Reindustrialization Faces Major Hurdles in America

The president aims to reindustrialize America, envisioning bustling steel mills, chip fabs, and assembly lines branded with “Made in the U.S.A.” Yet, there’s a crucial challenge that hasn’t been addressed.

That challenge is the need for automation.

Currently, the U.S. faces a notable shortage: not enough workers, not enough skills, and not enough affordable labor. The figures indicate that automation is necessary to bridge these gaps.

The next significant opportunities in the market will stem from physical AI—robotic arms, vision sensors, and autonomous systems that turn traditional factories into fully automated operations.

Consider the $7 trillion currently sitting idle in money-market funds, earning minimal returns. History shows this capital doesn’t remain stagnant for long; it awaits a trigger to invest in the market again.

This catalyst could be what some are calling the “Summer Panic,” an event expected to disrupt the cash flow and propel physical-AI stocks into unprecedented growth.

In this report, you’ll learn about:

- The hidden catalyst that may prompt trillions to invest in robotics.

- Previous instances of “breadth thrusts” leading to double-digit gains—and why this one could be the largest.

- The No. 1 Stock to consider before automation transforms U.S. manufacturing.

Though Washington has yet to address this key issue and Wall Street has not fully factored it in, proactive investors could capitalize on the automation wave before it becomes mainstream.

Prepare yourself—the robots are ready to make their move, and the investment opportunities are about to follow.

The $7 Trillion Catalyst: Potential “Summer Panic”

Currently, around $7 trillion sits in money-market accounts, yielding approximately 4.5% as investors wait for clearer guidance. Strategists from J.P. Morgan, BlackRock, and Vanguard caution that this cash won’t stay idle indefinitely if market narratives shift.

We are anticipating a catalyst that could puncture the “cash bubble,” initiating a significant rotation back into stocks—what has been termed the 2025 Summer Panic.

On May 7, this anticipated event is expected to trigger substantial market shifts. To help investors prepare, a 2025 Summer Panic Summit will be held on Thursday, May 1, at 7 p.m. Eastern. You can register here.

It’s been nearly 30 years since investors last witnessed a similar bullish signal paired with a groundbreaking technology platform. In 1997, it was the internet; today, it is artificial intelligence.

Once the influx of capital starts, history suggests it will surge quickly. In 1997, such signals led to an 8% decline in money-market balances within a single quarter and sparked a two-year market rally, generating numerous millionaires.

With the current conditions appearing even more favorable, the $7 trillion in cash could soon flow toward companies developing America’s AI-driven factories.

Trump’s Industrial Vision: Ambitious Yet Challenging

President Trump has proposed a bold industrial policy aimed at reallocating $500 billion to enhance AI infrastructure through the Stargate Project, promoting domestic manufacturing, and regaining supply-chain independence.

This vision includes the establishment of chip fabs in Ohio, electric vehicle battery plants in Michigan, robotics in Texas, and steel production in Pennsylvania.

However, a significant issue remains unaddressed: Who will fill these factory jobs?

Labor Supply: Shortage of Available Workers

Currently, under 2 million Americans are claiming unemployment benefits, while Trump’s reshoring plans involve replacing millions of jobs that have moved overseas.

- China boasts over 100 million manufacturing workers.

- India has around 20 million.

- Vietnam employs more than 10 million.

This totals approximately 130 to 150 million manufacturing roles in just three Asian nations, many of which supply U.S. markets. The U.S. cannot adequately staff its existing facilities, let alone an expanded industrial network, without increased automation.

Labor Preferences: American Workforce Reluctance

Historically, manufacturing jobs were outsourced for multiple reasons. The work is often challenging, sometimes dangerous, and generally unappealing to younger Americans seeking more promising career paths.

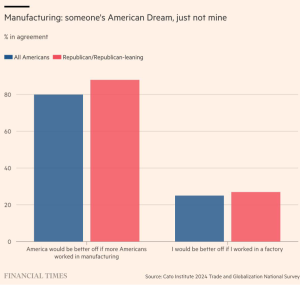

A recent survey by the Cato Institute highlights this issue:

- 80% of participants believe the country would benefit from more people working in manufacturing.

- Only 20% say they would prefer working in a factory.

Clearly, the workforce preferences have shifted, and if President Trump’s vision comes to fruition, America’s factories will need to adapt rapidly.

# U.S. Manufacturing: Embracing Automation to Compete

Labor Costs: U.S. Companies Struggle to Compete on Wages

Recent economic data starkly illustrates the challenge:

- Minimum wage in China averages about $300 a month.

- Vietnam: roughly $200.

- India: below $200 in many regions.

- In the U.S., the federal minimum wage surpasses $1,200 a month, with factories often offering even higher pay.

As a result, U.S. labor costs are four to six times more than Asian counterparts. This disparity is not sustainable unless companies invest in AI-driven machines that do not require breaks, benefits, or paid time off.

Reshoring Requires Physical AI

In summary, the revival of U.S. industry hinges on automation and robotics.

The modern American factory will not resemble Detroit in the 1950s. Instead, it will mirror the technological advancements seen in Tesla Inc.’s (TSLA) Gigafactory, replicated across various sectors.

Workforces will significantly shrink as machines take over roles traditionally held by humans. The objective may be to replace overseas labor with American jobs, but the reality is a shift towards replacing foreign labor with domestic machines.

This shift underscores our belief that physical AI—encompassing robots, automated systems, and machine vision—is the next frontier of the AI Revolution.

The Physical AI Revolution is Here

So far, the focus of AI discussions has centered around software like language models and chatbots, which have transformed knowledge work.

However, the next significant advancements will occur in the physical realm, including:

- Factory robots equipped to see, learn, and adapt.

- Warehouse pick-and-pack robots driven by machine vision.

- Autonomous forklifts and mobile platforms.

- AI-assisted robotic arms for manufacturing, welding, and inspection tasks.

With Stargate’s rollout of domestic computing infrastructure, this kind of robotic intelligence can expand rapidly. Similar to how ChatGPT accelerated digital AI usage, the upcoming infrastructure initiative supported by the Trump administration may boost the adoption of physical AI in manufacturing, logistics, and defense sectors.

Identifying market-leading investments in this technological megatrend is a key focus of my expertise. My track record in identifying emerging tech investments is well established:

- TipRanks recognized me as the No. 1 Stock Picker of 2020, out of over 15,000 professionals.

- Since 2014, I have pinpointed nearly 200 stocks that doubled in value, along with numerous others that surged 10X, 20X, and even 30X—such as Alphabet Inc. (GOOG), Amazon.com Inc. (AMZN), and others long before they gained widespread recognition.

- These “Mag 7” predictions turned a hypothetical $70,000 investment into approximately $1.2 million at its peak.

Looking ahead, I believe the next potential wealth-building opportunity will come from a selection of small, U.S.-based physical AI leaders, which I’m referring to as the “MAGA 7.” Here, “MAGA” stands for Make AI Great in America.

Seizing Generational Wealth Potential

This moment represents a unique convergence of (1) a market signal poised to induce a rally (anticipated on May 7), (2) an unprecedented accumulation of cash reserves, and (3) a breakthrough technology landscape—comparable to the late-1990s dot-com era.

Investors who acted promptly in 1997 transformed five-figure investments into six- and seven-figure fortunes within a few years.

If my predictions hold true, May 7 could signify the dawn of a second, possibly larger, market surge, during which physical AI industry leaders emerge as the new power players in American manufacturing.

This presents an investment opportunity often described as “generational wealth.” Rather than simply increasing portfolio value marginally, it could dramatically enhance family balance sheets for decades.

This trend is not merely political; it is a significant investment megatrend.

- The economic calculations favor automation.

- Political will points towards domestic manufacturing.

- The growth of AI infrastructure suggests the onset of a physical AI supercycle.

President Trump aims to revitalize U.S. manufacturing, but robots are essential for achieving economic viability. Should the Federal Reserve signal an easing cycle on May 7, the $7 trillion currently sidelined could flood into the companies developing America’s next industrial workforce.

To discuss strategies for safeguarding and growing our portfolios, I am hosting an important online strategy session on Thursday, May 1, at 7 p.m. Eastern. During this session, I will outline how to not only protect investments this summer but also potentially realize triple-digit gains in the coming years.

I will also present seven new investment prospects—the “MAGA 7”—that are positioned at the forefront of this historic shift.

On the date of publication, Luke Lango did not hold any positions in the securities mentioned in this article.

For inquiries or feedback regarding this issue, contact us at [email protected].