Developing a Trend-Following Strategy for Coffee Futures Trading

This article details the creation of a systematic trading strategy for coffee futures (@KC), which are traded on the Intercontinental Exchange (ICE) in New York. Our aim is to diversify a trading portfolio by exploring lesser-known assets compared to more frequently traded futures.

Coffee Futures: A Soft Commodity Opportunity

Coffee futures fall under the category of “soft commodities,” alongside sugar, cocoa, cotton, and orange juice. This sector boasts several attractive features, such as substantial intraday volatility, low correlation with equity futures, and respectable trading volumes.

Employing a Trend-Following Approach

Our analysis uses a Trend-Following strategy, a method known for its effective performance across various commodity markets. The goal is to assess its applicability for trading coffee futures.

Strategy Logic and Code Overview

The Trend-Following strategy we are formulating depends on identifying significant price breakouts. Specifically, the system will initiate a long position when the price exceeds the highest high recorded over a specified number of sessions, represented as Highest(High, n_sessions). Conversely, a short position is triggered when the price dips below the lowest low over those sessions, denoted as Lowest(Low, n_sessions).

This system operates during the entire trading session of coffee futures, which spans from 4:15 AM to 1:30 PM (exchange time), Monday through Friday. Both entry and exit take place within the same trading day. Thus, all positions are closed by the end of the session unless an earlier stop-loss is triggered, which we set at $1,500 for this analysis.

We conduct performance evaluations using a 15-minute timeframe for trade execution (data1) and a daily timeframe to determine entry levels (data2), utilizing historical data from early 2010 through the end of 2023.

input:n_sessioni(5),mystop(1000),myprofit(0);

if EntriesToday(d)=0 then Buy next bar at Highest(High,n_sessioni)data2 stop;

if EntriesToday(d)=0 then Sellshort next bar at Lowest(Low,n_sessioni)data2 stop;

if mystop>0 then setstoploss(mystop);

if myprofit>0 then setprofittarget(myprofit);

setstopcontract;

setexitonclose;

Optimizing Session Counts in Breakout Levels

The first step in refining our strategy involves determining the optimal number of sessions (“n_sessions“) for breakout calculations. We will test values from 1 to 10, increasing incrementally by 1, to assess their influence on performance.

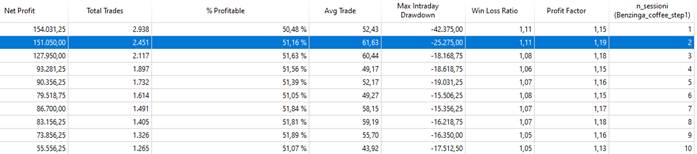

Figure 1 shows the optimization of the “n_sessions” input to identify the most effective number of sessions for calculating price highs and lows.

The results of our optimization indicate that increasing the number of sessions generally leads to a decline in net profit and overall performance metrics; however, maximum drawdown remains fairly stable. As a result, we settle on n_sessions = 2, meaning that our entry levels are derived from the highs and lows of the past two sessions. A breakout beyond these levels will kick off the position entry.

In our first test of the system, we observe a profitable, steadily rising equity curve. This suggests that coffee futures are receptive to Trend-Following logic. Although further refinements are necessary, initial findings are encouraging, with an average trade yielding $62 and a net profit of $151,000—an impressive result for an early-stage system without additional filtering or optimizations.

Enhancing Strategy Performance through Time Window Adjustments

To improve our Trend-Following trading system, we will investigate whether modifying the operational time window—rather than executing the system throughout the full trading session—can enhance results.

This involves revising the code to include a custom function, as well as introducing two new input parameters: “MyStartTrade” and “MyEndTrade“, which define the timeframe during which trades are permitted. Following these adjustments, we will optimize these parameters.

var:istartofsession(false);

istartofsession=_OHLCMulti5(0415,1330,ohlcvalues);

array:ohlcValues[23](0);

input: stoploss(1500), takeprofit(0);

input: MyStartTrade(415),MyEndTrade(1330);

input: n_sessioni(2);

//ingressi

if tw(MyStartTrade,MyEndTrade)

and EntriesToday(d)=0

then begin

Buy next bar at Highest(High,n_sessioni)data2 stop;

Sellshort next bar at lowest(Low,n_sessioni)data2 stop;

end;

if stoploss>0 then setstoploss(stoploss);

if takeprofit>0 then setprofittarget(takeprofit);

setstopcontract;

setexitonclose;

Enhancing Trading Strategy Performance: Key Optimizations and Insights

Figure 4 – Optimization of the “MyStartTrade” input to determine the best time to start trading.

Figure 5 – Optimization of the “MyEndTrade” input to determine the best time to stop trading.

Results from the optimization indicate that refining the trading window increases performance. By adjusting the start time to 5:00 AM and the end time to 12:00 PM, we observe a significant reduction in maximum drawdown, which drops from over $25,000 to below $20,000.

This enhancement likely results from early trading activity being erratic post-market opening. Furthermore, initiating new trades later in the day is less logical, as all positions must conclude by day’s end.

Improving Strategy with a Price Pattern Filter

Next, we focus on a vital metric for effective trading: average trade value. A profitable system must yield enough returns to cover costs like commissions and slippage, especially crucial in coffee futures where each tick holds a value of $18.75.

We propose integrating a filter utilizing the “Daily Factor” (DF), which assesses the previous day’s price movement relative to its full daily range (high to low).

This filter does not indicate market direction but offers volatility insights: a low Daily Factor signifies little price movement, while a high Daily Factor points to strong price activity, whether bullish or bearish.

After calculating the Daily Factor (“DF“), we will compare it against a predetermined threshold (“DF_level“) to decide on trade entries. Both “DF” and “DF_level” range from 0 to 1.

To incorporate this filter, we add specific lines to our script, optimizing the “DF_level” parameter within the 0.1 to 1 range, in increments of 0.05.

// Daily Factor

input: DF_level(1);

var: DF(0);

if (highs(1) – lows(1)) <> 0 then begin

DF = absvalue(opens(1) – closes(1)) / (highs(1) – lows(1));

end;

Figure 6 – Optimization of the “DF_level” input to define the filter based on the Daily Factor pattern.

From the optimization, we selected a threshold of 0.8, meaning we will open a position only if the previous session’s move (Open-Close) is less than 80% of the overall range (High-Low). This adjustment increases our average trade value by $20, pushing it above $80 while reducing maximum drawdown and enhancing net profit.

Identifying Profitable Days for Trading

While optimization has greatly improved our system, it is not yet ready for live trading with actual funds. We need to further refine our approach by identifying less profitable days in the week.

To achieve this, we introduce two new inputs, “skipdaylong” and “skipdayshort,” which allow us to exclude specific trading days. These inputs will be optimized for values between 1 and 6, corresponding to the days of the week, with 1 representing Monday and 6 representing Saturday.

input: skipdaylong(-1), skipdayshort(-1);

if dayofweek(d) <> skipdaylong then Buy next bar at Highest(High,len)data2 stop;

if dayofweek(d) <> skipdayshort then Sellshort next bar at Lowest(Low,len)data2 stop;

Figure 7 – Results of the optimization for the “skipdaylong” and “skipdayshort” inputs, sorted by average trade.

To confirm our optimization results, we utilize a proprietary program to assess each instrument’s bias across different timeframes, including intraday hourly to monthly and yearly trends. As illustrated in Figure 8, Mondays often exhibit sideways movement without a clear trend in Coffee futures, contrasting with more defined, generally bearish trends on other days. Additionally, the Daily Factor observed on Fridays is noticeably lower than on other days. Consequently, we have opted to exclude Mondays from our trading strategy, moving toward a $100 average trade.

Figure 8 – Results of the weekly bias

Optimizing Coffee Futures Trading Strategies: Insights and Performance

Analysis conducted using the proprietary Bias Finder software has revealed valuable data concerning Coffee futures.

Performance Metrics: Stop-Loss and Profit Targets

In our study, we concluded with a critical stage: stop-loss optimization, which we adjusted from an initial setting of $1,500. Concurrently, a profit target was added to our strategy assessment, set at $1,700 for both metrics. This final adjustment aimed to evaluate potential enhancements to the trading strategy.

The outcomes from this research present a net profit of $167,000, with an average trade yield of $107. Additionally, the maximum drawdown was approximately $13,000, indicating manageable risk exposure.

Figure 9 illustrates the optimization of the stop-loss value within the Trend Following strategy employed for Coffee futures.

Figure 10 details the optimization results for the profit target within the same Trend Following strategy for Coffee futures.

Figure 11 showcases the final equity curve derived from our Coffee futures strategy.

Figure 12 presents a summary of final performance alongside a total trade analysis for the Coffee futures strategy.

Final Thoughts on the Trend Following Trading System for Coffee Futures

The Trend Following strategy discussed in this report has demonstrated significant potential for trading Coffee futures. This highlights the benefit of considering less familiar markets, which can enhance overall portfolio diversification. Although valuable insights have emerged from this analysis, further refinement remains essential before implementing live trading strategies. Key areas for improvement include identifying the most lucrative trades and optimizing the average trade to ensure robustness in real-market conditions.

Until next time, wishing you success in your trading endeavors!

Andrea Unger

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.