Credit Corp Group (ASX:CCP) has taken a leap forward with its one-year price target soaring to 20.61 per share, marking an impressive 6.89% increase from the previous estimate of 19.28 set on January 16, 2024.

Analysts have pooled their insights on CCP, leading to an average price target that spans from a low of 16.29 to a high of 28.24 per share. This target signals a remarkable 59.51% rise from the stock’s last reported closing price of 12.92 per share.

Reader’s Revelation: Fund Sentiment Unveiled

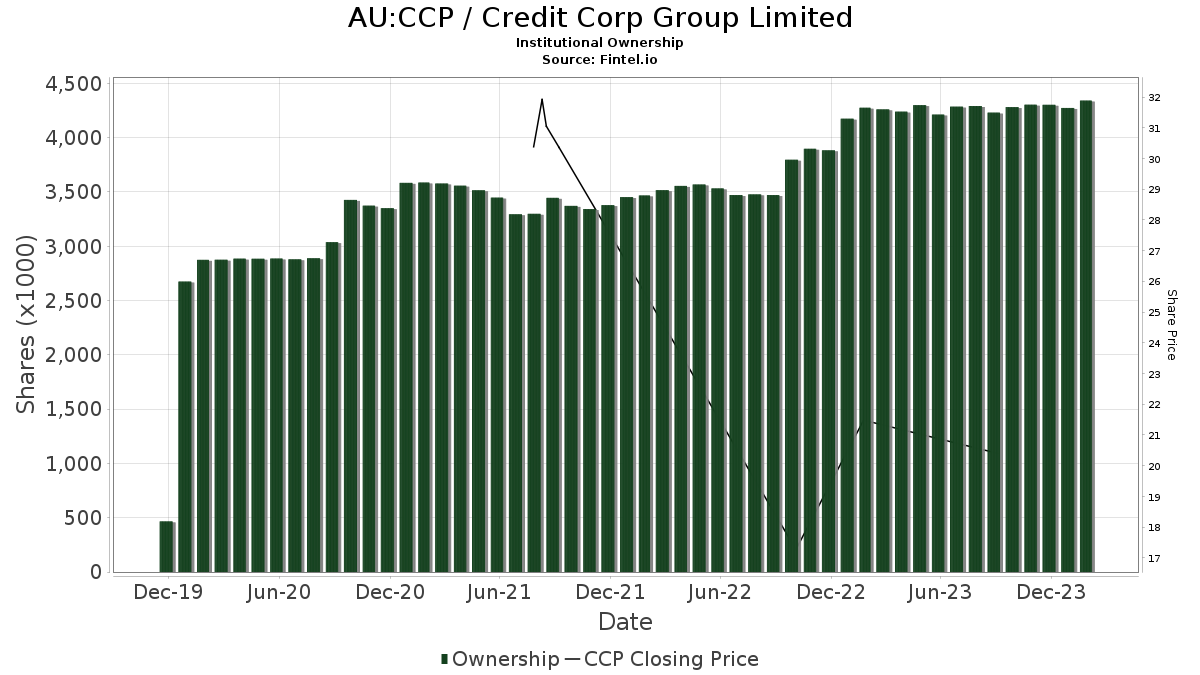

Credit Corp Group has caught the eye of 45 funds or institutions, with a 2.27% increase in ownership reported in the most recent quarter. The collective weight of CCP in these funds, which stands at a humble 0.03%, has experienced a decrease of 33.24%. Institutional ownership has seen a 0.90% surge over the last three months, with a total of 4,343K shares now in their possession.

Insights into Shareholder Movement

VGTSX – Vanguard Total International Stock Index Fund Investor Shares stands out as a major player, holding 798K CCP shares equivalent to 1.17% ownership. The firm has upped its stake by 0.16% since its previous filing, although it has scaled down its CCP investments by 46.12% in the last quarter.

VTMGX – Vanguard Developed Markets Index Fund Admiral Shares remains steady with 468K CCP shares, representing 0.69% ownership, with no changes reported in the recent quarter.

Dfa Investment Trust Co – The Asia Pacific Small Company Series has decreased its CCP exposure by 3.75%, holding 438K shares, equivalent to 0.64% ownership. The firm’s portfolio allocation in CCP dipped by 46.95% in the last quarter.

IEFA – iShares Core MSCI EAFE ETF showcases growth, holding 387K CCP shares, equivalent to 0.57% ownership. The firm has increased its stake by 2.21%, despite decreasing its portfolio allocation in CCP by 45.74% in the last quarter.

SCZ – iShares MSCI EAFE Small-Cap ETF has reduced its CCP holdings by 8.12%, now owning 269K shares, or 0.40% ownership. The firm has slashed its portfolio allocation in CCP by 44.80% over the last quarter.

Fintel is a treasure trove for investors, providing comprehensive research tools for individuals, financial advisors, and small hedge funds alike. Our platform encompasses global fundamentals, analyst reports, ownership data, and various sentiments related to the market. For those seeking insights and profitable opportunities, Fintel is the place to be.

Curious to delve deeper? Click to Learn More and explore the world of investing like never before. This story originally appeared on Fintel.

The perspectives and thoughts articulated in this piece are solely those of the author and may not necessarily align with the views of Nasdaq, Inc.