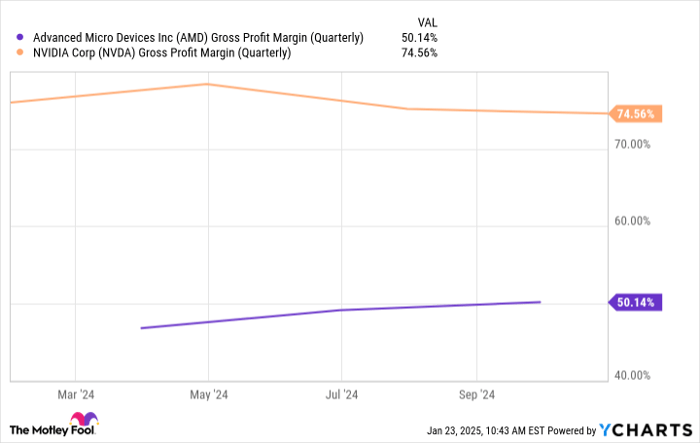

Despite most AI firms thriving in 2024, AMD has encountered challenges, with its stock declining by about 18%. A key obstacle has been the dominance of AI chip leader Nvidia, which commands an impressive market share, high profit margins, and significant pricing leverage.

AMD Gross Profit Margin (Quarterly) data by YCharts.

Analysts have mixed feelings regarding AMD’s future performance, but many still favor it, given the expansive growth in its sector. Over the past three months, 32 analysts have reviewed AMD, with 21 advising to buy, 10 suggesting to hold, and one recommending to sell. The average price target suggests nearly a 40% increase from current levels.

Can XRP Capitalize on the Current Trends?

After years of underperformance, XRP has experienced a notable resurgence. However, it is still facing an appeal from the Securities and Exchange Commission (SEC) regarding whether Ripple and its founders sold XRP as an unregistered security in 2013. Many believe this appeal will not succeed, allowing the lawsuit to conclude and potentially enabling the launch of a spot crypto exchange-traded fund (ETF).

Additionally, XRP may gain traction as Ripple’s stablecoin RLUSD develops, as transaction fees in RLUSD require XRP tokens. Moreover, Ripple is increasingly utilized by financial institutions for cross-border transactions. XRP’s network can manage up to 1,500 transactions per second, although it competes closely with Solana.

Which Wave Will Prevail Longer: AI or Crypto?

The outcome regarding whether XRP’s market cap will outstrip AMD’s is closely tied to the longevity of the current crypto market surge. Historically, XRP has outperformed Bitcoin during bullish trends but tends to lag in bear markets.

Trump’s pro-crypto stance suggests that the bullish sentiment could persist, yet the cryptocurrency arena remains fluctuating. Should inflation remain stubbornly high, this might impact the rally. The AI trend may sustain itself, although AMD has not significantly benefited from it and faced hurdles in 2024.

Ultimately, if the crypto trend continues, it is plausible that XRP could surpass AMD in market value. Meanwhile, AMD must demonstrate its capability to seize the opportunities within its vast market.

A New Investment Opportunity Awaits

Missed out on prior investment successes? This may be your chance to catch up.

On rare occasions, our team of analysts identifies a “Double Down” stock—a company they believe is poised for significant growth. If you think you’ve already missed the best moment to invest, now could be the perfect time before it’s too late. The numbers back it up:

- Nvidia: Investing $1,000 at our recommendation in 2009 would now be worth $369,816!*

- Apple: $1,000 invested when we recommended it in 2008 would be worth $42,191!*

- Netflix: If you invested $1,000 when we issued our recommendation in 2004, it would have grown to $527,206!*

Currently, our “Double Down” alerts focus on three remarkable companies, with limited time left to act.

Learn more »

*Stock Advisor returns as of January 21, 2025

Bram Berkowitz has positions in Bitcoin and XRP. The Motley Fool has positions in and recommends Advanced Micro Devices, Bitcoin, Nvidia, Solana, and XRP. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.