The Consumer Price Index (CPI) Report was released on January 11, 2024, at 8:30 AM. The report reflects changes in the prices (inflation/deflation) of a wide array of goods and services bought by consumers in the U.S. during the month of December 2023.

Guiding you through a detailed analysis of the CPI report, we will also uncover the likely implications of the reported data for the U.S. economy and financial markets.

A Detailed Look at the Data

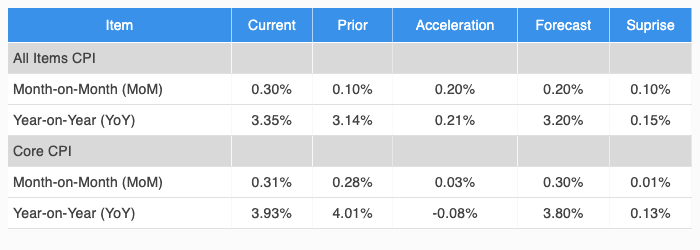

Reviewing the key data and analysis for this month’s CPI report can be found in Figure 1.

Figure 1: Change, Acceleration, Expectations, and Surprise

The All Items CPI accelerated and surprised to the upside. Core CPI held steady and was in line with expectations, although it both accelerated and beat expectations slightly.

Price Changes in Major CPI Components Over Various Time Frames

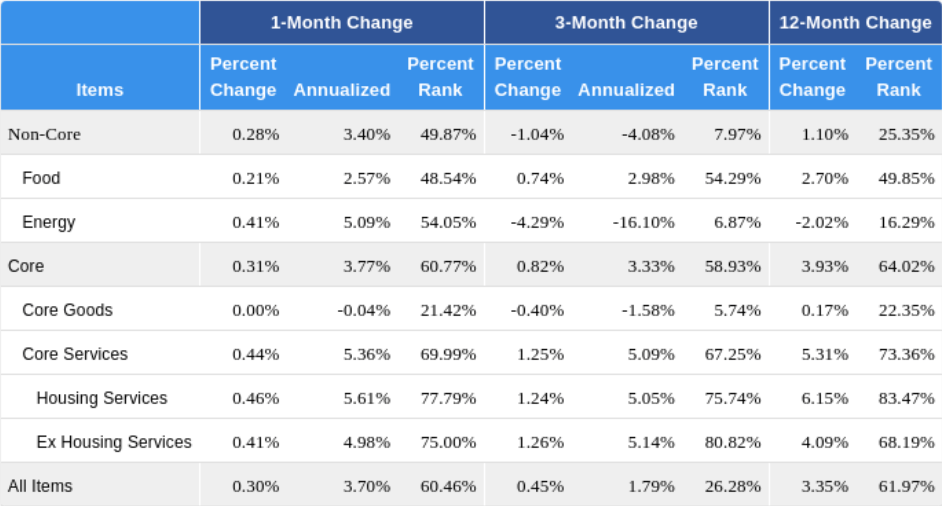

This section focuses on the growth rates of major CPI components over various time frames. It highlights the acceleration and/or deceleration of growth rates over time, the relative growth rates between components, and the growth rates of each component compared to its own history (percent rank).

Figure 2: Percent Change, Annualized Change and Percent Rank: 1, 3 and 12 months

Focusing on core services ex-housing, the metric the Fed is closely watching, it is running well above the Fed’s 2.0% target, and stubbornly so. On a 1-month and 3-month basis, this metric is running at 4.98% and 5.14% annualized rate, respectively. These figures are unsettling for the Fed.

Conversely, core goods have shown a dramatic trend towards deflation, with price changes in this category actually deflating and at the extreme lower end of historical averages.

Decomposition Analysis of Monthly Change: Major CPI Components

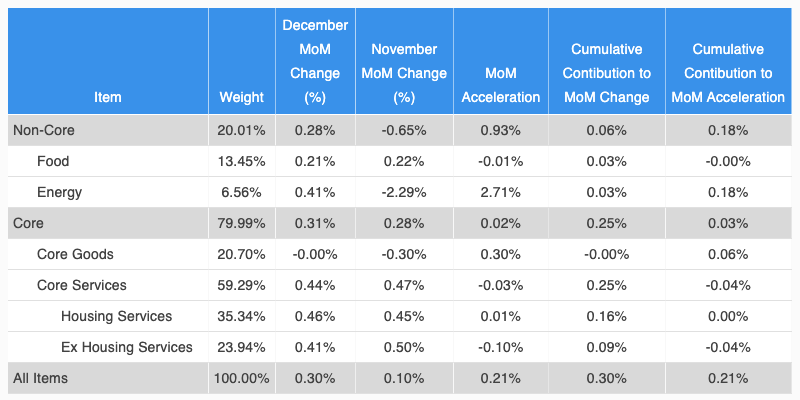

In Figure 3, there is a decomposition analysis of change and acceleration, breaking CPI down into Non-Core and Core components. The growth of non-core CPI is further decomposed into two subcomponents and the growth of core CPI into three subcomponents. While all five columns in the table provide important information, readers should pay special attention to the rightmost column (Cumulative Contribution to Acceleration) as it reveals exactly what drove the month over month, or MoM, acceleration/deceleration in CPI during the current month compared to the prior month.

Figure 3: Analysis of Key Aggregate Components of CPI

Energy was the largest contributor to the acceleration of All Items CPI. Core Goods accelerated while Core Services decelerated.

Core Services except Housing – the indicator the Fed is currently focusing on – decelerated in December. However, this key indicator remains well above what is acceptable to the Fed.

Moving forward, we shall delve deeper into the CPI report. For more detailed information on interpreting the tables and graphs in this article, please refer to the following Seeking Alpha blog post.

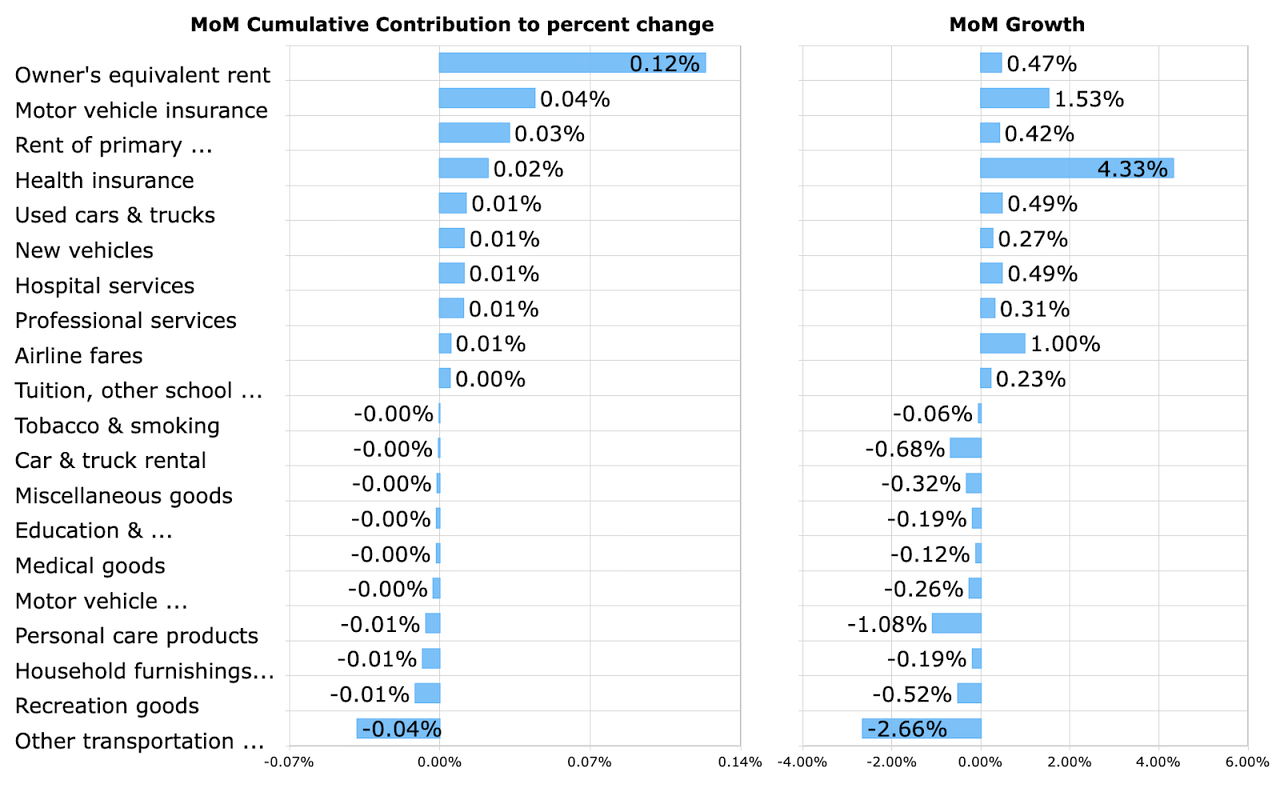

Contributions to Monthly Change in Core CPI

In Figure 4, we provide a bar chart that highlights notable positive and negative contributors to the MoM percent change in Core CPI. These contributions consider both the magnitude of the MoM change in each component as well as the weight of each component in CPI.

Figure 4: Top Contributors to MoM Percent Change

Once again, Owner’s Equivalent Rent was the most important positive contributor to the monthly change in CPI. Motor Vehicle Insurance also contributed positively to the monthly change in CPI.

Housing components carry the largest weight in the CPI (accounting for about 40% of core CPI). It is crucial to note that real-time indicators suggest significant disinflation in the housing components of CPI for the second half of 2024. Hence, the first half of 2024 will see significant downward pressure on both All-Items and Core CPI from the housing component. Nonetheless, declines in CPI driven by this severely lagged component are not relevant for understanding the present housing markets or the economy.

Contributions to Monthly Acceleration in Core CPI

In Figure 5, the focus shifts from a decomposition of the rate of change to a decomposition of the rate of acceleration. The bar chart highlights notable positive and negative contributors to the MoM acceleration in Core CPI. These contributions take into account both the magnitude of the MoM accelerations in the components and the weight of each component in CPI.

Figure 5: Top Contributors to MoM Acceleration of Core CPI

The CPI Report: Market Implications and Observations

We recommend that investors carefully scrutinize the table below as it likely contains the items that caused deviations from forecasters’ expectations of Core CPI.

Contributors to CPI Acceleration

Among the leading contributors to the acceleration of Core CPI are Apparel and Household Furnishings. Surprisingly, both these items had a significant negative impact on Core CPI last month.

Highlights of Top Movers

In Figure 6, we spotlight several CPI components with the largest positive and negative changes during the period. The year-over-year change in these specific components is displayed to the right.

Notable Findings & Implications

The latest CPI report did not spring any major surprises; however, it did reveal some concerning aspects that merit attention.

Primarily, the core services ex-housing, a metric closely monitored by the Fed, is running at a 3-month annualized rate of 5.14%. This persistent level of inflation should raise significant concerns for the Fed.

Moreover, it is our view that WTI crude oil is likely approaching an intermediate-term low, suggesting more potential upside risk than downside risk for CPI in the future.

Additionally, core goods prices have been impacted by supply chain normalization. However, this effect is expected to diminish or reverse in 2024, ceasing to be a drag on CPI.

Housing CPI components are showing signs of disinflation and are anticipated to continue exerting downward pressure on core CPI throughout most, if not all, of 2024. However, housing CPI data is significantly delayed, posing a risk of a false impression created by the lagged data.

Considering these factors, it is our opinion that the details of this report do not align with current market expectations of Fed rate cuts. Until inflation in core services ex-housing diminishes substantially, a cautious approach to interest rates and liquidity in the economy appears necessary.

Impact on Financial Markets

Equity and interest rate markets showed limited reaction to this report, given that Core CPI mostly met expectations and the upside surprise in All-Items CPI was mild.

However, the persistent high inflation in core services ex-housing is a cause for concern and is likely to have intermediate-term ramifications.

Looking ahead, it is plausible that the market will face increasingly hawkish rhetoric from the Fed. Market expectations for Fed rate cuts might be out-of-sync with what the Fed is poised to deliver, based on the insights from this CPI report.

In Conclusion

Since the third quarter of 2022, we have emphasized that 2023 would be a year of disinflation, and it was. However, apart from the housing components, we believe the economy is currently at an inflection point, where the disinflationary process may have stalled. Core inflation ex-housing seems to be persistently high, posing a significant risk of overall inflation reacceleration, particularly if oil prices begin to rise.

While we expect CPI to continue decelerating in the coming months, the potential for a reacceleration of inflation in the U.S. looms, particularly in the second half of 2024. At our Investing Group, we are actively preparing for this potential shift from a bullish to bearish inflation environment later this year.