Breaking news hit the financial world on February 21, 2024, as Crescent Capital BDC announced the declaration of a steady quarterly dividend amounting to $0.10 per share ($0.40 yearly) – a pleasing increase from the previous $0.09 per share. Shareholders as of February 29, 2024, will enjoy the fruits of this decision on March 15, 2024.

At the present share price of $16.82 per share, the stock boasts a dividend yield of 2.38%. Reflecting on the past five years, with samples taken weekly, the mean dividend yield stands impressively at 11.17%, with the lowest recorded at 8.27%, and the pinnacle soaring to 26.41%.

The curious statistic buffs will revel in knowing that the standard deviation of these yields comes in at 2.34 (n=144) with the current yield plummeting 3.75 standard deviations below the historical average – a gripping narrative in the world of dividends.

Impressively, Crescent Capital BDC has upheld its dividend payout for the last three years without an increment, a testimony to its financial perseverance within a volatile market climate.

Deciphering Fund Sentiments

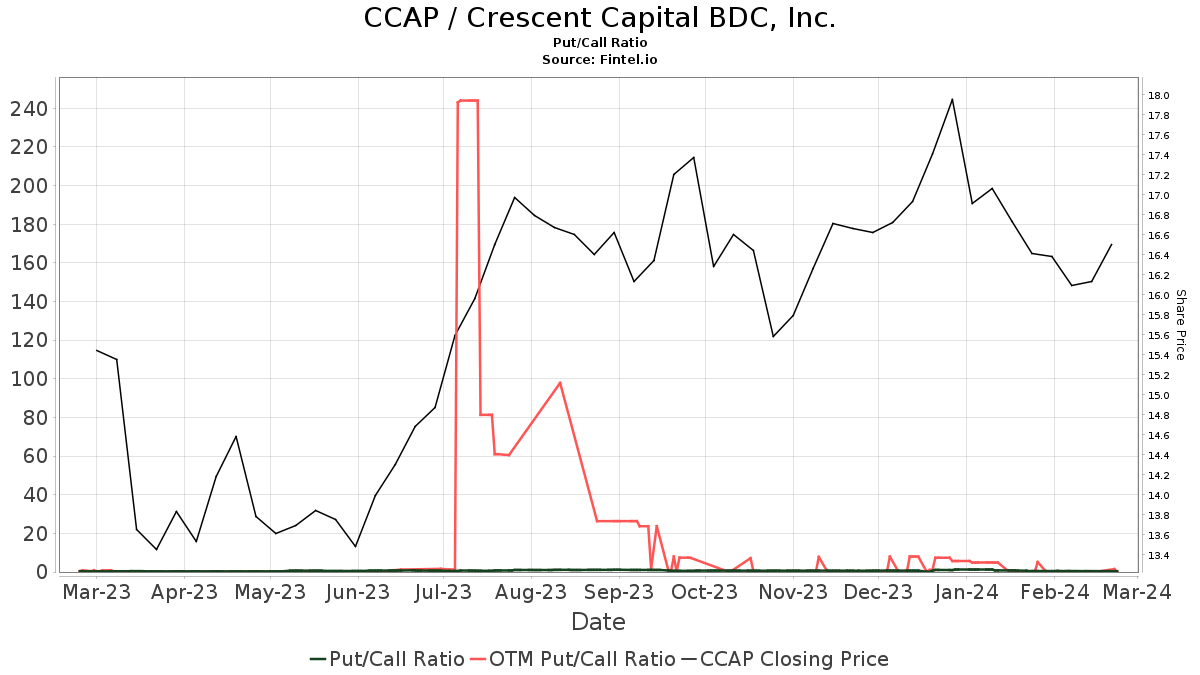

Revealing figures shine a light on the engagement of 89 funds or institutions in Crescent Capital BDC – an uptick of 8 owners or 9.88% in the previous quarter. The average portfolio weight across all funds dedicated to CCAP surged by 16.14%, settling at a commendable 0.29%. Despite this upward trajectory, the total shares owned by institutions witnessed a decrease of 12.32% in the last three months, pegging at 12,801K shares. The put/call ratio of CCAP currently stands at a promising 0.42, indicating an optimistic and bullish outlook.

The put/call ratio of CCAP currently stands at a promising 0.42, indicating an optimistic and bullish outlook.

Exploring Analyst Price Forecasts

Diving into the world of analyst predictions, the average one-year price target for Crescent Capital BDC as of February 24, 2024, is a tantalizing 18.36. Various forecasts range between a low of 16.66 to a high of $19.95, representing an average price target uplift of 9.16% from the latest closing price of 16.82. Additionally, the projected annual revenue for Crescent Capital BDC is a projected 194MM, showcasing a 5.41% increase. The anticipated annual non-GAAP EPS stands at a sturdy 1.86.

Inspecting Shareholder Dynamics

Noteworthy entities such as Texas County & District Retirement System, Fidelity National Financial, Fairfax Financial Holdings, and Mariner grace the list of shareholders holding significant stakes in Crescent Capital BDC. While some behemoths held their position steady, Mariner showcased a 1.00% decrease in ownership, a move that reflects a 11.03% portfolio allocation retraction in CCAP over the past quarter.

Ares Management stood pat with its 470K shares untouched in the last quarter.

Unveiling Crescent Capital BDC Background Information

Delve deeper into the narrative, and Crescent BDC emerges as a stalwart business development company, weaving together the twin goals of current income and capital appreciation. Rooted in providing capital solutions to middle-market enterprises with sturdy business fundamentals and promising growth avenues, Crescent BDC orchestrates this feat through the expert orchestration of Crescent Capital Group LP (‘Crescent’). Having elected to be regulated as a business development company under the Investment Company Act of 1940, Crescent BDC stands as a beacon of financial acumen and steadfast commitment to its shareholders.

Additional reading:

Fintel serves as a comprehensive investing research platform catering to individual investors, traders, financial advisors, and modest hedge funds. With a global scope encapsulating fundamentals, analyst reports, ownership data, fund sentiment, options sentiment, insider trading, options flow, unusual options trades, and more, Fintel takes the investor experience to new heights.

Discover the power of advanced, backtested quantitative models that underpin our exclusive stock picks, designed to enhance profitability and bolster investment acumen.

Embark on a financial odyssey with us, only on Fintel.