“`html

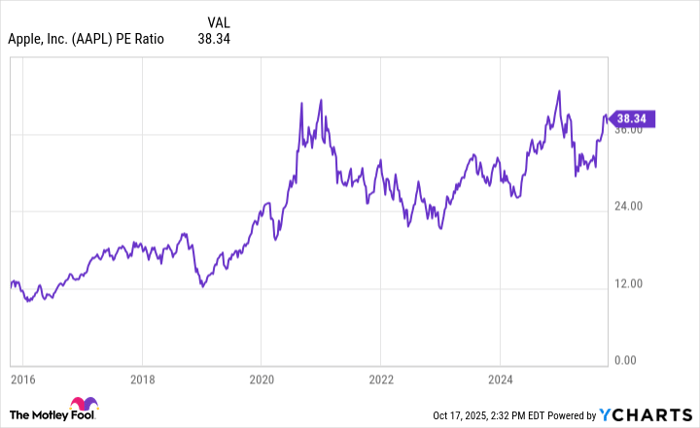

Warren Buffett has led Berkshire Hathaway (NYSE: BRK.A, NYSE: BRK.B) for over 50 years, growing its market capitalization to $1 trillion. Buffett’s investment strategy focuses on competitive advantages, reasonable valuations, and moderate diversification. He typically invests in companies with a price-to-earnings (P/E) ratio of between 5 and 15, using this metric along with a portfolio focused on 10 to 15 stocks.

For individual investors wanting to emulate Buffett, it’s advised to start with $500, allocating $50 to each selected stock. Buffett emphasizes looking for stocks with sustainable competitive advantages, such as branding or scale, as exemplified by his investments in Coca-Cola (NYSE: KO) and Apple (NASDAQ: AAPL).

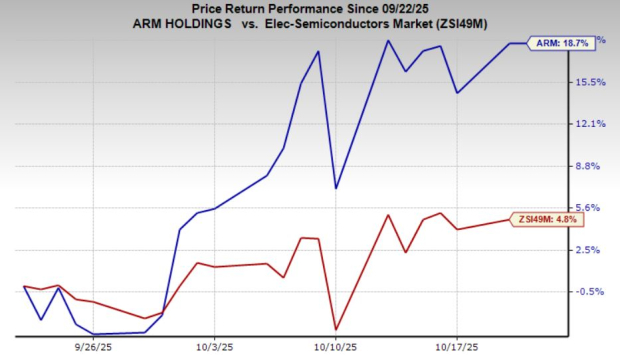

Berkshire Hathaway’s four largest positions make up 63% of its investment portfolio, highlighting Buffett’s approach of concentrated investments rather than excessive diversification. For those eyeing alternative investment recommendations, recent analysis from the Motley Fool identified 10 stocks for potential strong returns that do not include Berkshire Hathaway.

“`